China Smartphone Shipments Weaker

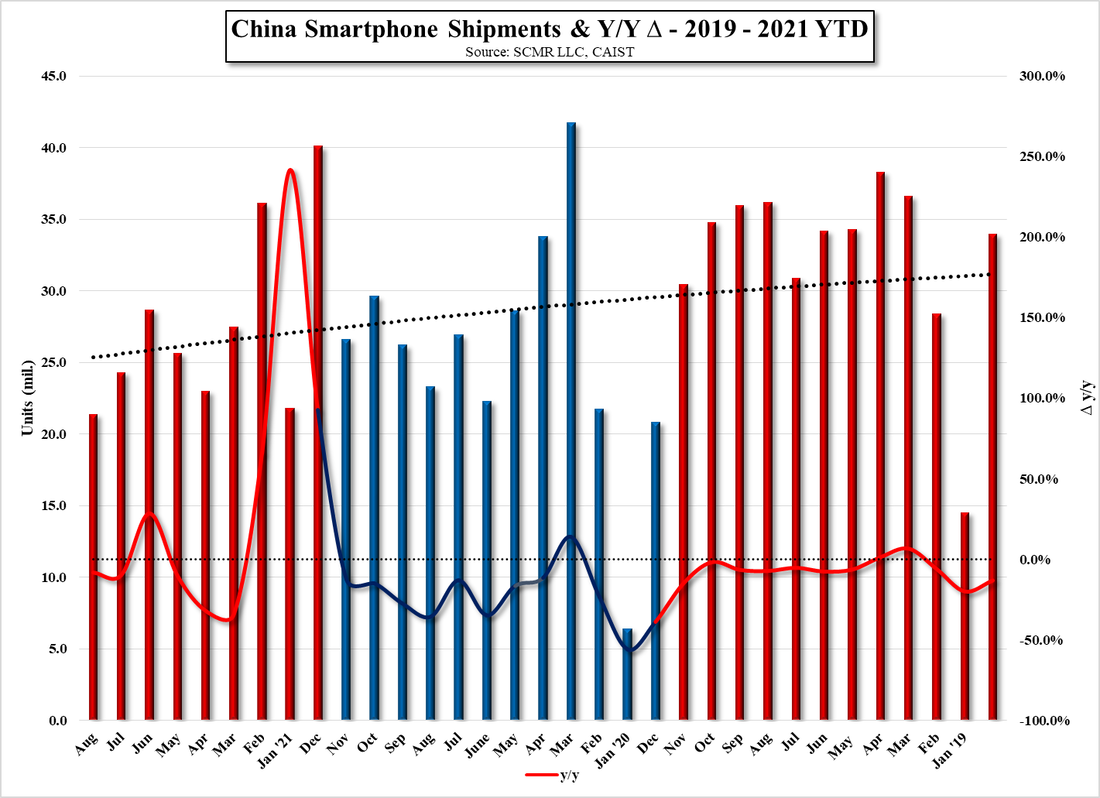

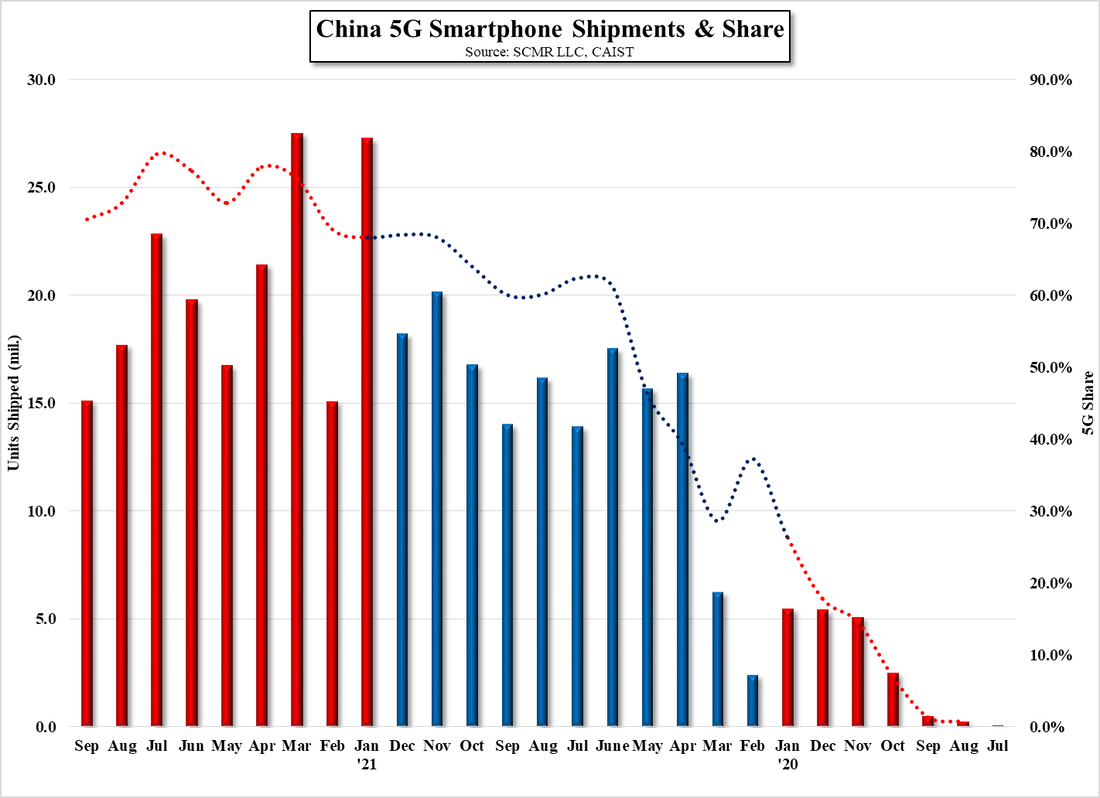

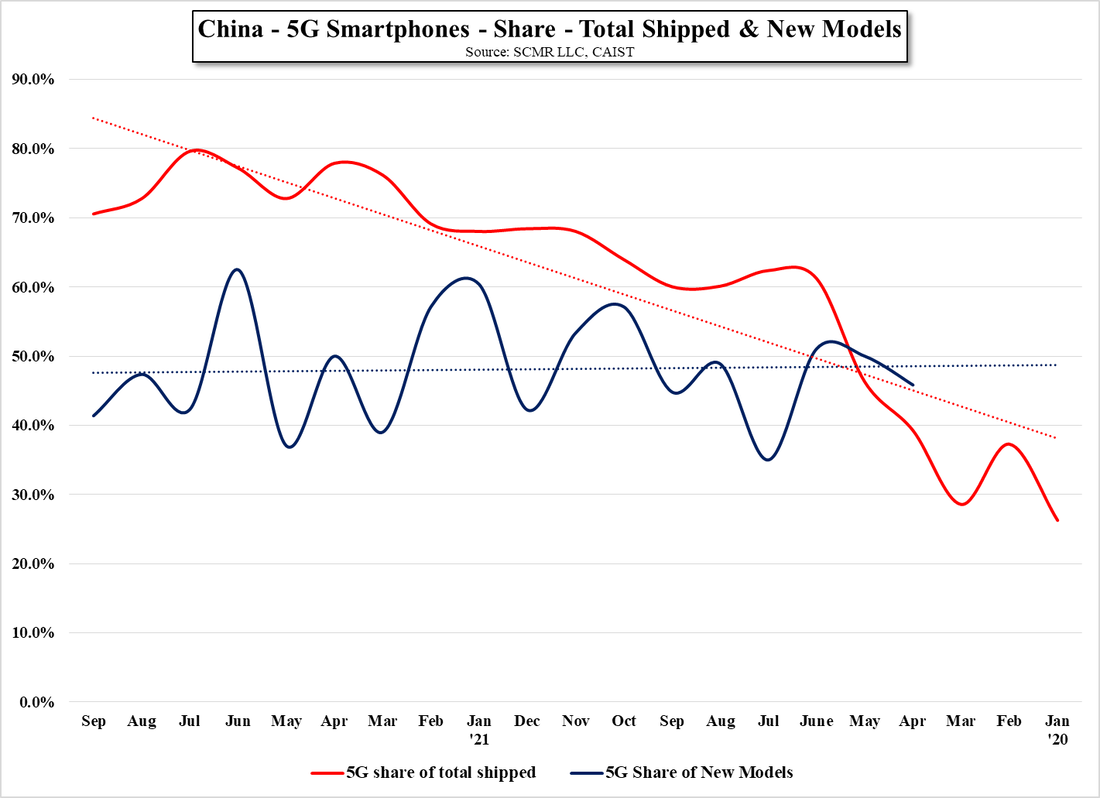

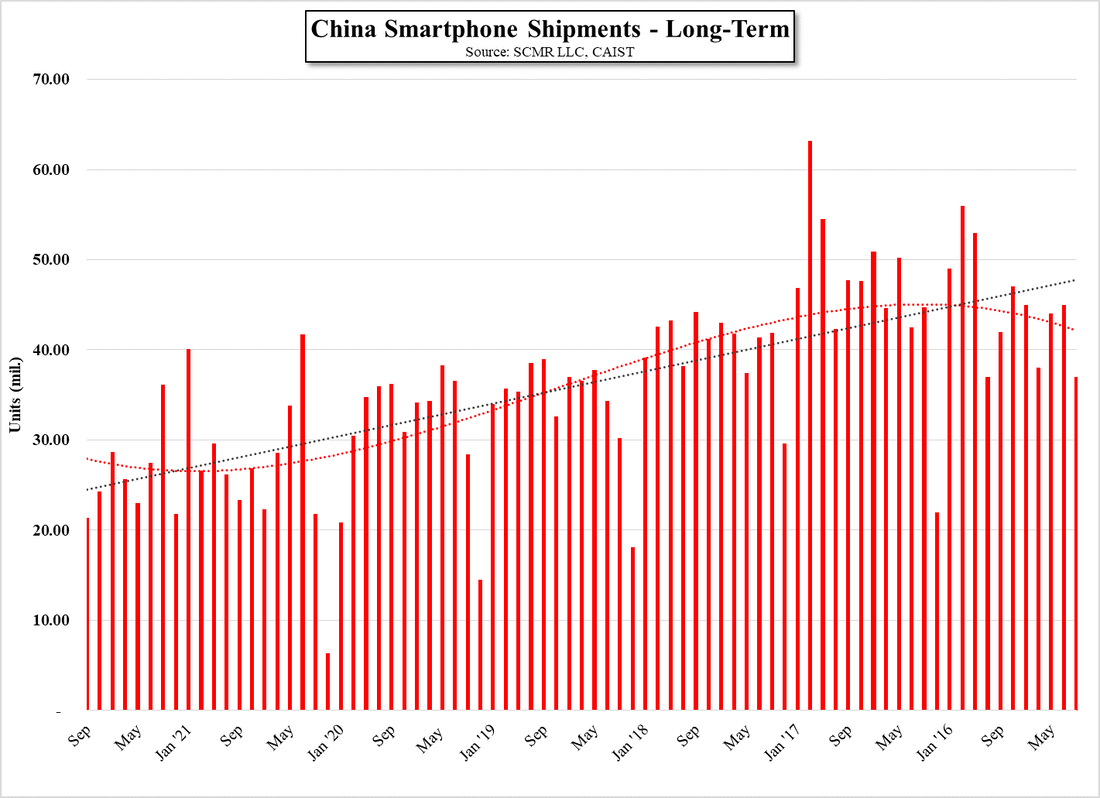

Based on September’s performance, we lower our expectations for China’s full year 2021 smartphone shipments from 332.9m units to 313.6m units, a reduction of 5.8%, which would put the year up 1.8%, rather than our previous estimate of 8.1%, and the 2nd half being considerably weaker than the first half of the year. 5G smartphones shipments were 15.1m units, down 16.6% m/m but up 7.9% y/y. This marks the 2nd month in a row of negative monthly 5G shipment growth in China, with both declining faster than the overall market on a m/m basis. While this is something to be closely watched, as 5G smartphones have been a source of growth in the Chinese market, we believe the slowdown in 5G shipments is a function more of an overall slowdown in the Chinese market than a function of 5G itself, especially as China continues to build out 5G networks. 5G smartphone share of total shipments in the Chinese market has been above 70% since March of this year and while it could drop below 70% in 4Q, the average for the first 9 months of this year (73.8%) is considerably higher than last year’s 46.8% for the same period.

