China Handset Shipments – May

5G smartphone shipments declined to 16.7m units, down 22.0% m/m but up 6.8% y/y, although the share of 5G smartphones as a percentage of total handsets also declined to 72.6% from its peak of 77.8% last month, and th number of new 5G models released in May declined to its lowest level this year. We expect that the release cycle for 5G smartphones in China would account for the low number of 5G new models and weaker shipments, although component shortages might begin to slow the rate of 5G smartphone growth in the near-term. That said, we expect 5G share of total shipments in China this year to remain above 70% for the remainder of the year and new 5G model releases to pick up in September.

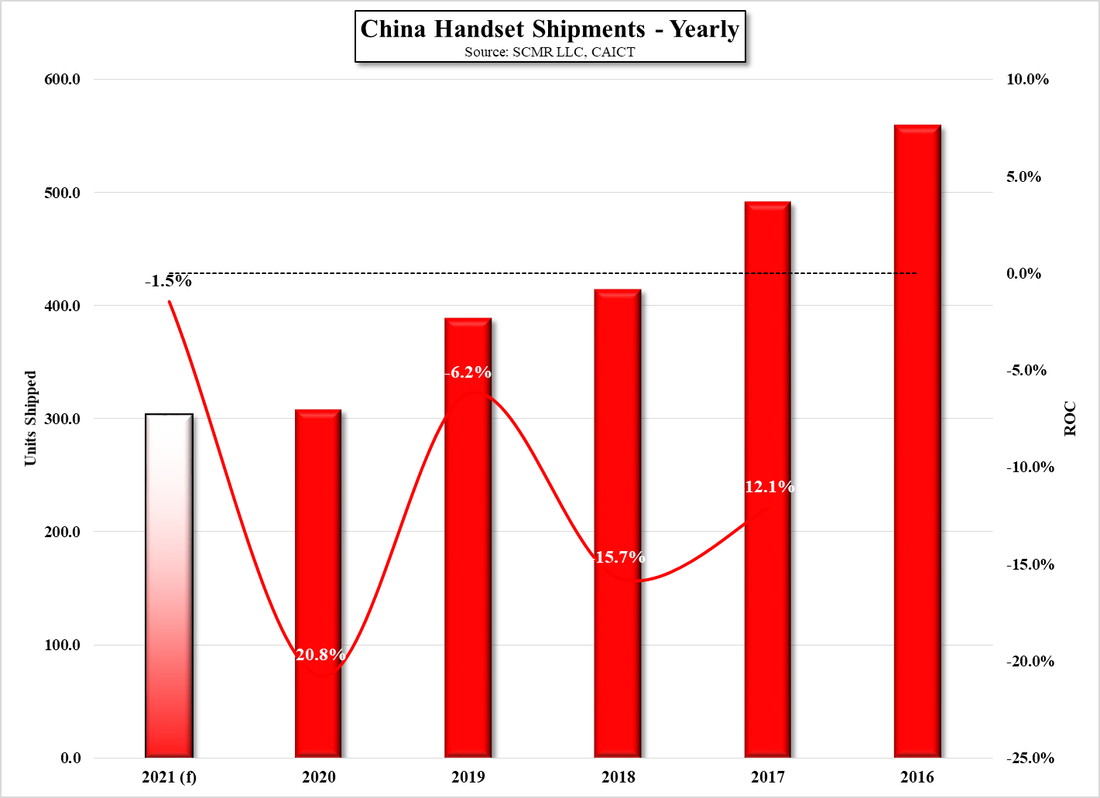

On an overall basis, China’s smartphone market remains lackluster, and Huawei’s (pvt) trade issues with the US, while they are less impactful on the Mainland, do have a sobering effect on smartphone demand in China. As Huawei is unable to avail itself of 5nm or 7nm process nodes, their ability to compete with other smartphone brands is muted, despite the lessened impact of limited Android services in China. Other Chinese brands continue to try to fill the gap, but to remove what was the number one brand in China from its position in its home country would be like removing the iPhone in the US. Many will migrate to other brands, but the transition is not an easy one and will opt to hold on to existing Huawei phones for a while to see if the trade logjam breaks. In the interim, the Chinese smartphone market continues to weaken.

RSS Feed

RSS Feed