China Smartphone Shipments Fall in February

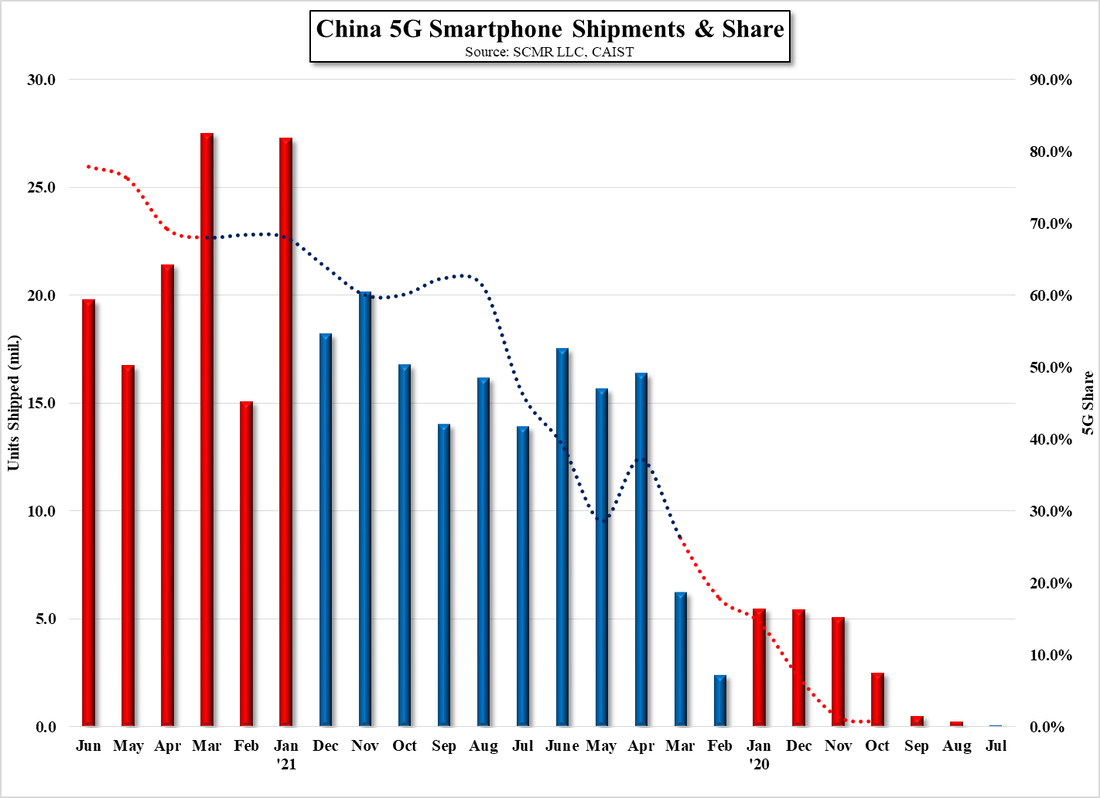

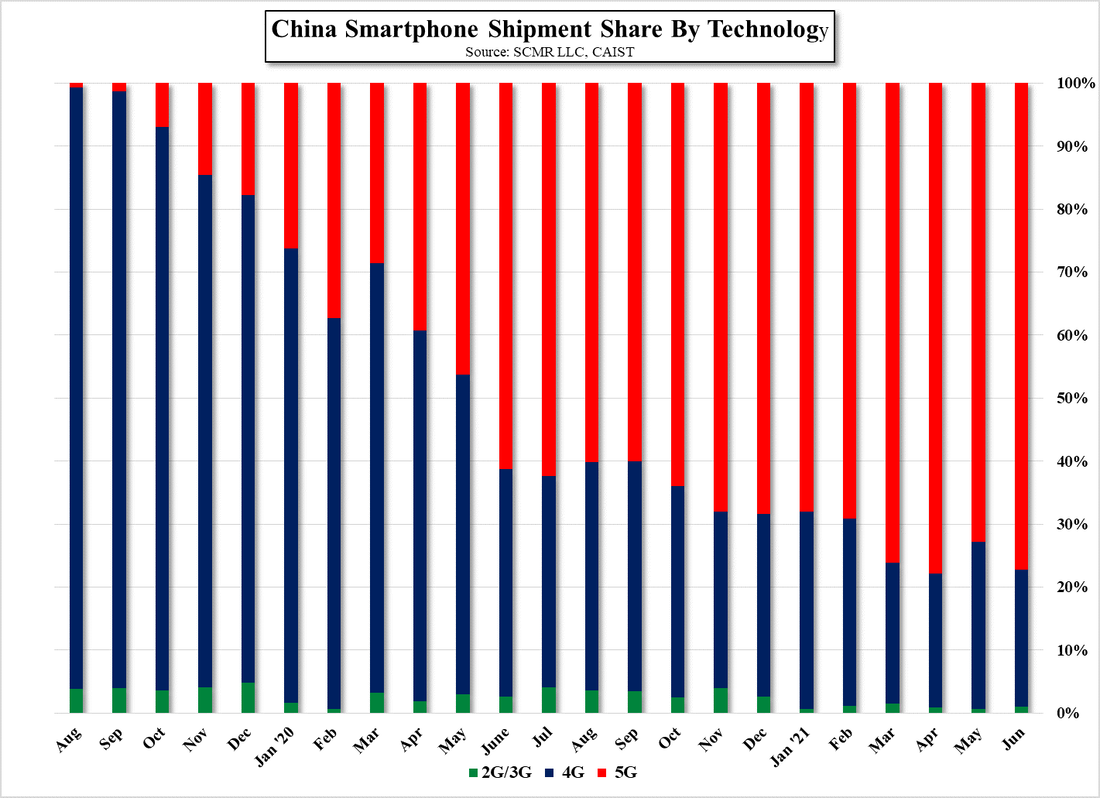

5G smartphone shipments in China were 11.37m units, down 56.8% m/m and down 24.5% y/y, again against a strong February report last year. As 5G data is still relatively short-term, it is hard to read much into the decline but while 5G models remain about 50% of total new models in China, 5G shipments as a percentage of total Chinese smartphone shipments have fallen below the trend line for the last three months. We doubt that pricing has much to do with the decline, as there is little premium attached to 5G models however given the