Leaks

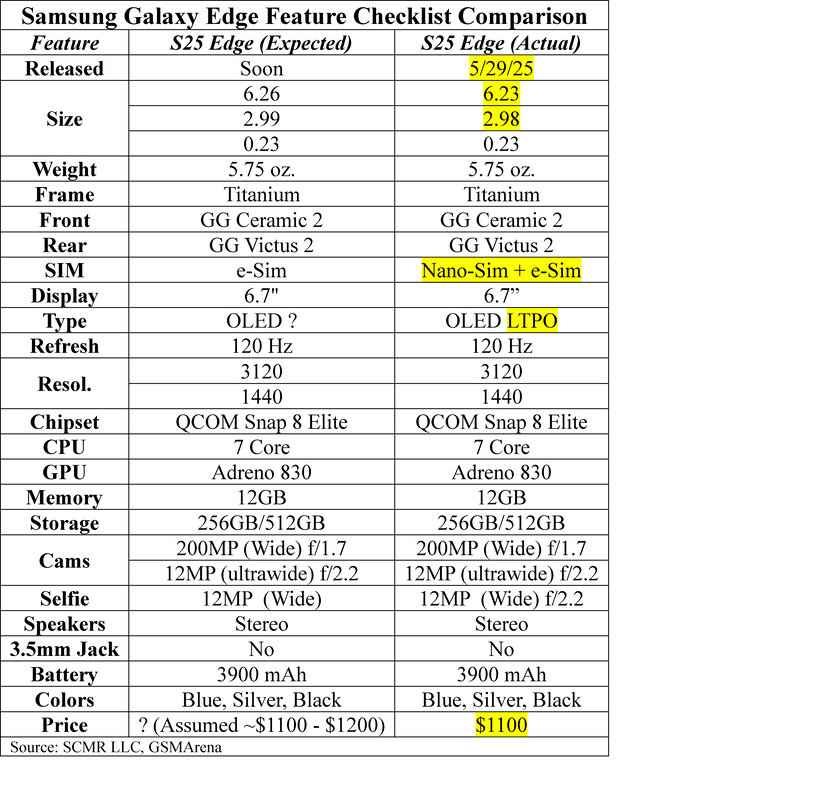

Below we show our feature set list from yesterday and the actual feature list from the release. We highlight those features that were not correct in yellow. As can be seen, we were off by 3/100ths of an inch on the length and 1/100th of an inch on the width. The Edge can handle both Sim types, not just one as we expected, the display has an LTPO (Low temperature Poly-Oxide) backplane (we were unsure if it would be LTPS or LTPO), and the initial price will be at the low end of our expectations at $1,100 for both memory configurations. Other than those errors, the device features seem to have been well telegraphed.

RSS Feed

RSS Feed