Cycles

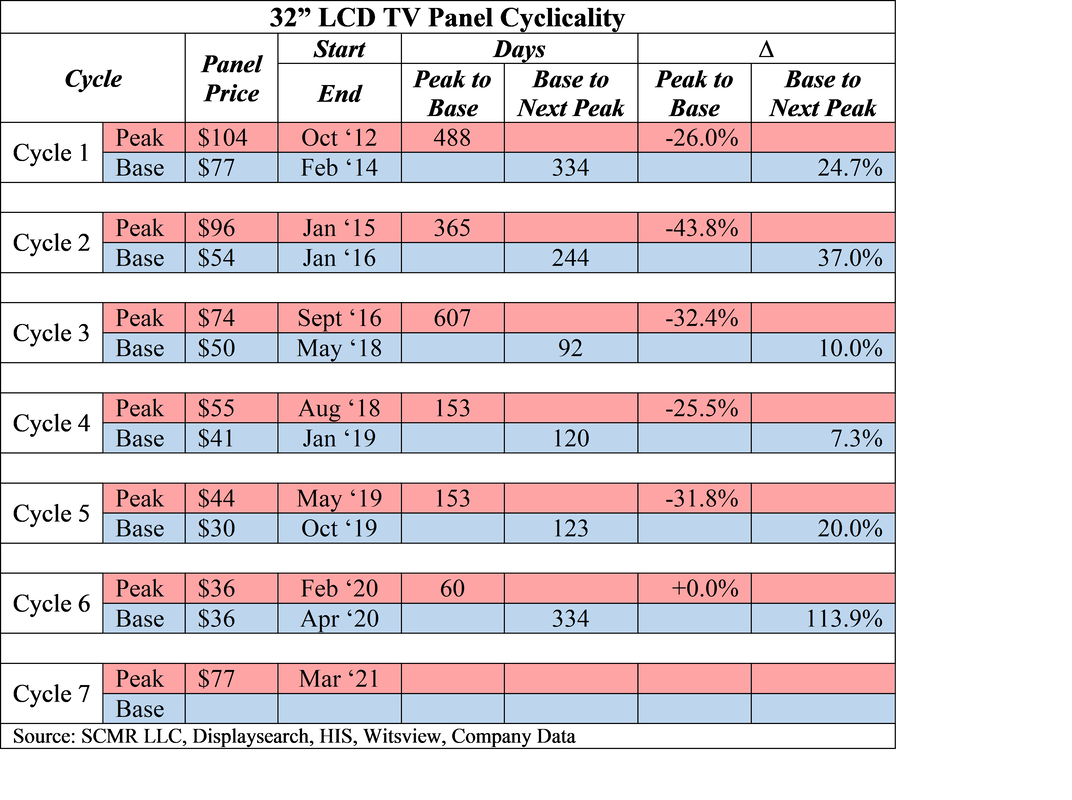

The panel we are speaking about is a 32” LCD TV panel, one we highlighted in yesterday’s data. We broke down the price trends shown in Fig. 1 into ‘cycles’, some of which are long, and some, primarily newer ones, are ‘mini-cycles’ of short duration. The table below delineates those cycles, showing a peak and base price for the panel for each cycle, when and how long the cycle was, and the price difference between the peak and the base of each cycle. We also added a final column that shows how much of a price gain was achieved between the base of the previous cycle and the next peak, indicating how much of a ‘price recovery’ took place for each cycle.

