QD/OLED Expansion on the Cheap

We note that TFT production is typically done on a line that is separate from the deposition line, typically run in parallel to the deposition line, and an early point at which actual production capacity begins to fall below that stated maximum is the time it takes to produce the TFT against the time it takes to produce the second step, the deposition of OLED materials. The TFT process tends to have a shorter end-to-end process time than the deposition line, as it is based on process tools used in semiconductor manufacturing that are widely available, while OLED deposition tools are quite specific to the industry and produced by few equipment vendors, such as Sunic Systems (171090.KS), Canon-Tokki (CAJ), Dai Nippon Printing (7912.JP), and Screen Holdings (7735.JP). Potential bottlenecks occur when TFT production must wait for the deposition process, reducing overall fab efficiency, although given the three potential TFT types used for OLED displays (LTPS, IGZO, LTPO[1]), each with its on process steps and complexity, TFT process time can vary considerably depending on the product specifications.

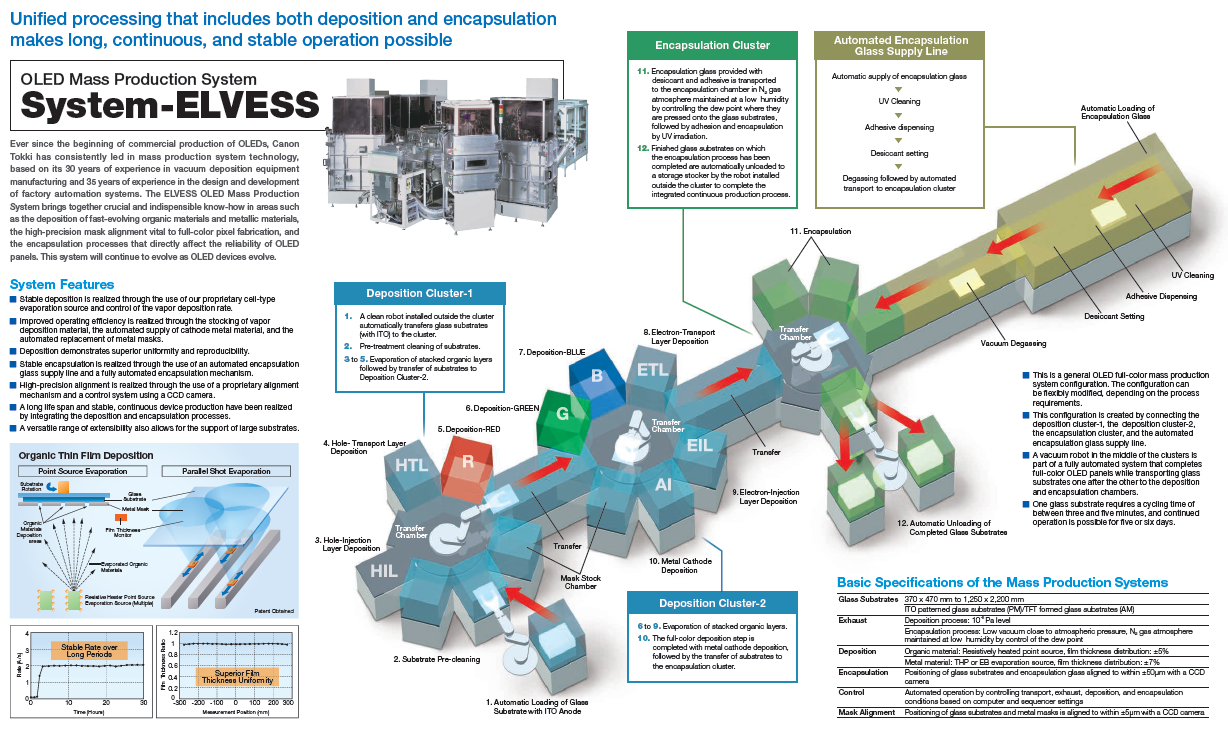

There are a number of steps that occur before a substrate gets to the deposition line, including detailed optical inspection, a number of cleaning steps, the coating of a layer of Indium Tin Oxide (ITO) that will become the anode of the OLED stack, and laminating the flexible substrate to a rigid glass sheet to keep it stable during processing. The substrates are loaded into a robotic system that performs additional cleaning and then moved by another robot to a chamber that deposits HIL (Hole-Injection Layer) materials. When that process is completed the robot moves the substrate to another chamber where HTL materials (Hole Transport Layer) are deposited, followed by three individual steps where red, green, and blue OLED materials re deposited. Each of these deposition steps is done through a fine metal mask, essentially a screen that keeps each pixel or sub-pixel spaced correctly. Following the deposition of the three OLED emitters, the substrate moves to chambers that deposit ETL (Electron Transport Layer) and EIL (Electron Injection Layer) materials.

