China Smartphone Shipments – June, 2Q, & 1H

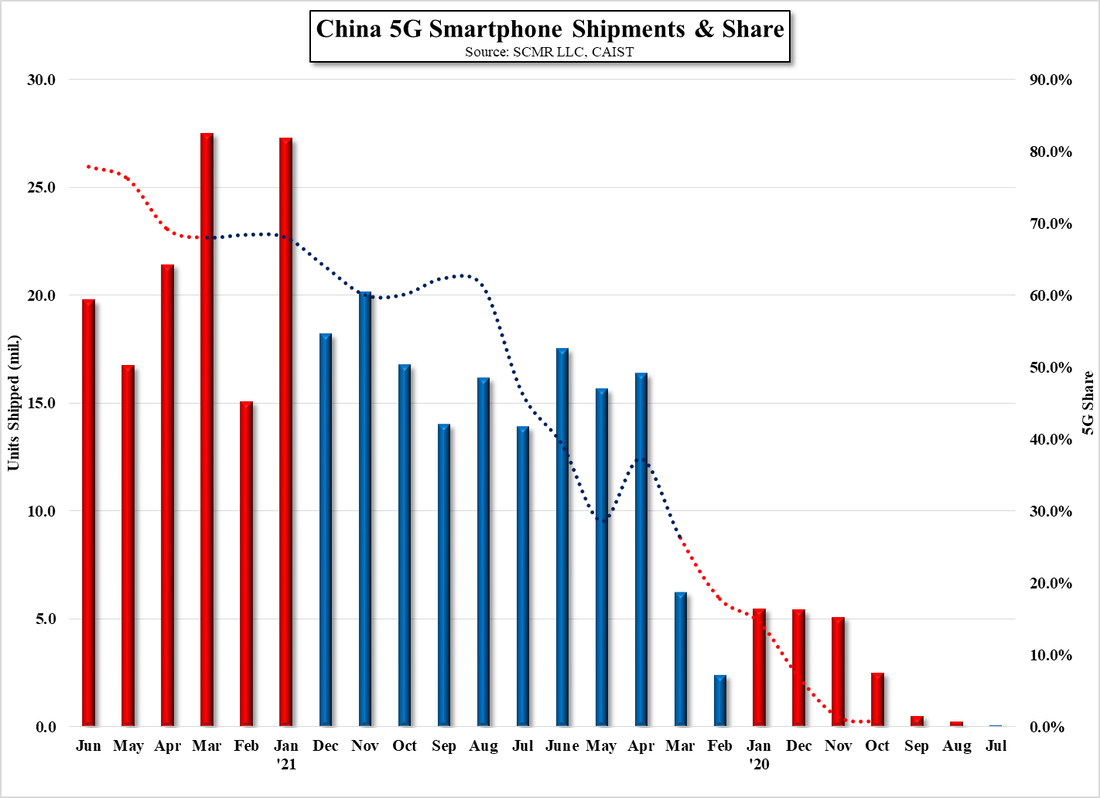

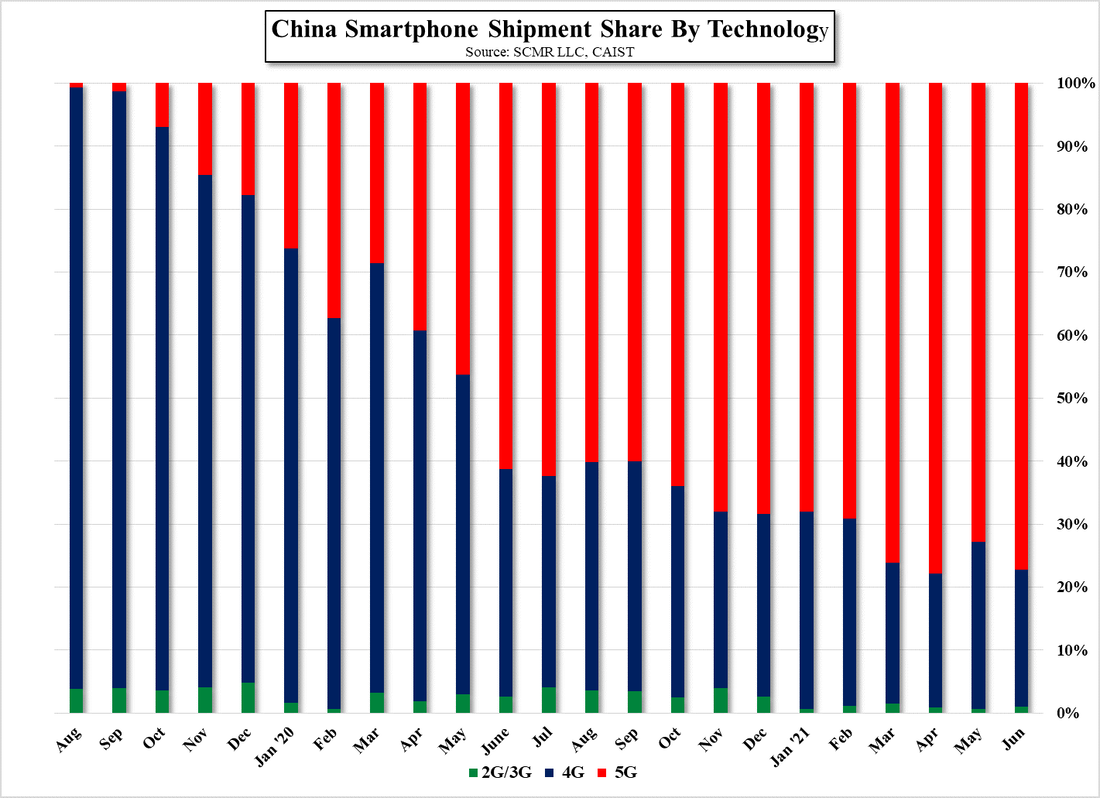

The Chinese smartphone market is also feeling the effects of the US government trade ban on Huawei (pvt), who had been selling phones with components stockpiled earlier in 1Q, but was unable to secure additional components in 2Q. On the positive side, 5G smartphone shipments continue to increase, seeing an 18.2% increase m/m to 19.79m units, and while 5G shipments in 2Q were down 17% q/q, they were up 17% y/y, again with the q/q weakness likely coming from Huawei. 5G shipments in 1H were 127.8m units, up 101% y/y. 5G smartphone shipments represented 77.2% of the total in June, slightly below the peak of 77.9% seen in April, but remains on an increasing trend line. As 5G antenna and modem costs are reduced, we expect the 5G share trend to continue to increase but we expect the y/y ROC to level off until 5G connectivity becomes more