weaker economic growth seen in China, we would expect a shift toward lower priced phones generally, which would be less likely to be 5G ready.

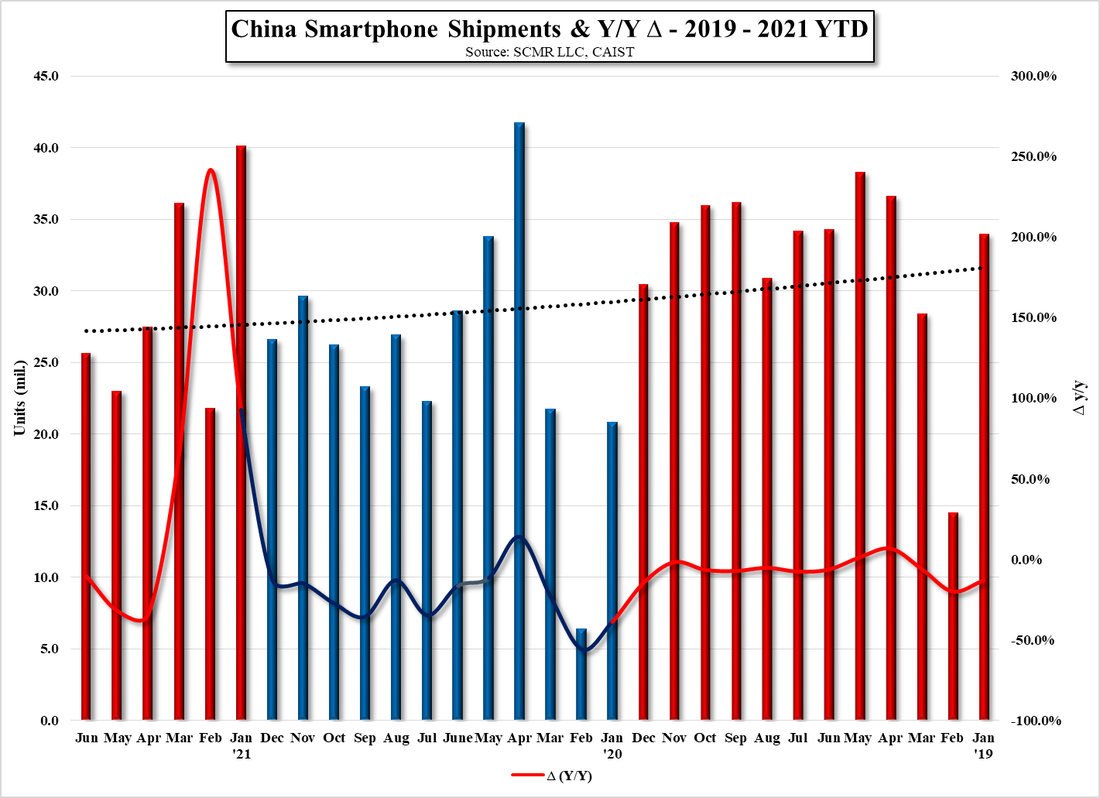

As is the norm, February is an odd month for CE products, especially in China given the February 1 New Year holiday, so we give it less weight than other months, while March tends to be more pivotal. Typically March shipments in China are up 102.1% m/m, including last year’s 65.6% jump and the 2020 m/m increase of 240.8%, so we are expecting shipment to be a bit over 29m units in March, which will determine how we adjust our 2022 full year shipment estimate.

RSS Feed

RSS Feed