Display Industry Summary – June

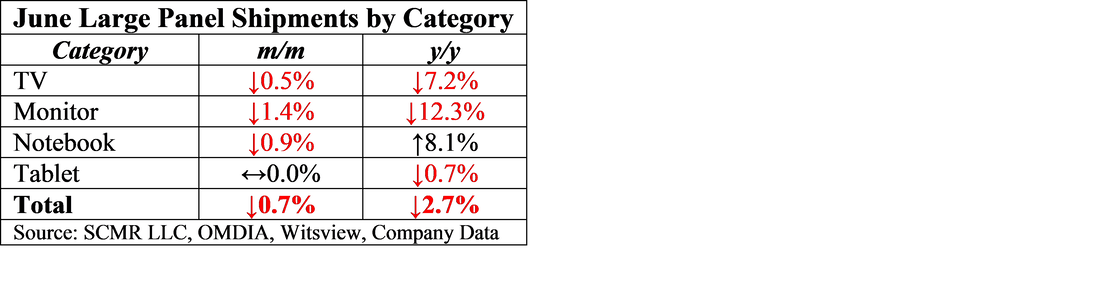

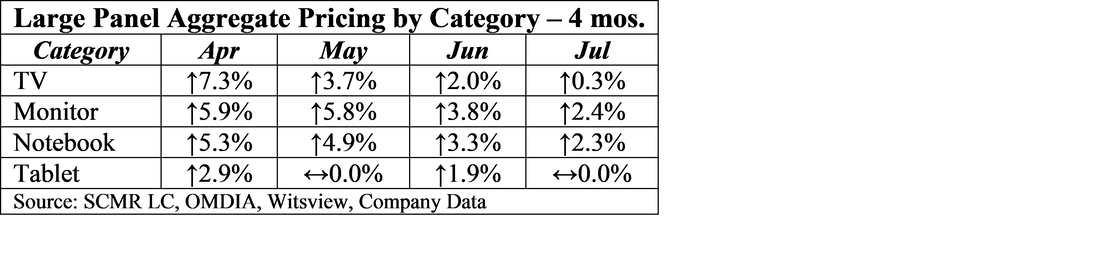

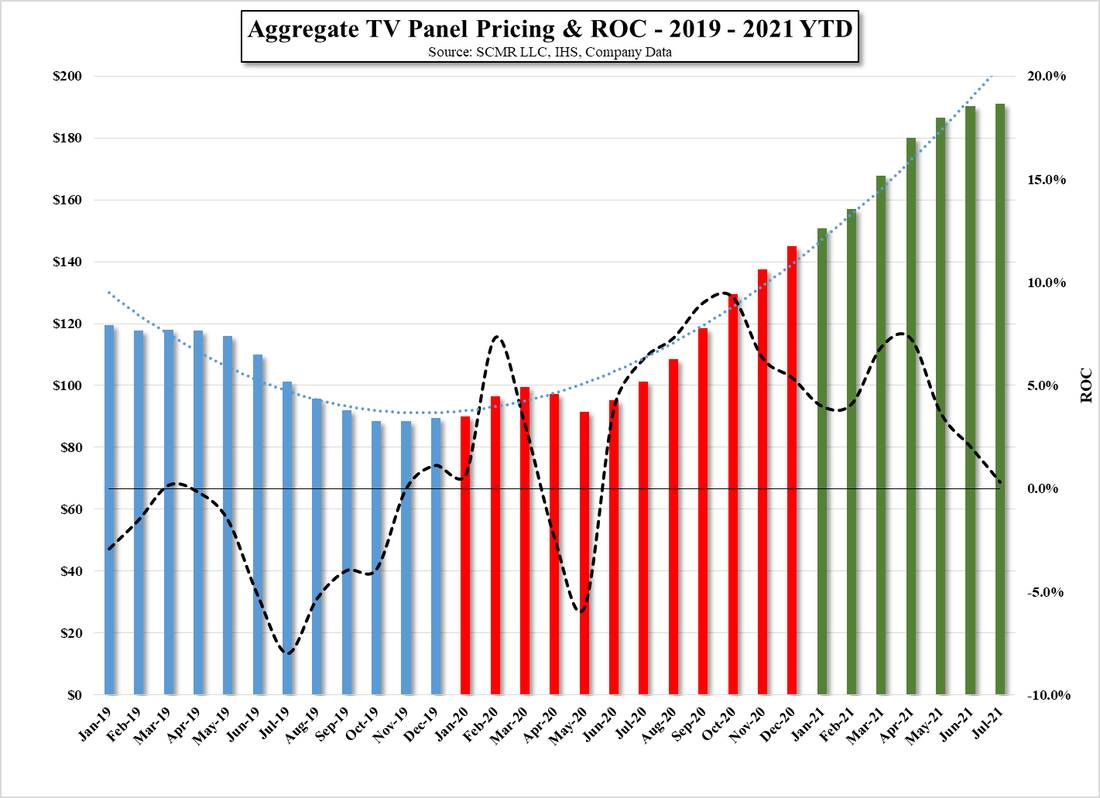

We expect panel producers will pass off the shipment and ASP issues as a function of component shortages which have limited shipments, but while we believe there are certainly component shortages that are limiting panel shipments, it is very difficult to discern whether a change in demand has also affected both industry characteristics in June. As we noted above, we would have expected slower shipments in July, but not a lower ASP as we had expected overall panel prices to continue to rise, albeit at a slower rate than in the past year.

