China Smartphone Shipments - Recovery?

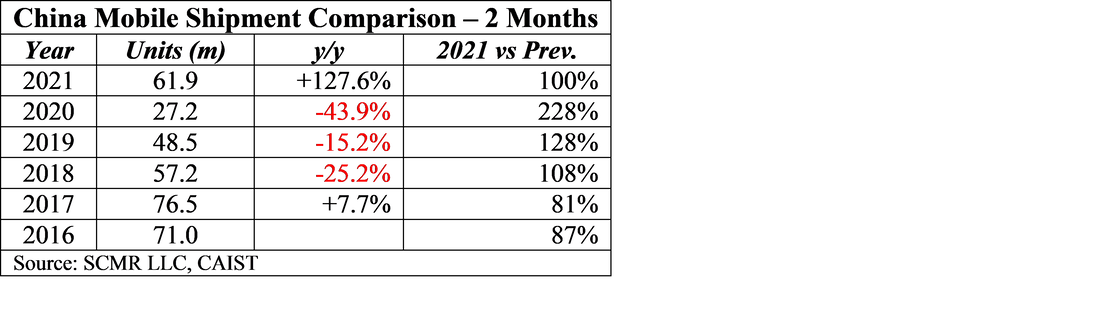

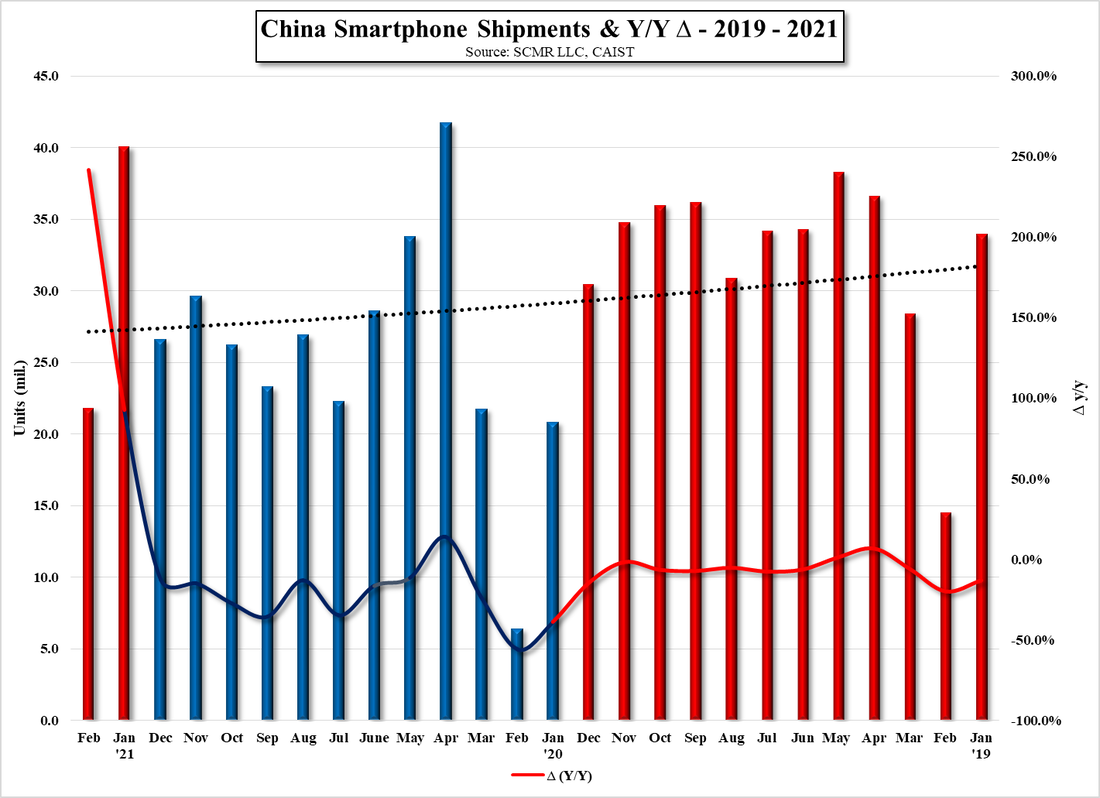

In terms of February Chinese mobile shipments themselves, while February 2021 shipments were up 241.5% y/y, reflecting the extremely poor shipments during the initial COVID-19 lockdown in China, and puts the 1st two months of 2021 127.6% above last year’s first two months. Given the unusual circumstances seen in 2020, we went back to see how the first two months of 2021 compared with earlier years. As seen in the table below, the first two months of 2021 have been strong on both an absolute and relative basis, with unit volume stronger than any year since 2018 and Fig. 1 points out that January ’21 was close to April of 2020, which was a snap-back month after the initial COVID-19 lockdown in China.

