Displays – Was 2Q the Bottom?

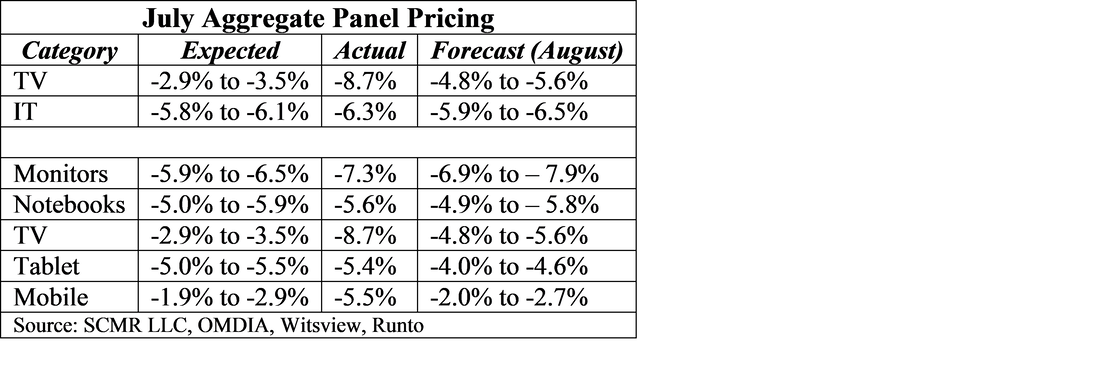

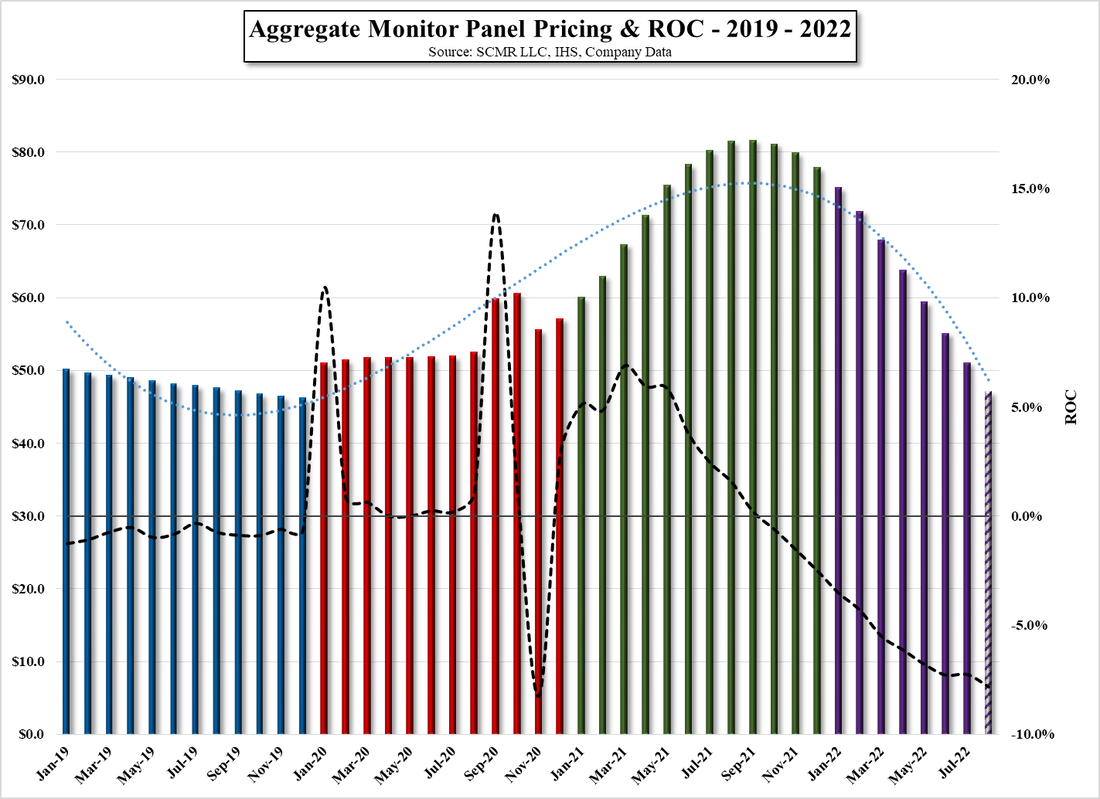