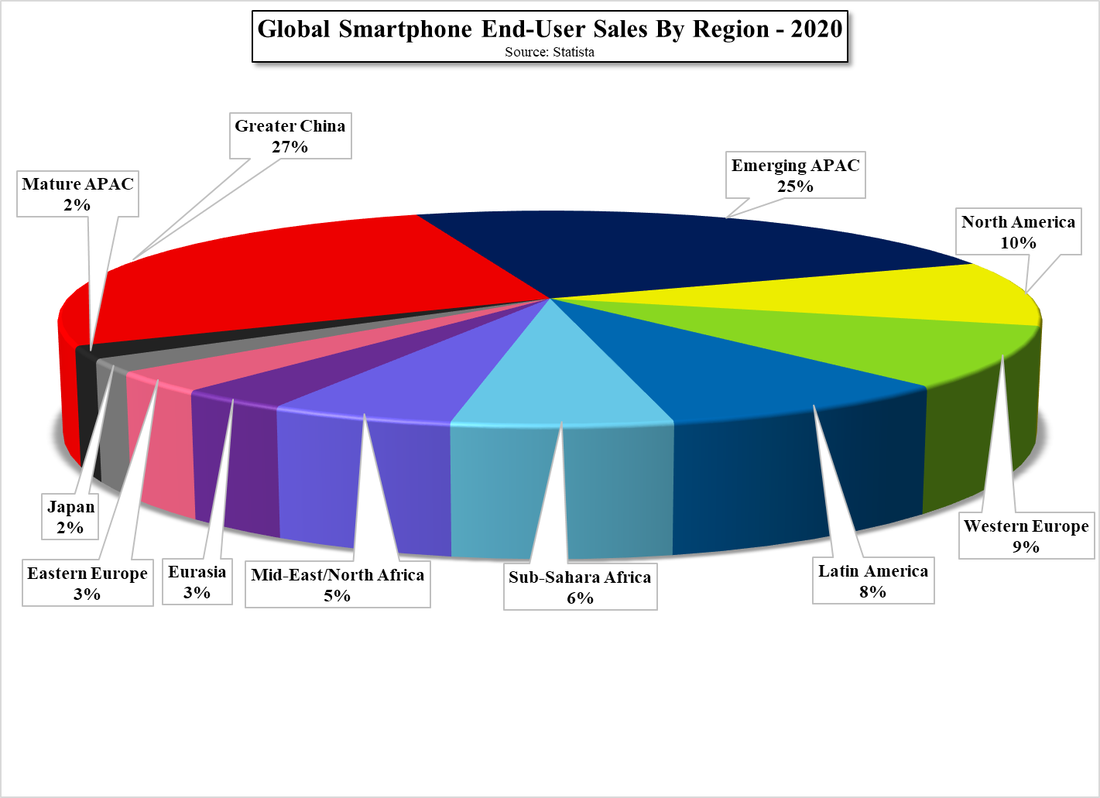

While we believe the Chinese smartphone market is maturing, smartphone penetration rates are still estimated to be below 60%, and while penetration rate increases will become harder to come by going forward, the 5G conversion replacement cycle will likely support at least some growth again next year. That said, 6G is a few years off and it will be difficult for the Chinese market to see much unit growth in 2023 and beyond until that cycle becomes a reality, which will make the Chinese smartphone market even more competitive than it is currently. While this does not bode well for Chinese smartphone brands, it will likely lead to more feature rich and potentially less expensive models for Chinese consumers over the next few years, and while this is a plus for potential Chinese smartphone buyers, it will continue to put pressure on non-Chinese brands, who are faced with further share loss in China and more global competition as Chinese brands look to grow outside of the Mainland.

RSS Feed

RSS Feed