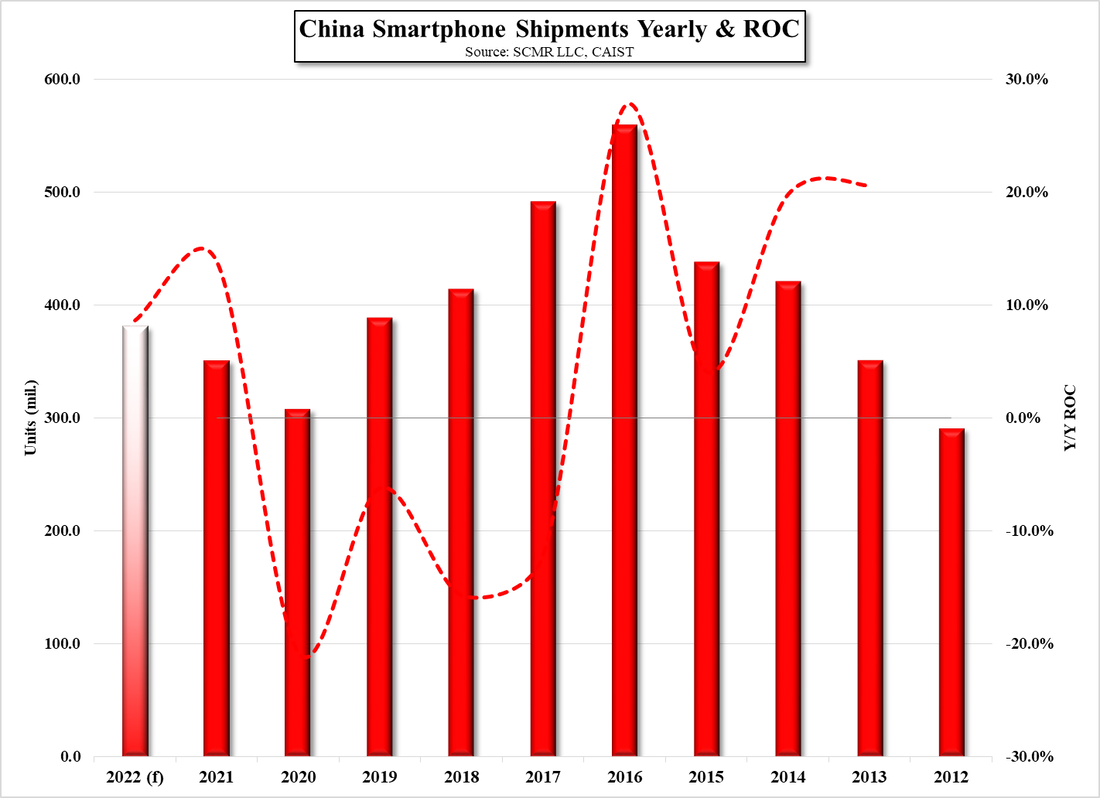

China Smartphone Shipments – January & 2022 Forecast

We expect the most significant mitigating factor will be component shortages that could limit shipments or push back model release dates, which leads us to forecast full year mobile phone shipments in China to be 381.24m units, up a relatively conservative 8.7% y/y. We expect 5G phones to continue to grow share, reaching an average of 80.7% for the year, which would imply shipments of 307.67m 5G units this year, unit growth of 15.6% over 2021’s 266.2m 5G shipments on the Mainland. While we expect there could be considerable play in all of our shipment estimates for China, we expect that on an overall basis 2022 will be a less volatile year than the last two.

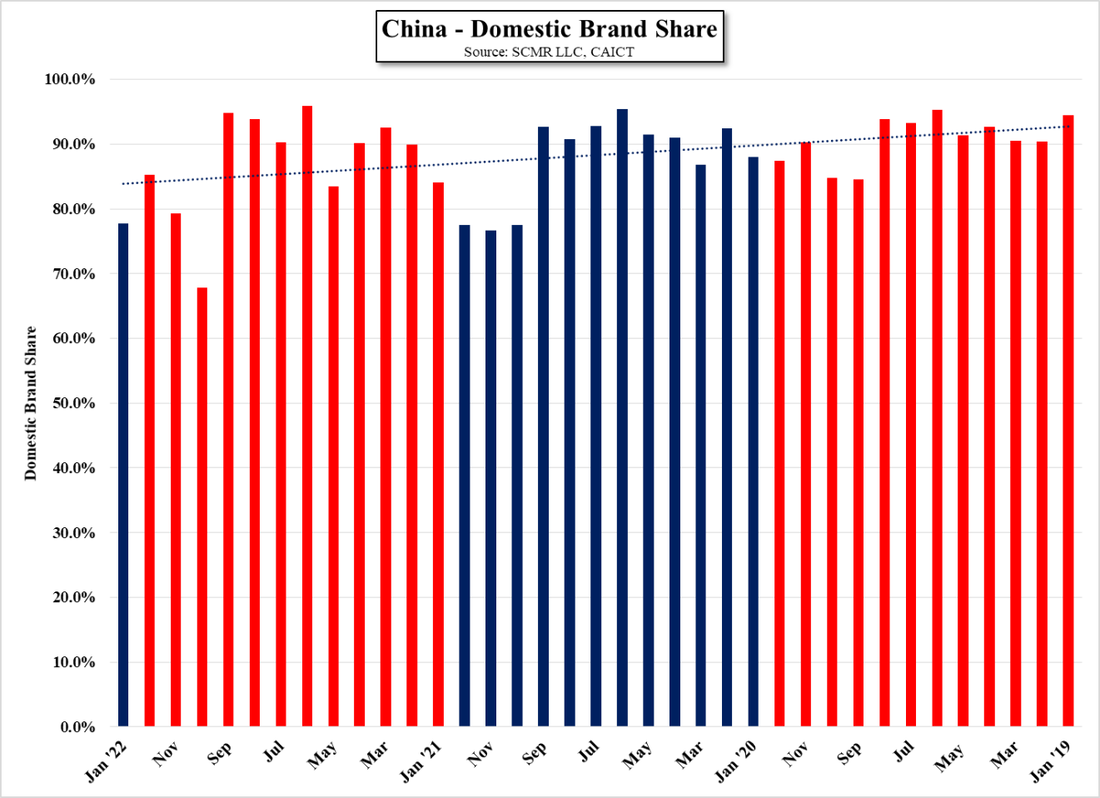

We have noticed a trend that seems to be maintaining itself over the last few years and that is a decline in the share of the Chinese market by domestic brands as seen in Figure 6, which has declined (trendline) since 2019. That said, there have been some monthly domestic brand share increases that have made such data look less valid, such as the peak in June ’21 of 95.9% domestic brand share, but we expect much of that has to do with the timing of domestic brand releases versus foreign brand release schedules. Chinese brands certainly have the largest share of the domestic market, but the impact of trade sanctions against former share leader Huawei (pvt) by the US has reduced their share both globally and in China, and while domestic brands have picked up much of that slack, it has opened the door a bit wider for foreign brands such as Apple (AAPL) and Samsung (005930.KS).

RSS Feed

RSS Feed