China Semis

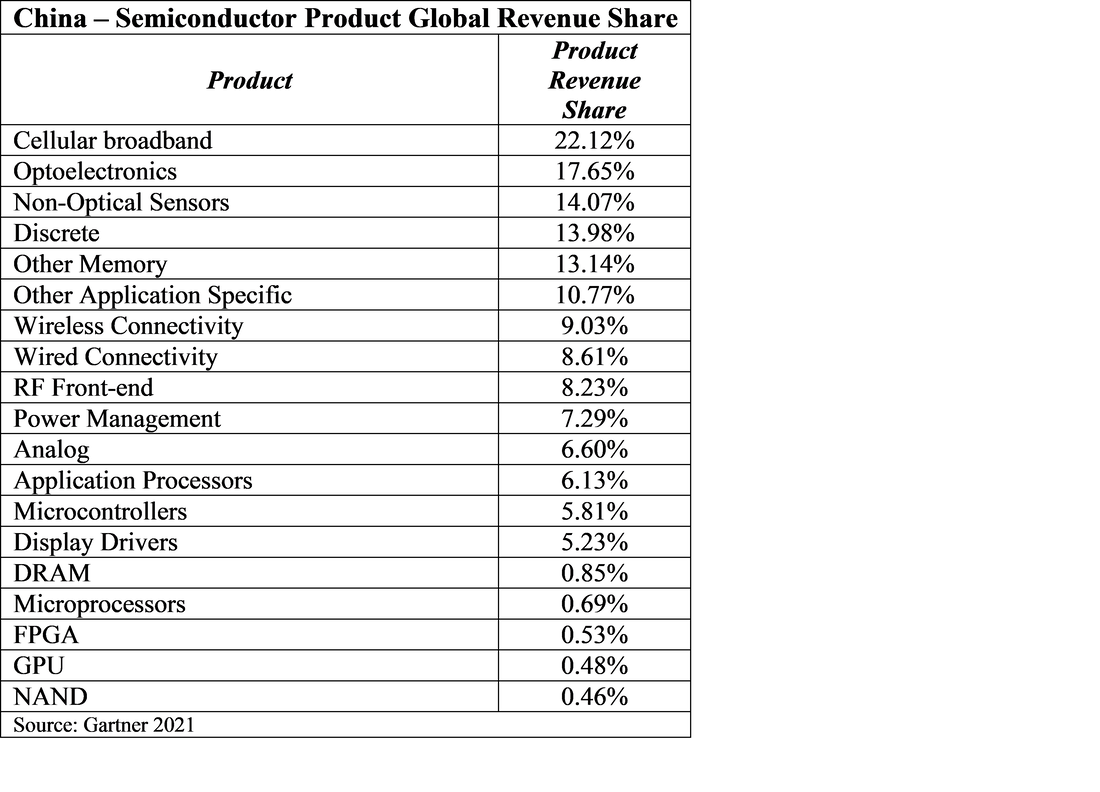

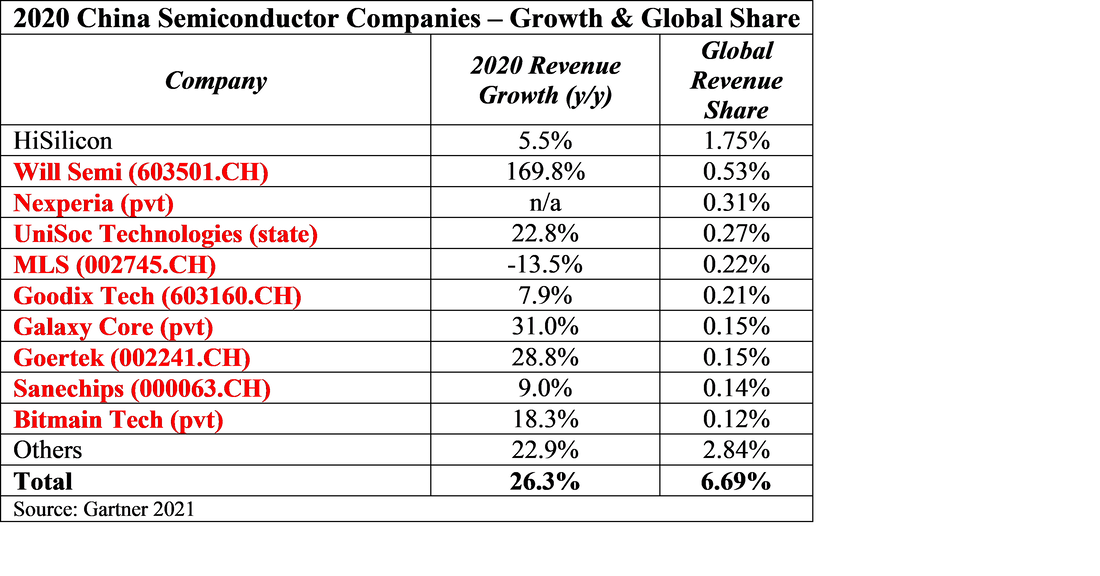

When looking at China’s semiconductor producers, only one has a global share over 1%, and that company, HiSilicon (pvt) is an affiliate of Huawei (pvt), a prime target of US trade sanctions against China., keeping it essentially out of the global market. While most of the other larger semiconductor suppliers in China do not fall under the US trade sanction guidelines, they need to maintain very high growth rates to push China’s overall global revenue share further, while others outside of China are doing the same. There are those that expect China to displace Korea in the number 2 spot within the next 4 years, and while there is certainly growth in China’s semiconductor market and its global reach, we are in the midst of a semiconductor ‘up’ cycle, which has helped to move China’s semiconductor industry a bit faster than what might be normal. What happens after this cycle is over could push out China’s ability to capture revenue share, despite increasing wafer capacity, and make that target a bit harder to reach, and as a few Chinese semiconductor companies have found out over the last few years, throwing money at a problem does not always result in success.

RSS Feed

RSS Feed