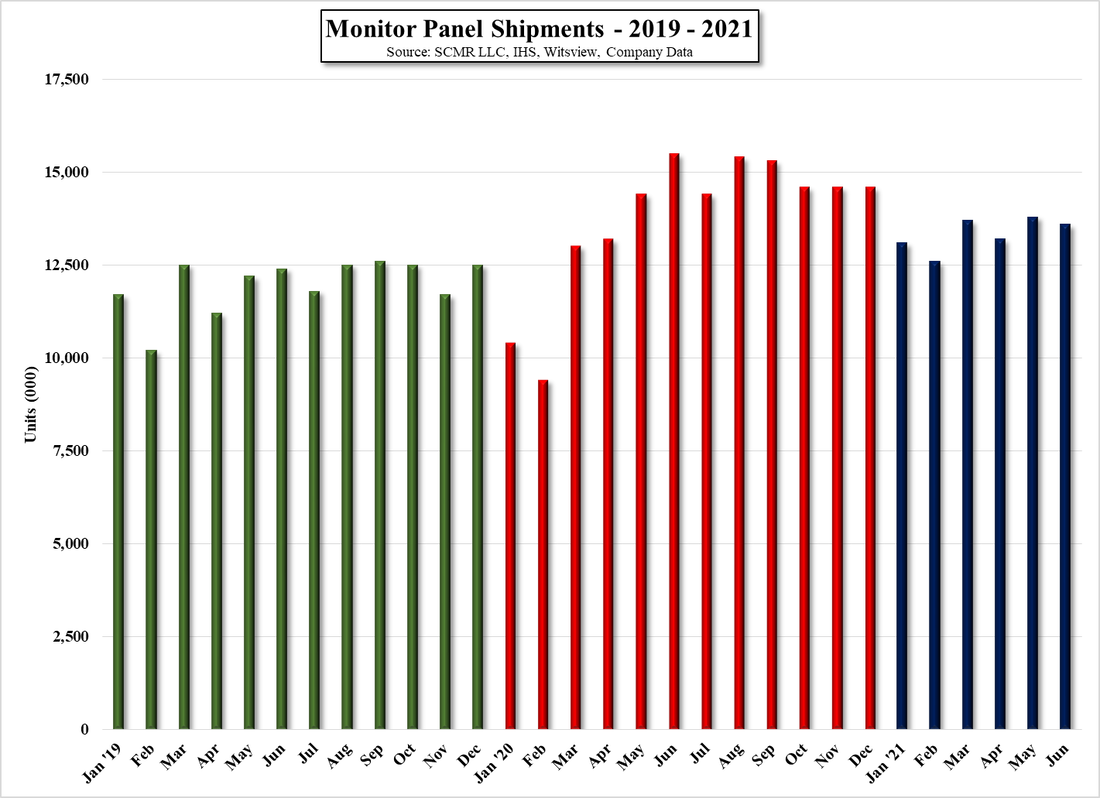

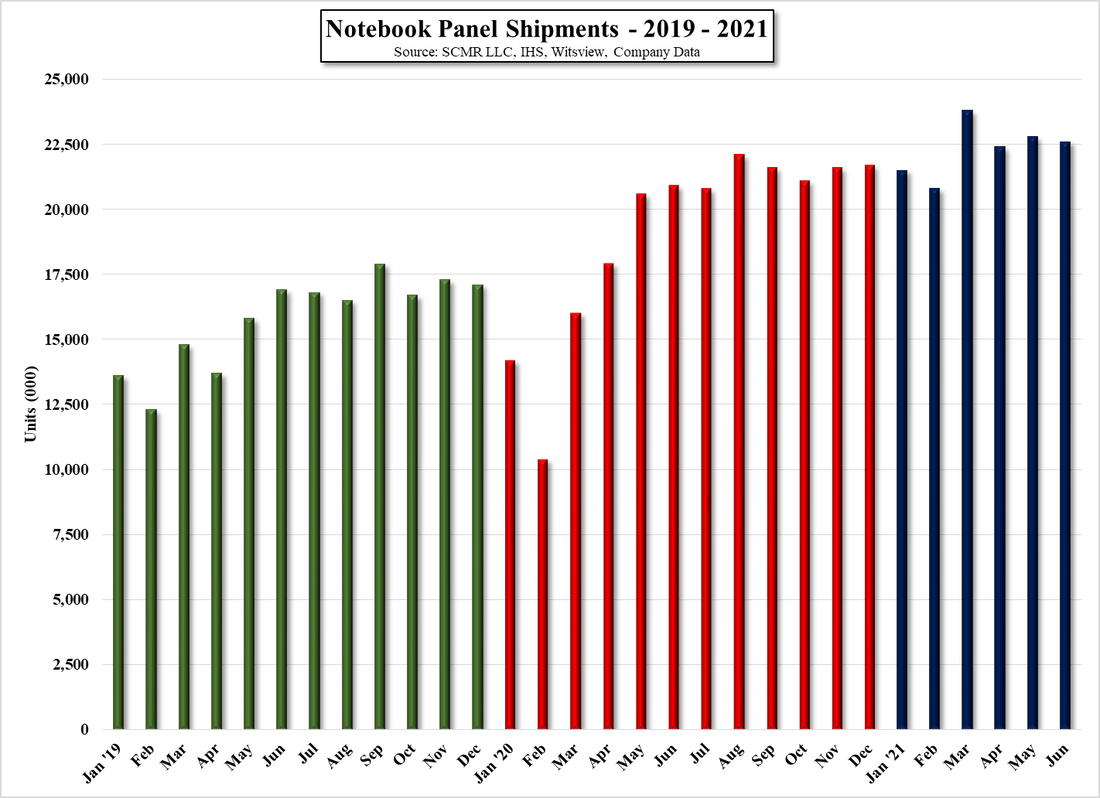

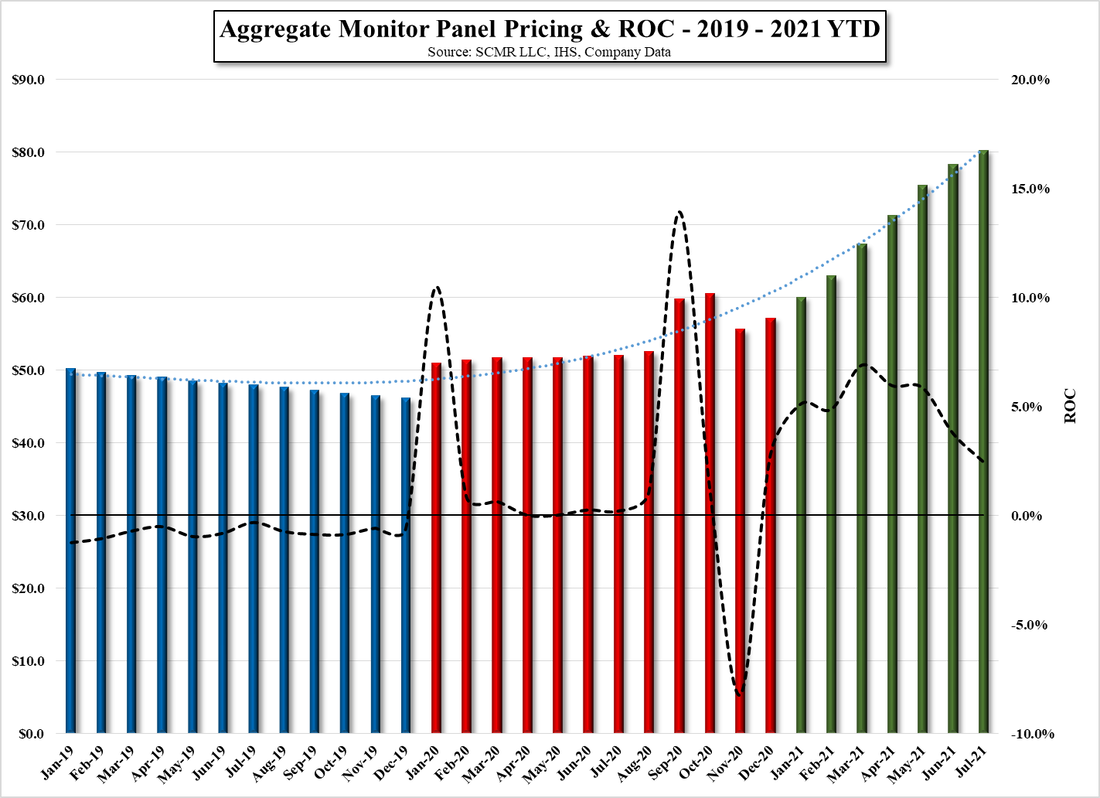

In June many large panel producers saw negative m/m sales growth, with AU Optronics (AUOTY) in Taiwan, and Chinastar (pvt), HKC (0248.HK), and CHOT (pvt) in China, the exceptions. The purchase of Samsung’s (005930.KS) Suzhou LCD fab is helping Chinastar’s sales, and both HKC and CHOT are expanding capacity, however BOE (200725.CH), China’s largest LCD panel producer saw negative m/m growth in sales, similar to South Korean and Taiwan large panel producers, and we would expect those trends to continue into this month. We exclude those panel producers that are primarily small panel focused.

RSS Feed

RSS Feed