CE Inflation - The Bitcoin Kind

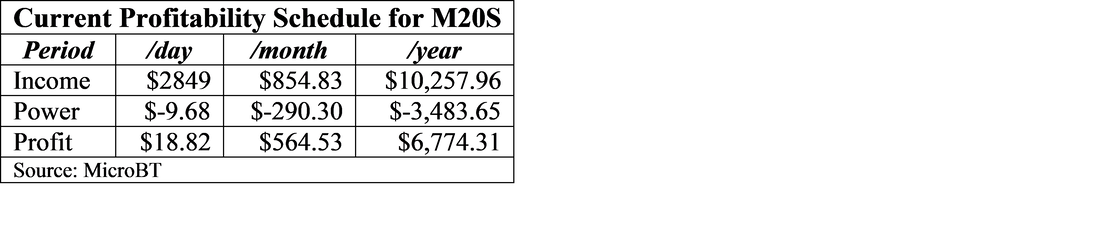

It starts at bitcoins, which have been on the rise, rising from $5,830.25 one year ago to $59,893.95 today. This has incentivized Chinese bitcoin miners, where power is cheap, to build out bitcoin mining capacity. In order to do so, miners need processing capacity, more specifically computational capacity, and a common place to find computational power is graphics cards that normally perform the mathematical computations necessary to convert data into a format that can be displayed by monitors or other display devices. True bitcoin mining systems tend to be based on customized ASICs and have a higher return than using graphic cards, but are even harder to find currently.

The leader in the graphics card space is Nvidia (NVDA) whose GeForce RTX line runs from the RTX 3070 to the RTX 3090, with the major difference being Clock speed and memory. Since mining bitcoins is purely a computational function, faster speed means more computations, means more bitcoins mined, so miners always want the fastest card, but also that means higher power consumption, which is why much bitcoin mining is done in areas of China where power is the cheapest.

That said, given the relatively finite capacity of silicon foundries currently, and the issue facing Samsung’s (005930.KS) Austin plant, foundry customers are finding that they must bid for foundry capacity, escalating prices further. Graphic cards face both that problem, which limits their availability, and the very aggressive demand from bitcoin miners, which has caused prices to rise quickly as availability dried up. As an example, the Nvidia RTX 3070 card, which is the low-end of the RTX line, was initially priced at $600 in China. Over the last three months that price, if the card is available, has increased to $1,230. In the US the mid-level card, the RTX 3080, initially priced at $900 is now $2,000, and the high-end RTX 3090, originally priced at $1,400 is now $3,300 and hit $3,575 recently. Setting up a bitcoin mining server farm can use thousands of ASICs, and even then must carefully monitor prices to make sure it remains profitable, but small miners are the ones using graphics cards and the ones willing to pay up for same, as long as the price of bitcoins continues to rise.

So in this case there is a two-fold ‘inflation’ issue, first a shortage of components, in this case really a lack of available foundry capacity, and a specific increase in demand for the product. While the second issue is particular to components associated with bitcoin mining, and therefore the rise in the price of bitcoin, being unable to satisfy that demand at the silicon level is the root cause, which is the same as in much of the CE space. Increased demand from consumers for notebooks, monitors, and TVs during the COVID-19 pandemic and the inability to build out silicon or display capacity to meet that demand is winding its way through the CE space, and unless end-user demand begins to slow, we expect substantial CE ‘inflation’ this year.

RSS Feed

RSS Feed