We note that all of these deposition processes must take place in a non-reactive atmosphere, which is commonly Nitrogen, as exposure to even minute amounts of oxygen or water vapor will erode OLED materials and cause the substrate to be discarded, and a number of processes are done under high vacuum conditions, so there is considerable cycle time for reducing pressure and heating chambers for each step. Once the substrate has completed these steps it remains in the enclosed atmosphere and is encapsulated either with a sheet of glass sealed with glass frit[2] or through the deposition of alternating layers of transparent organic and inorganic materials.

The deposition system shown in Figure 1 is designed for Gen 2 substrates which are 1.87 ft2, which allows the chambers to be relatively small. Typical OLED production systems are designed to handle Gen 6 substrates, which are 29.86 ft2, although such substrates are typically processed after being cut in half or in quarters, keeping the chamber size as small as possible. These systems cost hundreds of millions of dollars depending on the configuration and given the small number of suppliers, lead times are between 9 months and 18 months, so considerable planning is needed to get the equipment to a new line and brought up to production specifications, but more importantly is cycle time, which in the case of the tool below is between 3 to 5 minutes/substrate for a single stack structure of this size, and that does not consider any additional layers that particular producers add to differentiate their product. Such a system can run almost continuously for ~5 days, at which point chambers must be cleaned and masks replaced, at which point the system has to be restarted, recalibrated, and tested before it is put back in production.

Even this cursory OLED process explanation shows the many points at which the process tact time can get extended, reducing output based on the equipment and process alone, and then comes yield, which is the variable that can be the difference between an OLED fab being profitable or not profitable. Once the OLED displays come out of the encapsulation process, they are tested. This is done visually (automated) where physical defects are tagged, electrically, to make sure each sub-pixel is able to turn on and off, and characteristically, where luminance, color point, and uniformity are checked. Some discrepancies that appear between sub-pixels can be corrected by adjusting electrical values, while others cause the OLED panel to fail and be binned for possible repair. OLED process engineers look for problems that are causing panels to fail testing procedures, and whether they are ‘one-time’ issues or whether they are recurring, and if they are recurring, is it an problem that is occurring at the same point in each display or more random.

