Is the Galaxy Exploding?

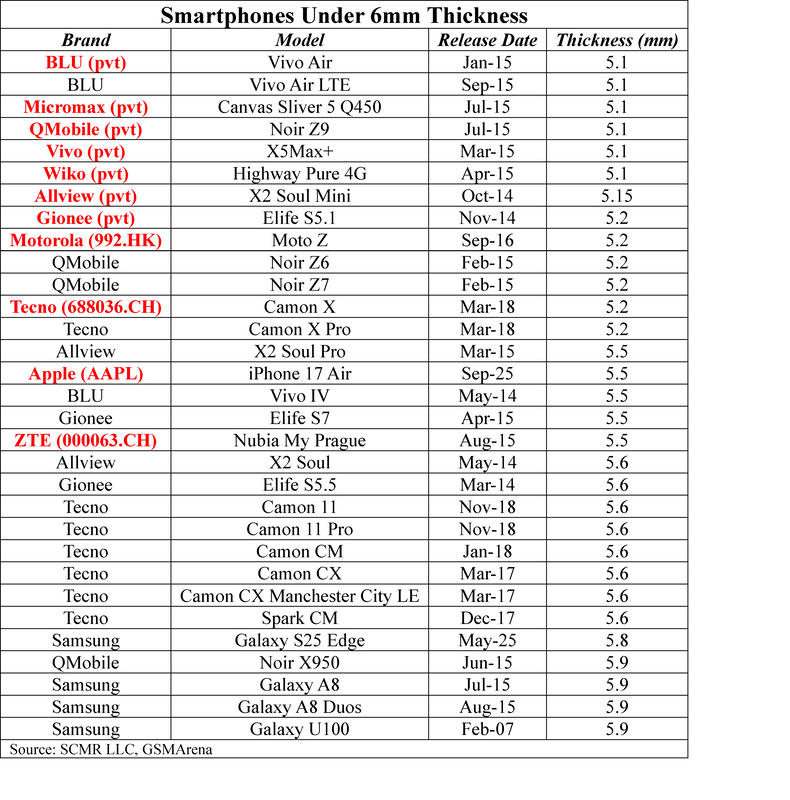

Samsung is expected to change the S Series lineup next year, with the potential to eliminate the s25 and replace it with an s26Pro and potentially drop the poorer selling SXX+, while maintaining the best-selling S25 Ultra. Much will depend on the price of the S26Pro, as it replaces the lowest price S series model and whether the Edge, which sits between the Ultra and the plus, can generate enough momentum to become a full pledged model.

RSS Feed

RSS Feed