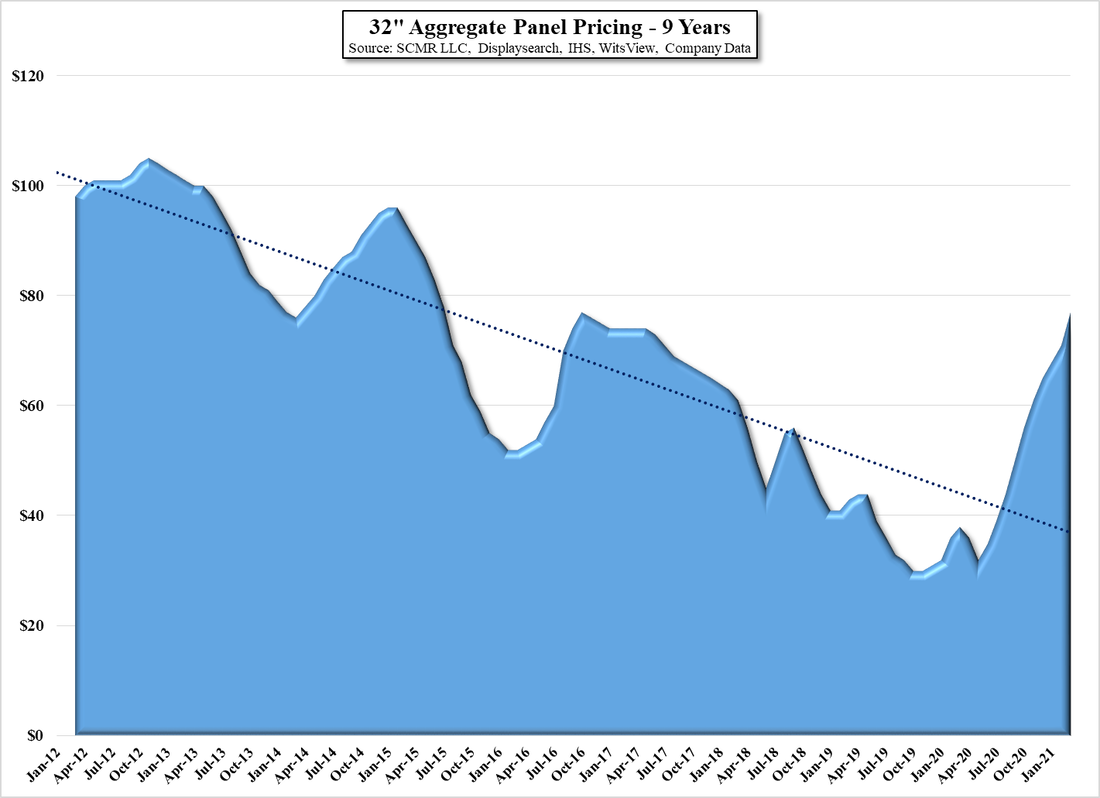

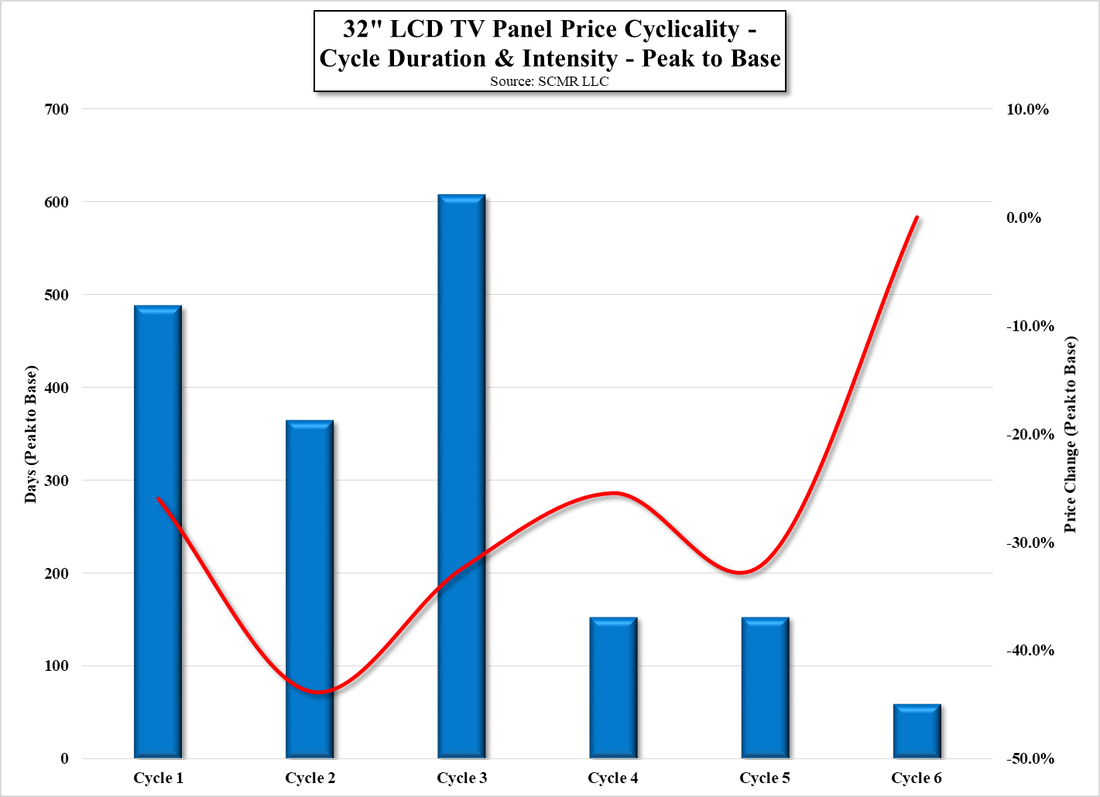

While looking at the chart (Fig. 1) gives an impression of the cyclical nature of TV panel pricing, the table is more specific. The average duration from each cyclical peak to its base is 304 days, although the cycles have been getting progressively shorter (Fig. 2), and the average duration from the previous cycle base to the next peak is 208 days, with little change over time, although we note that the base to peak for cycle 7, which we are in currently, if we assume today is the peak, took a long time to develop, which we believe accounts for some of its intensity. That said, the base-to-peak of cycle 1, which had the same base-to-next-peak duration, saw a price change of 24.7% whereas the price change in cycle 7 (current) is already 113.9%, already 4 times the price increase of its closest looking cycle.

