Crypto Data

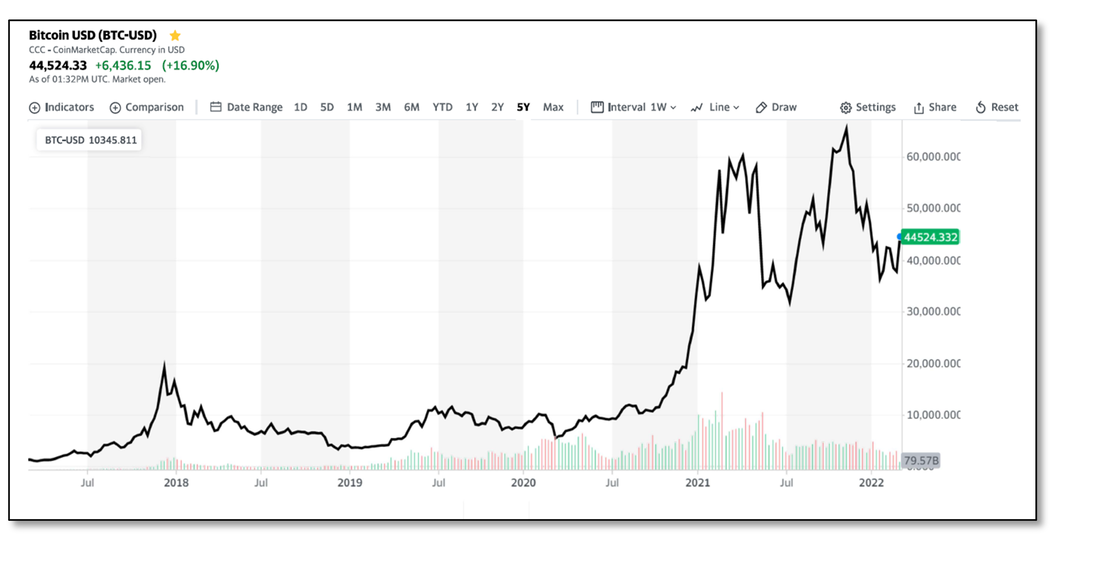

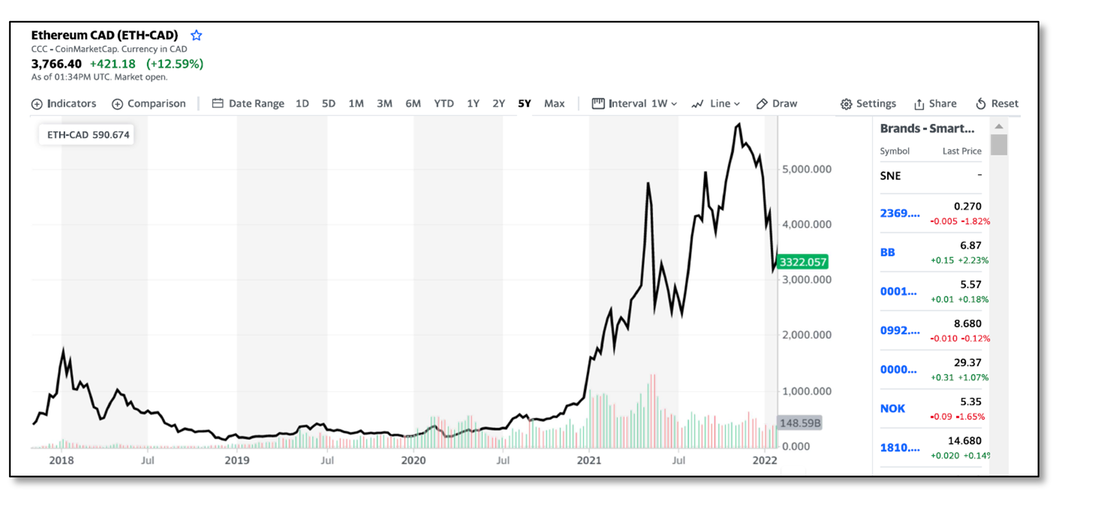

While our conclusions might differ a bit from others looking at the data, it seems to us that cryptocurrencies still have a long way to go to prove themselves as a legitimate substitute for hard currency, with a number of countries with known ‘bad actors’ in the security world ranking high on the list. Given that in some of these countries there is little else than peer-to-peer cryptocurrency trading, as centralized exchanges are not accessible, we temper that caution, also understanding that some emerging markets face currency devaluation, which pushes residents to use cryptocurrency to ‘preserve value’, which is done on P2P networks, and a number of emerging markets limit the amount of national currency that individuals can transfer to other countries, further encouraging the use of P2P networks, which allow residents to bypass such restrictions. That said, we view the data skeptically, even the fact that during the period between 3Q 2019 and 2Q 2021 (after a few quarters of flat growth) the index totals showed that cryptocurrency adoption grew 2300% and 881% over the last year. As cryptocurrency prices have risen, the attractiveness of such increases, both to institutional investors and individuals, but we expect the extreme volatility seen, particularly over the last few days, (up 14.6% as of this writing as Russia’s Swift sanctions push the government to use cryptocurrencies for payments) will bring cryptocurrency prices down to a more reasonable level of trading when the Ukrainian crisis is over, and temper some of the political enthusiasm that has been seen for cryptocurrencies.

While we show only the top 20 in the table below, in the P2P category, Kenya comes up in the #1 position, meaning the most P2P use/capita, while South Korea comes up last. China is first in the retail category, and the Cayman Islands is last.

RSS Feed

RSS Feed