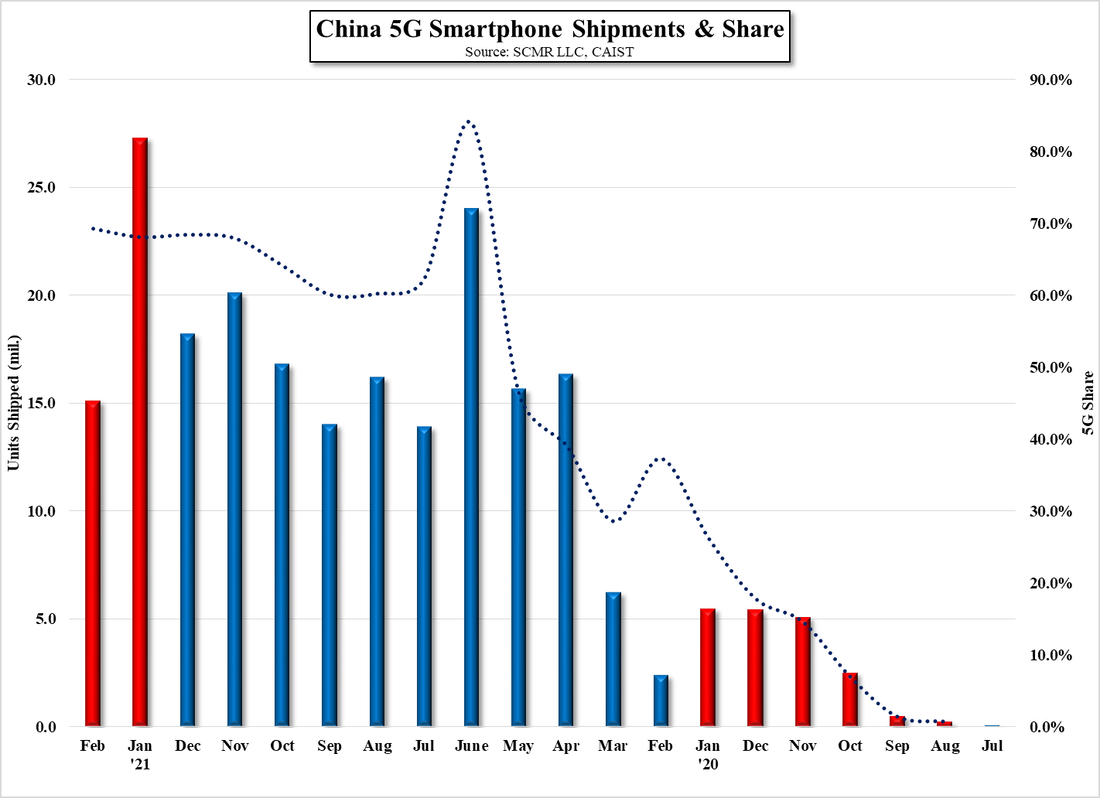

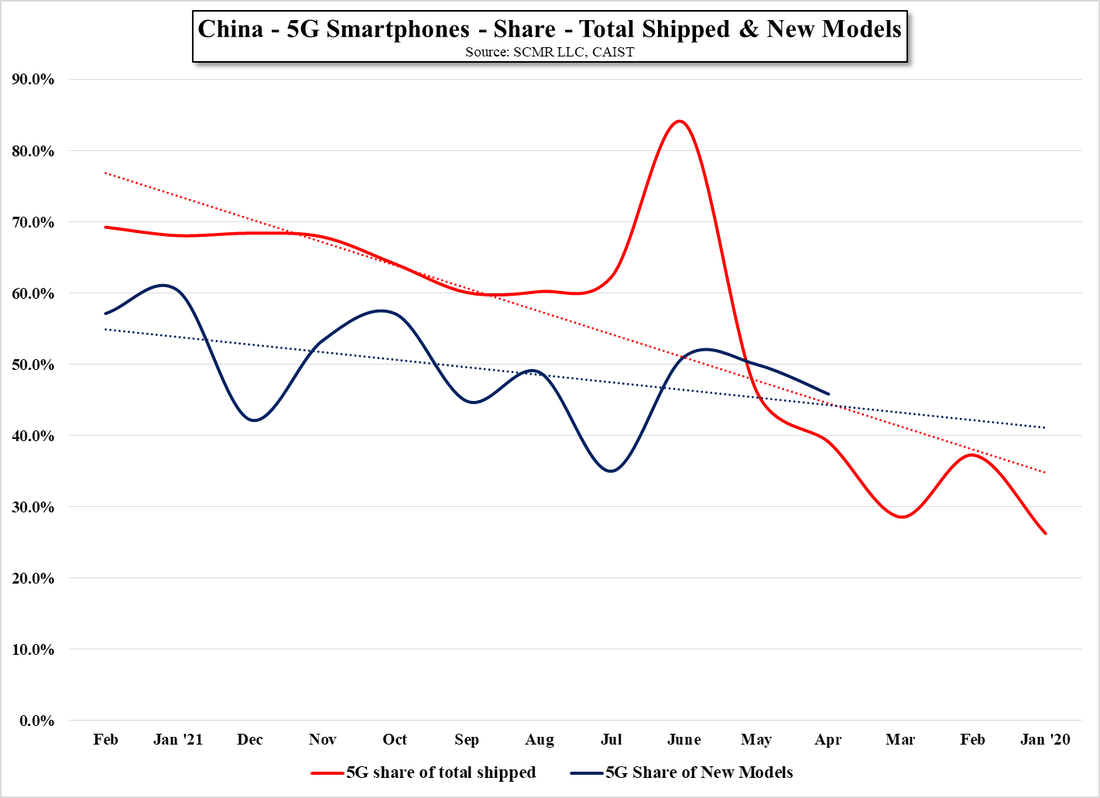

But the question remains as to whether January/February 2021 represents a return to growth in the Chinese mobile device market. Some have cited the desire of Chinese consumers to move to 5G, given China’s aggressive base station installations, but 5G Smartphone shipments, shown in Fig. 2 look quite similar to the overall shipment chart in Fig. 1 In fact we track both 5G smartphone shipments as a percentage of total smartphone shipments in China and the same comparison of new 5G models against total new models in China, and the share of 5G smartphones shipped relative to total shipments has remained roughly the same for the last few months, just a bit under 70%. While the number of new 5G models has been increasing, it has varied between 45% and 65% over the last few months, and is less of an indicator of adoption than 5G share of total shipments., so we have to rule out that a surge in 5G customers is the root for the current (2 months) recovery in the Chinese mobile market.