While this is really a statistical look at the pricing cycle of 32” LCD TV panels, it does give some indication as to how different this cycle (cycle 7) is from others. It will likely be longer than any other cycle when measuring time from previous base to peak (when that occurs), and certainly has been far more intense from base to peak, than any other cycle. We note that there are a number of exogenous factors at play in cycle 7, the largest being the effects of COVID-19 on demand, and to a lesser degree capacity, but we also have to note that much of LCD TV panel capacity is being produced by Chinese fabs who have a different mindset and profitability criteria than more traditional South Korean, Taiwanese, and Japanese producers.

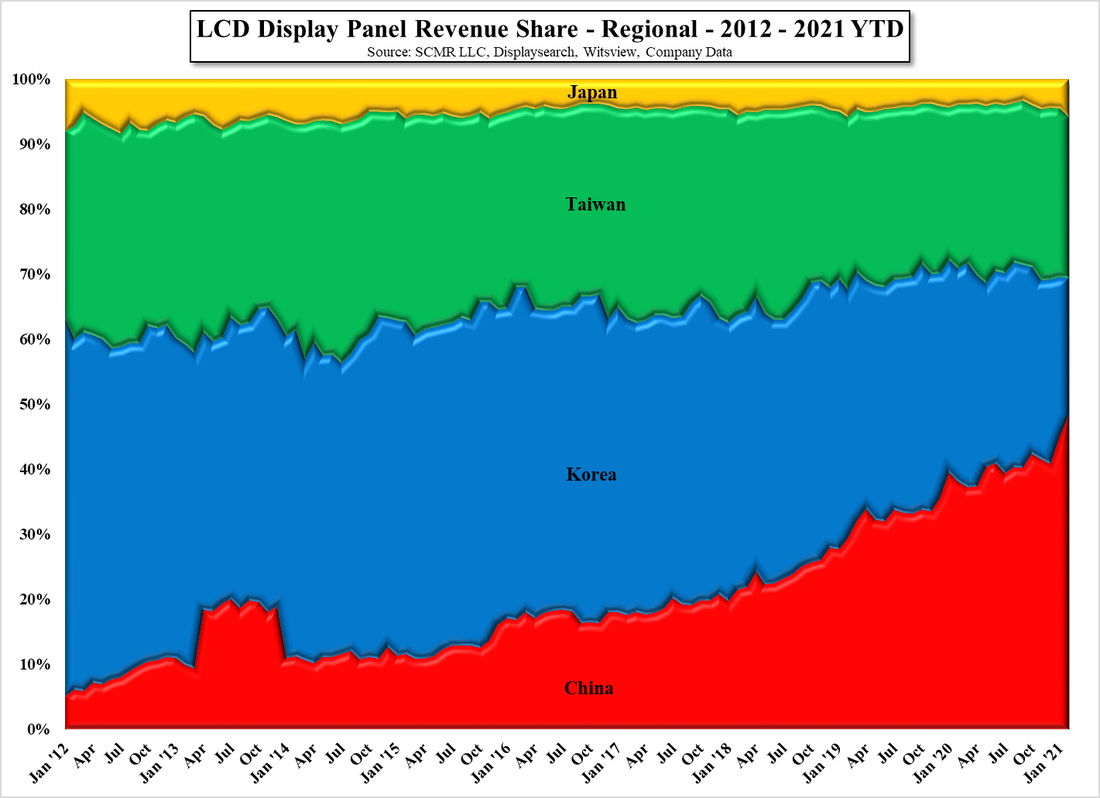

The subsidies offered by local and provincial Chinese governments can allow Chinese panel producers to operate at lower margins and take higher inventory risk than might have been the case in the past. This mindset also color’s Chinese TV set brand aggressive sales goals and panel buying plans, which are less colored by the devastating and long-lasting effects of early cycles, which has made more experienced panel producers a bit more conservative. China’s share heading into the first cycle was under 10% and now exerts far more influence on panel capacity and panel prices, which we expect to expand further in 2022, as Korean producers reduce LCD large panel capacity.

Looking at the cyclicality of the panel space, recognizing that 32” TV panels are but one part of overall panel pricing, we can see that current panel pricing presents a high risk situation to panel producers, while also providing considerable profit incentive. This makes the temptation to keep increasing panel prices all the more attractive, despite its eventual effect on the elasticity of demand. Panel producers are not known for their restraint when it comes to panel prices and we can’t fault them for taking advantage of the unbalanced market currently existing, however component shortages can limit production even if panel prices continue to rise, which could both cap out panel producer profitability and push consumer level pricing higher, a combination that would destabilize the industry.

Taking it one step further, the profitability of panel producers currently has also given them the incentive to expand capacity, particularly Chinese panel producers, and while this has some effect on slowing panel price upward momentum, it will have a bigger effect once the industry passes its cycle 7 peak and prices head down. Panel producers that have built new capacity will be incentivized to offer lower panel prices to fill fabs that are now being depreciated, and the effect on the slope of the back end of cycle 7 could be more intense, just as the front side of the cycle has been. We expect little change in panel producer behavior however, until there is obvious evidence that cycle 7 has reached its peak, and a month or two of ‘disbelief’, but the trend line in Fig. 1 will eventually point the way.

RSS Feed

RSS Feed