meaningful in low-end phones, likely in concert with the next round of integrated modems that we expect relatively early next year. We note that 2G and 3G phone shipments in China have now fallen to ~1% and are already meaningless relative to 4G and 5G.

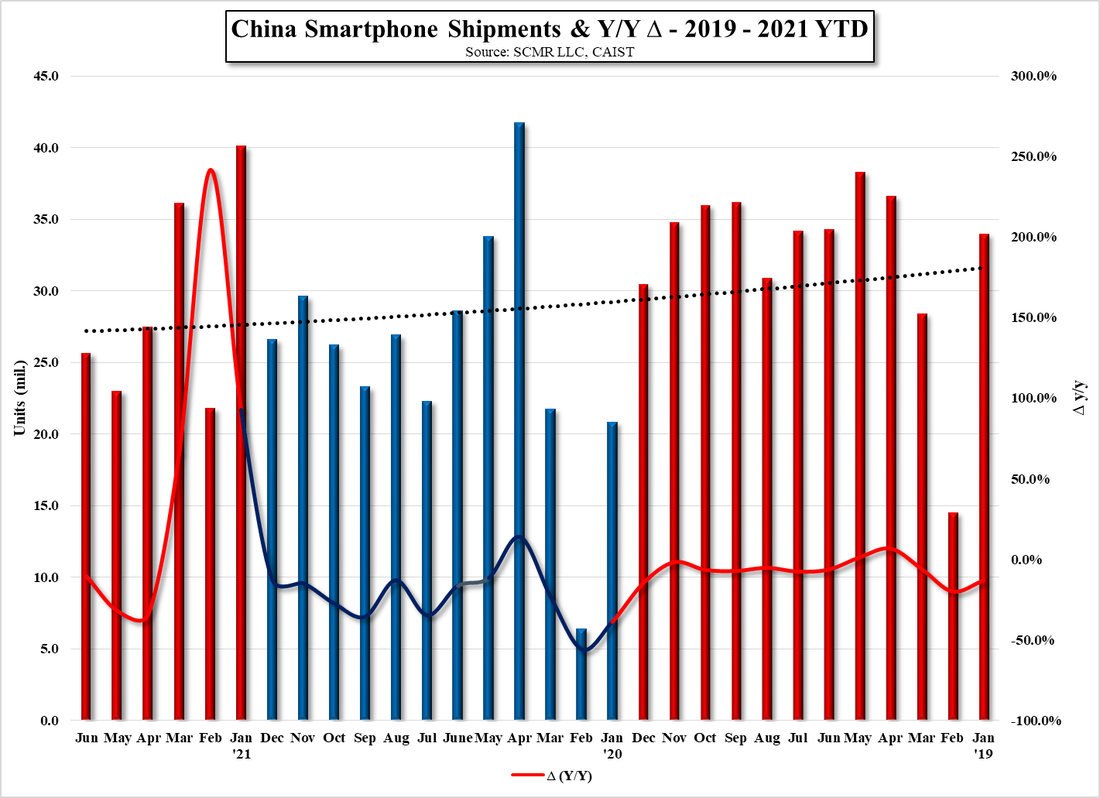

On an overall basis, if Huawei had not been facing such stringent US trade sanctions, we would have expected to still see a decline in Chinese smartphone shipments this year. Chinese brands have been working hard to capture the Huawei smartphone customer base but while they will likely capture much of that share, Apple (AAPL) remains a contender, but one that will show up primarily in 2H. Overall component shortages could also cut into total 2021 smartphone shipments in China, but we see less of an impact from component shortages in 2H and less of an overall impact on demand from increasing component prices for smartphones than with other CE devices.

RSS Feed

RSS Feed