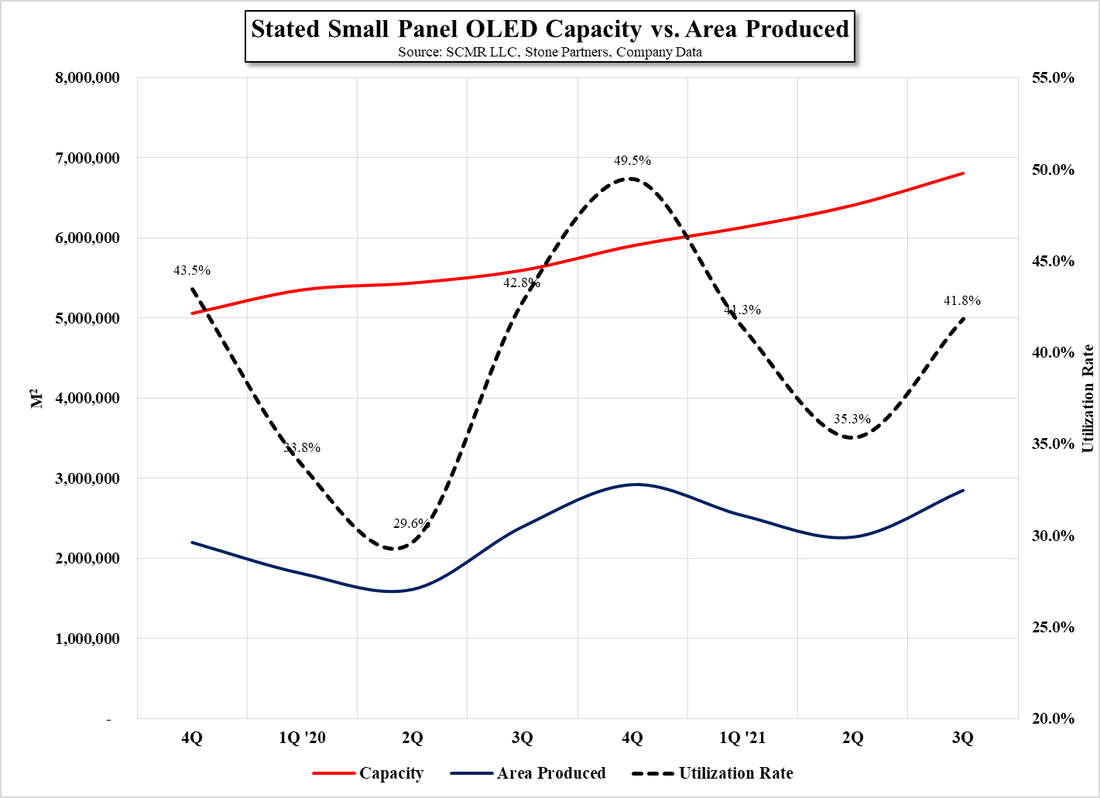

By assessing the test data engineers can determine the source of the problem and make adjustments quickly in order to maintain acceptable yields, especially at the beginning of a new product run or near the end of a use/clean cycle, and when one looks at an OLED line that is capable of producing 15,000 Gen 6 substrates/month or ~1 55” panel/minute, every 1% drop in yield equals ~$73,000/ month in lost sales[3]. It is therefore incumbent on OLED panel producers to watch and improve yields regardless of product in order to achieve profitability. But what if you have already improved yields and you are still below the quota needed to supply customers? Typically panel producers begin planning for a new fab, which is an 18 to 20 month process and costs upwards of $3b, a solution that is acceptable on a long-term basis but does little in the near-term. That said, Samsung Display (pvt) has come up with another, far less expensive solution that goes a long way toward solving the problem.

