China Smartphones & 5G

There was a big jump in new models released in August, increasing from 26 in July to 57 in August, while this in itself is not unusual in that 3Q is usually the peak quarter during which new smartphones are released, but going back as far as 2017 September has always been the strongest month for new smartphone releases in China. That would imply an even greater number of new models released on th Mainland in September (typically the increase of new models released in September on a m/m basis has been between 28.8% to 100%) unless the desire to anticipate the release of Apple’s (AAPL) iPhone 13 family pulled in many of those releases (we believe the former).

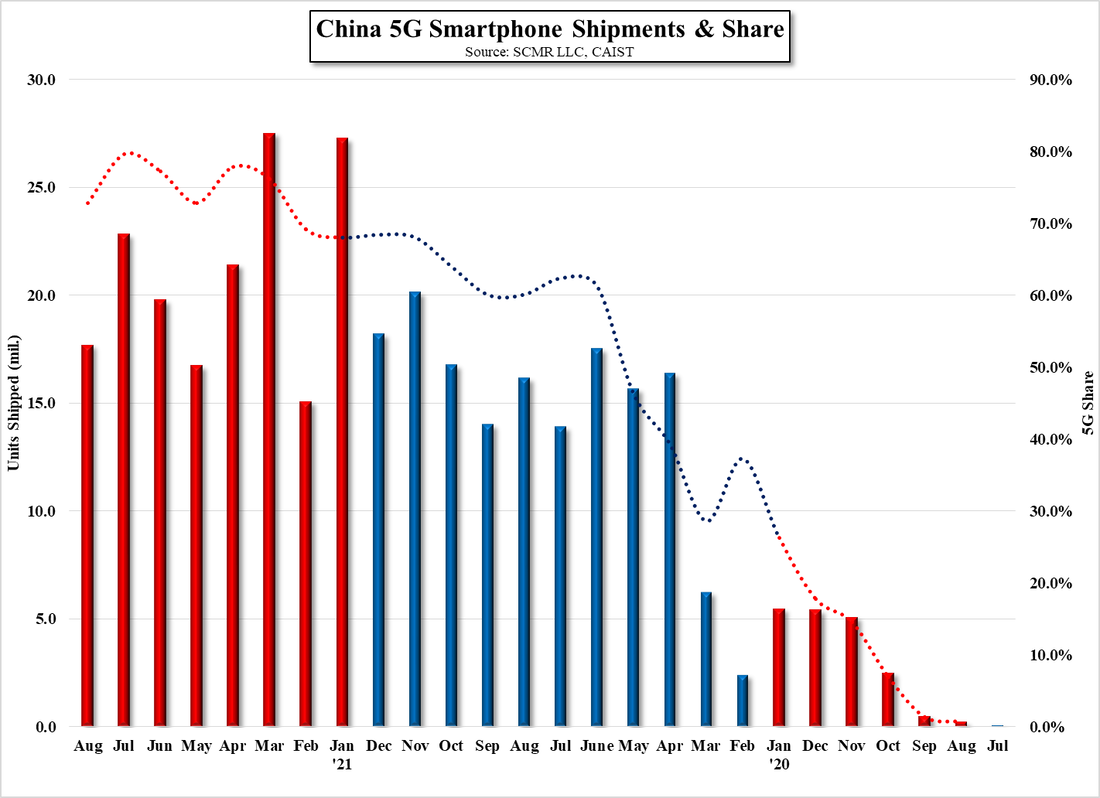

5G smartphone shipments in China were 17.69m units, down 22.5% m/m and up 9.4% y/y in August, a relatively weak month after a strong July, leading to a 72.8% share of total shipments. While a bit on the low side in terms of absolute 5G shipments, 5G shipments have maintained a share above 70% since February of this year and we expect little change from that metric going forward, especially under the above assumption that September this year will see an increasing number of new model releases in China. The share of 5G models out of all new models released in China this year has been averaging about 50%, which we also expect to stay consistent for the rest of the year.

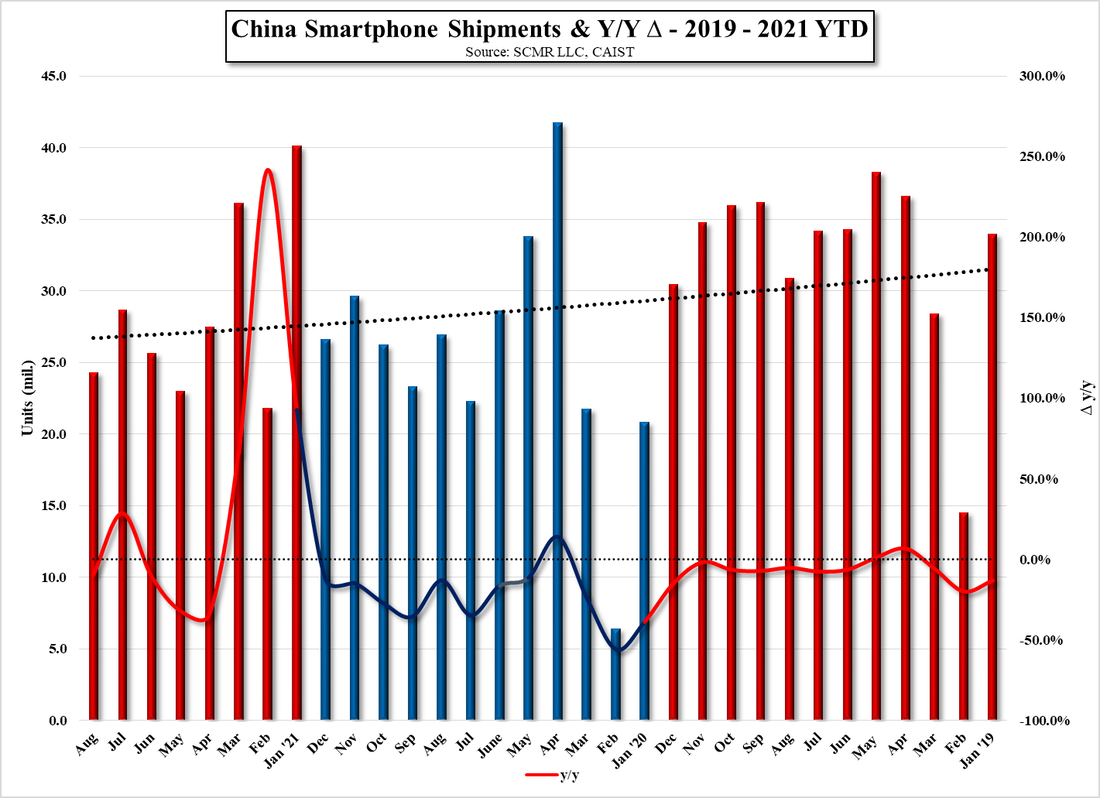

All in, shipments were as expected, to a bit lower, which reflects the increasing concerns over the economic effects of a resurgence of COVID-19 in China and a tight component market. Based on our expectations for the remainder of the year, we expect total mobile shipments in China to be 333m units, up 8.1% over last year, but down from our original estimate (late 2020) of 364.3m units, which would have been up 18.3% y/y. Based on our revised estimate, we expect 5G shipments in China to be between 248m and 255m units this year, which would be up between 53% and 56.7% y/y.

RSS Feed

RSS Feed