China LCD – Bigger, Better?

As the LCD production space is cyclical, one cannot always guarantee that either or both criteria can be met at all times, but when they are it sets the tone for the ‘gain share’ buzzer to go off, panel producers see themselves as the ‘leader’ in the space, and they start developing plans for further capacity expansion. Local governments, looking at current profitability, seem to assume that this will continue both for all time and regardless of capacity and are happy to keep the local coffers open with just the suggestion that ‘the world has changed’ or ‘It’s not like last cycle’. The problem is that nothing lasts forever in a cyclical world and the cost ($3b - $4b) to build a greenfield LCD fab is high. Such construction, even in China, who is known for their ability to build fab structures quite quickly, takes at least 18 months from planning to initial production and during that period panel prices can and do fluctuate wildly.

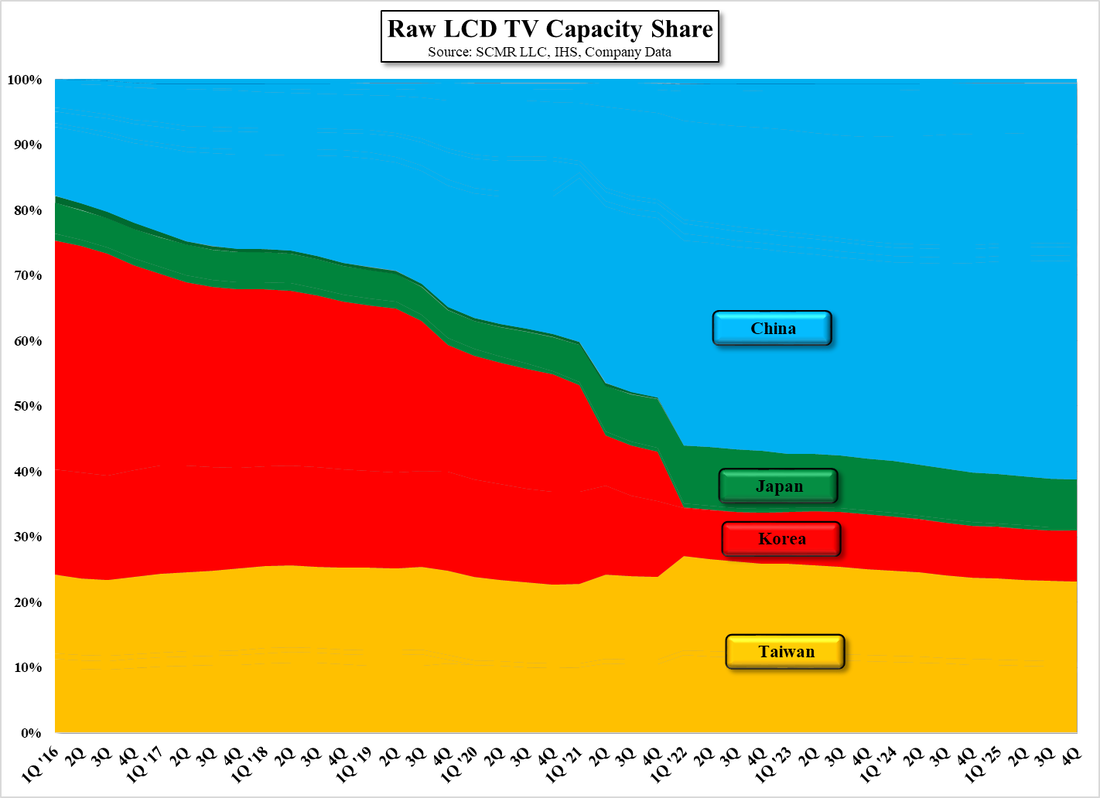

China is still bent on gaining share and our updated LCD industry model cites a number of Chinese fab expansion projects that will continue through 2022 and beyond. China will continue to gain share, particularly as South Korean producers back away from LCD panel production, but both demand and panel pricing must also stay at current levels or increase to keep capacity utilization high enough to maintain profitability, and that is a far more difficult question than ‘Should we finance a new fab in our city?’ Those decisions tend to be based on provincial competition and less on the effect it will have on the industry as a whole, but we doubt, even if the cyclicality of the industry were laid out in front of said decision makers, it would have much impact, as by the time the new fab is completed, local politicians would have moved on to more important state positions and the lack of profitability would become someone else’s problem.

It was easy for Chinese producers and financing sources to make decisions given the length of the up-cycle we have just seen, but even the short-term drops we have seen in TV panel prices should be a harbinger of what is likely to occur if unbridled capacity expansion continues. Based on the projects underway, and those most likely to be added, we have charted the TV capacity share in Fig. 3. China will certainly be the share leader going forward but the question really is, will that be the right place to be over the next few years? It is easy to be optimistic when things are good, but it’s better to be realistic. Bigger is not always better.

RSS Feed

RSS Feed