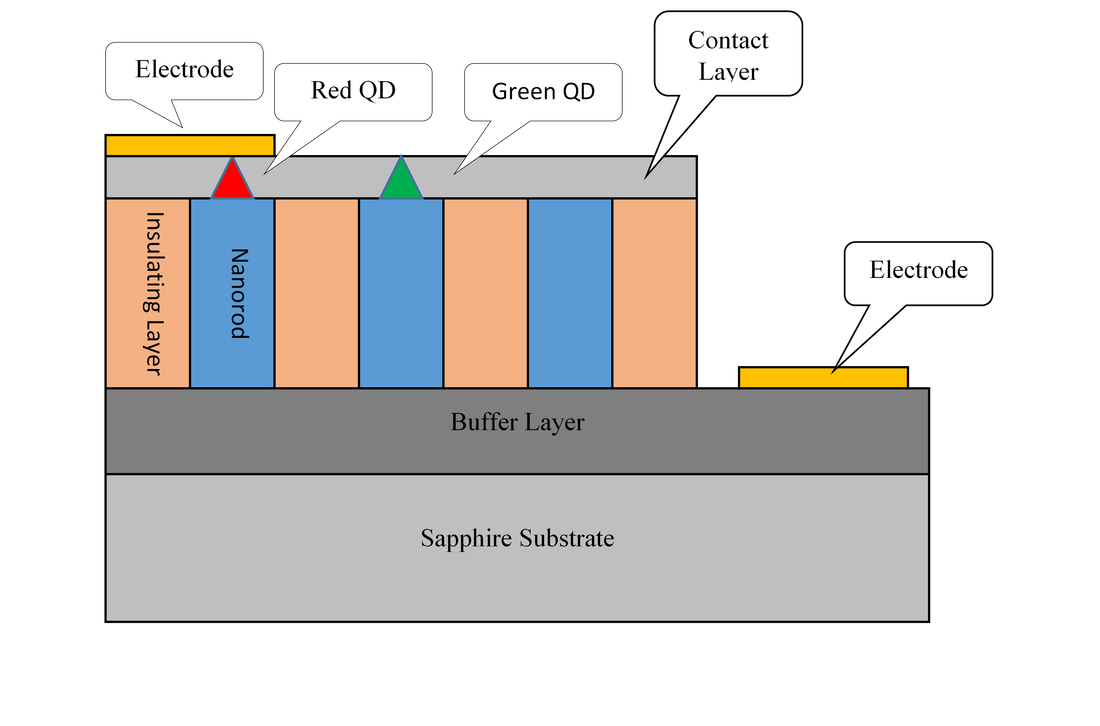

Samsung Display has developed a large panel display production process that combines the positive aspects of OLED materials and those of quantum dots. By using quantum dots to shift the color of blue/green OLED emitters to red and green, they avoid the use of a color filter that reduces the light output of WOLED displays produced by LG Display (LPL). The process is new and still being refined, even as the company is in production, but SDC’s concern (and that of their customers who are Samsung Electronics (005930.KS), Sony (SNE), Dell (DELL), and MSI (2377.TT)) was that they would not be able to produce enough QD/OLED displays to satisfy customer demand, as they have a single Gen 8 production fab for this new product line. This was especially onerous when the line first went into production as yields were ~50%, meaning they tossed one panel for every two they produced, but SDC was able to bring that yield up to an acceptable 85% by mid-year. However bringing yields from 50% to 85% is far easier than bringing it from 85% to 90% and that difference in unit volume would not be enough to fill the product gap they see coming, so SDC is working to change the other variable in their QD/OLED production process, that of tact time.

According to sources in South Korea, Samsung Display has set the goal of increasing output of its QD/OLED line by 30% by the end of the year by reducing bottlenecks that keep tact time high. This would imply a similar reduction in tact time, not an easy task, but one where SDC has the advantage of being the only producer of QD/OLED and has had more experience with RGB OLED production than any other OLED supplier, including LG Display, who is the only global supplier of WOLED TV panels. As the WOLED process uses conventional phosphors to filter the white OLED light into primary colors, the process differs from SDC’s large panel QD/OLED process, and from the basic RGB OLED process described above, but Samsung’s expertise and close connection to its OLED equipment suppliers gives them the opportunity to increase volume and sales without building out new capacity in the near-term, albeit a short-term solution.

We expect that SDC has already made the decisions necessary to begin planning for additional QD/OLED capacity, although this has not been an ideal time to be making such plans, which will likely be implemented in one of the company’s shuttered LCD fabs, but as noted this will take considerable time, so such an interim solution is like adding half of a 15k production line for free and one that likely put SDC upper management and that of parent Samsung Electronics in a happier state of mind, something in short supply across the CE space currently. Now they have 128 days in which to do it…

[1] LTPS – Low Temperature Poly-silicon

IGZO – Indium Gallium Zinc Oxide (aka ‘Oxide’)

LTPO – Low Temperature Poly-silicon Oxide

[2] Glass frit – a low melting point glass powder mixture that can be used to seal or bond glass to glass or other materials, essentially a glass solder.

[3] Assuming a generously low $160 cash cost

RSS Feed

RSS Feed