Chinese Smartphone Shipment Target Reductions

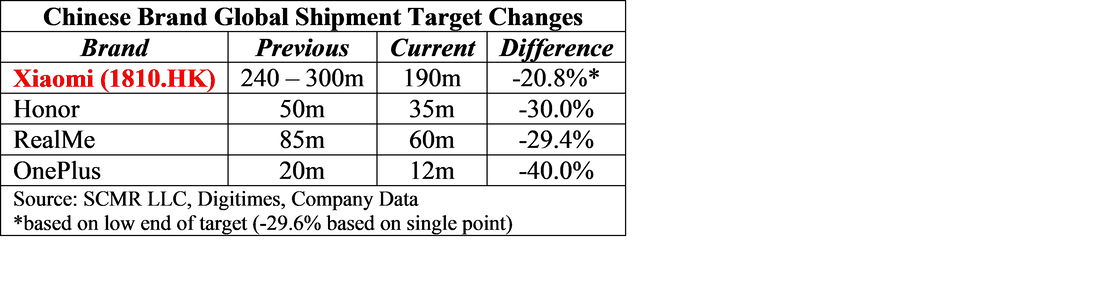

At least four Chinese smartphone brands have reduced their previous 2021 shipment targets, citing shortages and issues in India, but regardless of the reason, the reductions are being passed down to component suppliers. Of course, even with the reduced expectations for 2Q, Chinese smartphone brands are expecting an increase in 3Q and 4Q as new models are released, although no mention of what the strength will be based on or how the same issues that will affect shipments in 2Q will be dealt with in 2H. The question remains as to whether these reductions will give component suppliers a more realistic view of actual demand, rather than overbooking or component stockpiling, which has been an issue for the industry, particularly this year. The table below shows the changes made to shipment targets from four Chinese brands based on current targets and those made in 4Q last year.

Missing are Huawei (pvt) whose trade issues with the US have already severely impacted the company’s shipments both in China and globally, which would have been reduced regardless given the sale of its Honor (pvt) brand, along with Oppo (pvt) and Vivo (pvt) who have yet to update targets. With component shortages and depleted inventory levels, Huawei’s shipment levels and share have become far less relevant, with others Chinese brands vying to fill the gap. We note that the parent organization of Oppo, Vivo, RealMe (pvt), and OnePlus (pvt) is privately held BBK Electronics (pvt) based in Guangdong, China.

RSS Feed

RSS Feed