Display in May

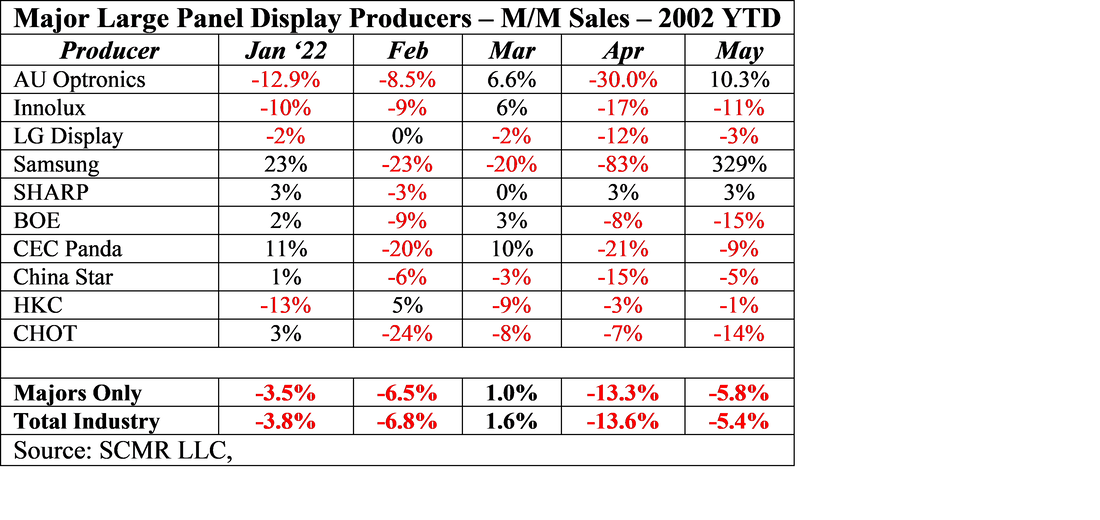

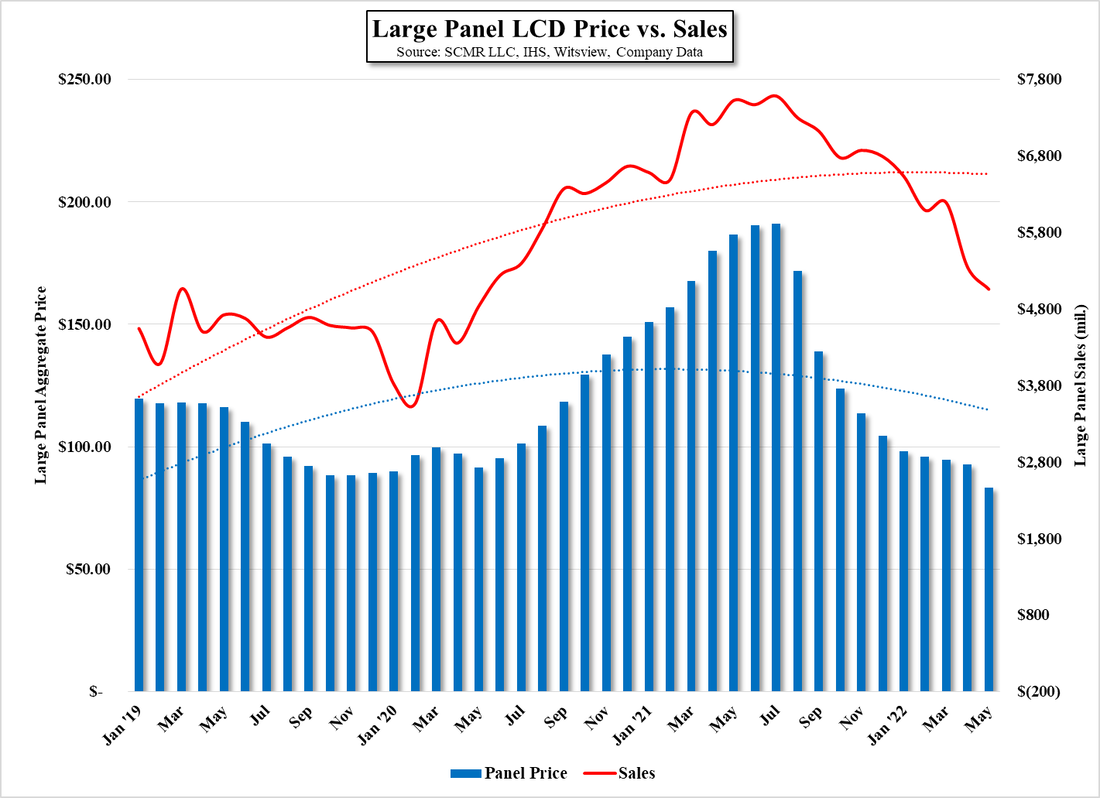

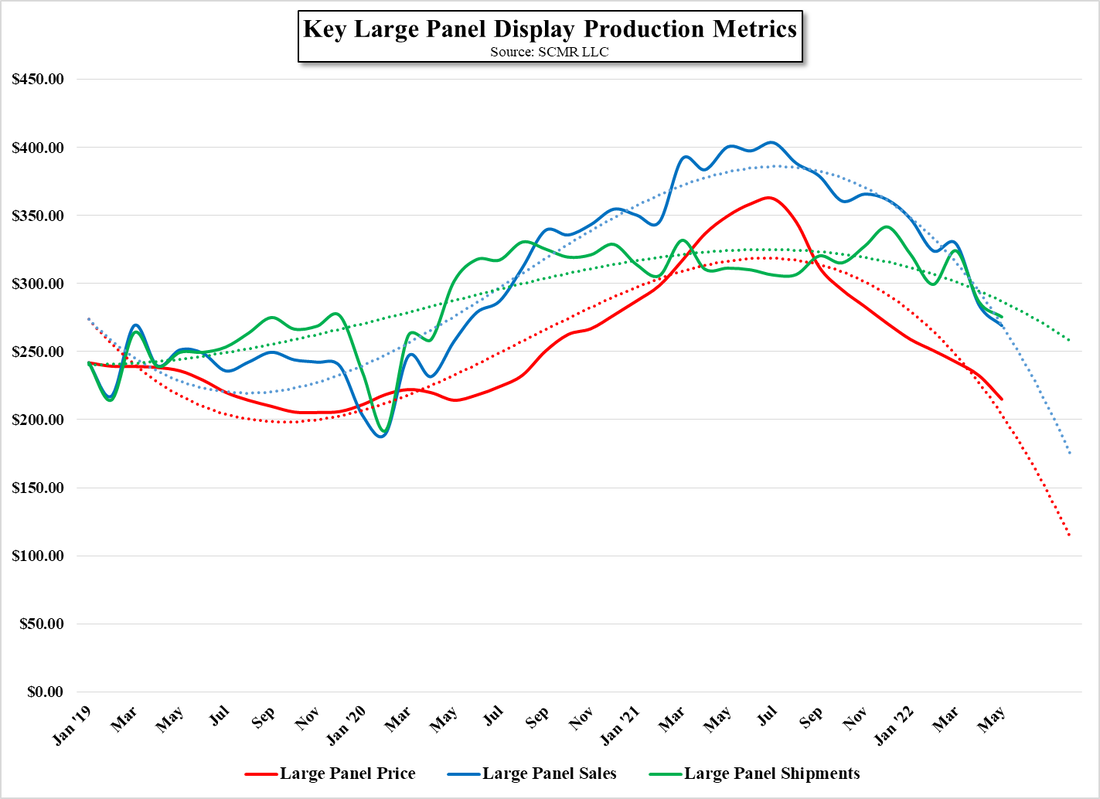

Making the scenario a bit more difficult is the fact that panel producers waited until June to make such utilization cuts, and the data for shipments in June will not be available for a few weeks, and with Chinese producers representing ~50% of industry large panel sales, the utilization reductions at BOE (200725.CH), Chinastar (pvt) and HKC (248.HK), who together represent 45.4% of total industry large panel display sales, and May large panel industry sales were down 5.4% m/m and 32.8% y/y, shipments were down less at -3.9% m/m and -11.5% y/y. Some producers have done better than others during this year, as shown in the table below, which shows only those producers that are primarily large panel suppliers. We note that Samsung Display (pvt) has been winding down its remaining LCD large panel production which accounts for the large swings shown below.