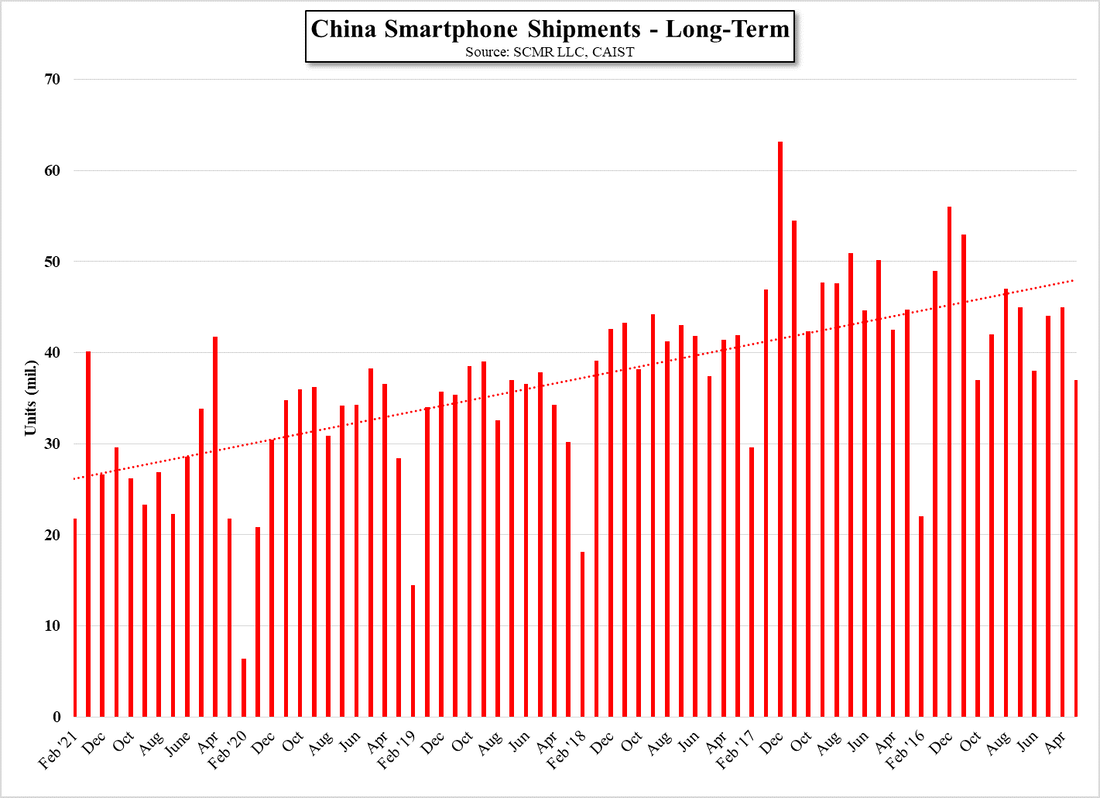

When we look at the long-term chart of Chinese Smartphone Shipments (Fig.4) the recovery looks a bit less sanguine and more in-line with the long-term trend, and as Glenn Close famously said, “I’m not gonna be ignored”, so we wait for March data to gain a bit more insight into whether the population of China has decided that they need to upgrade their smartphones this year, whether the smartphone penetration rate (83% last year according to GSMA) is increasing significantly, or whether this is another period of pent-up demand that cycles back to the norms seen previously. We still believe that 5G is certainly a factor that has helped to sustain the smartphone replacement rate in China, but whether 5G alone can account for the early strength this year still seems problematical. .

RSS Feed

RSS Feed