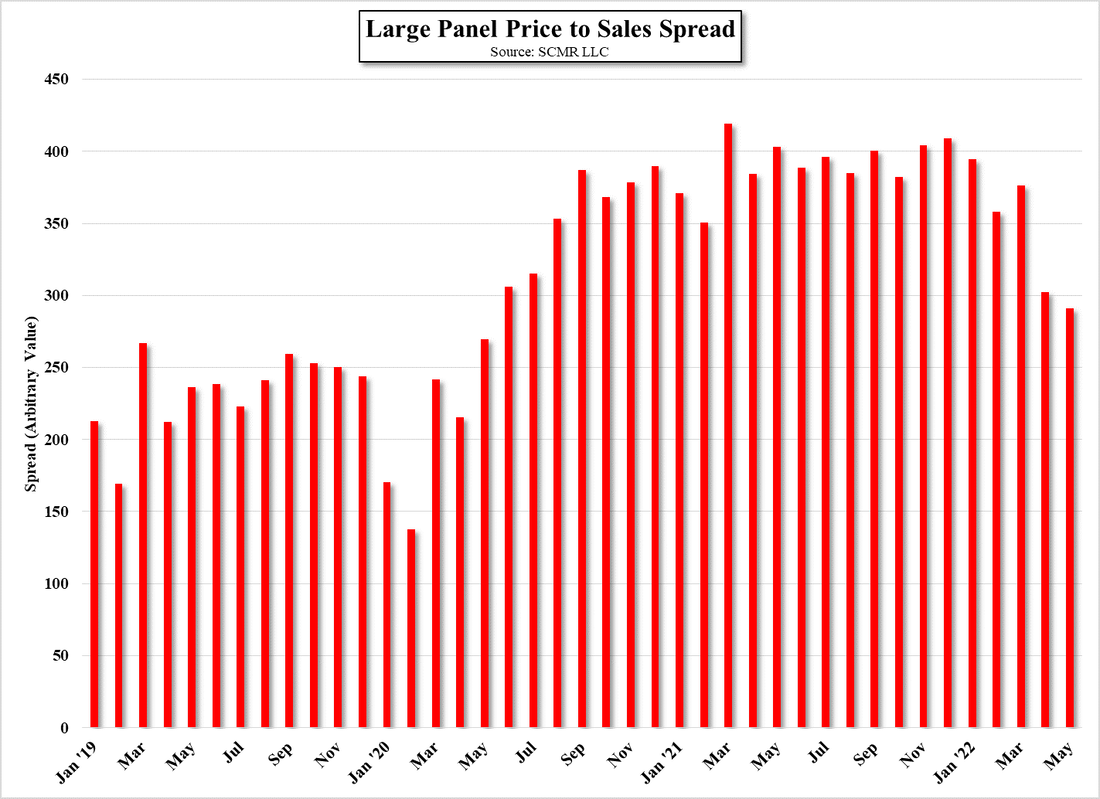

While orders from customers can make a substantial difference to m/m data for individual producers, we expect much of the negative growth for large panel LCD producers seen this year is a function of declining large panel prices, however in June we expect both large panel prices to decline and to also see the effects of utilization cut backs that have been rumored across much of the industry. If the cuts are substantial enough, they will have some effect on high inventory levels over the next two months, but if they are less than expected, and seasonal builds begin in August, we expect panel producers will face a very rocky 3rd and possibly 4th quarter this year. If that turns out to be the case, we would expect January/February ’23 to be especially week, as many fabs will essentially shut down for the latter part of January during the Chinese New Year holiday, which occurs on January 22

RSS Feed

RSS Feed