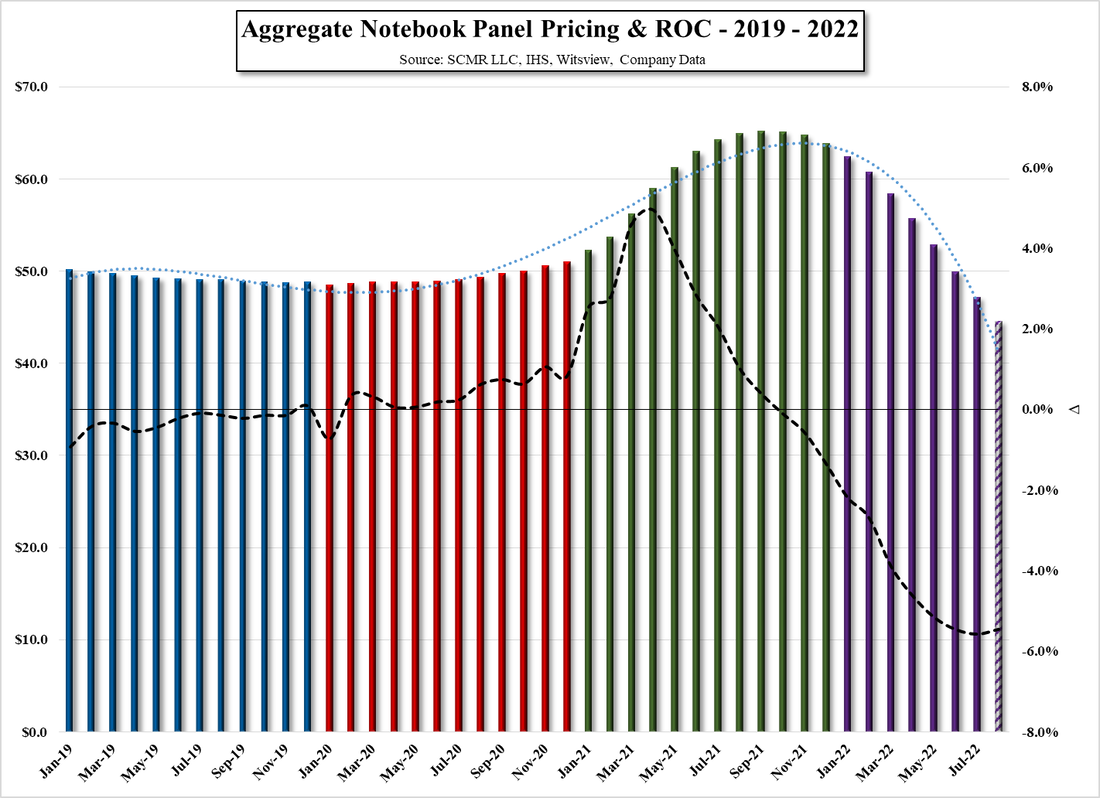

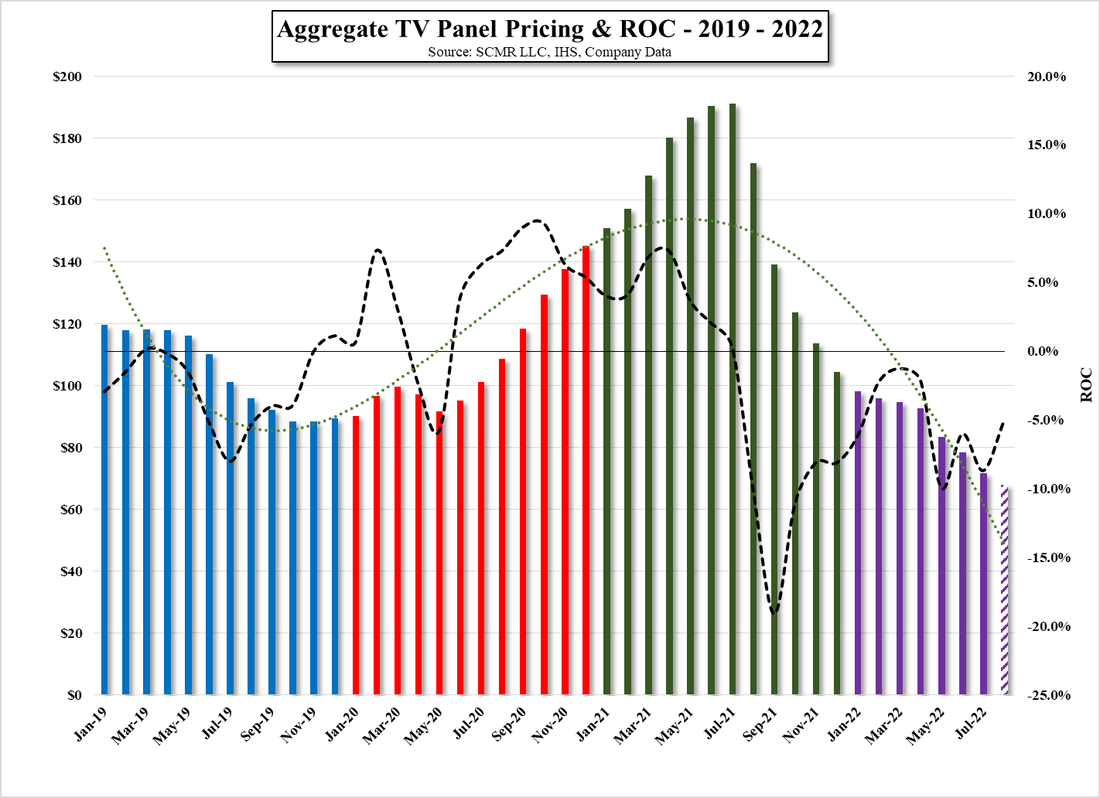

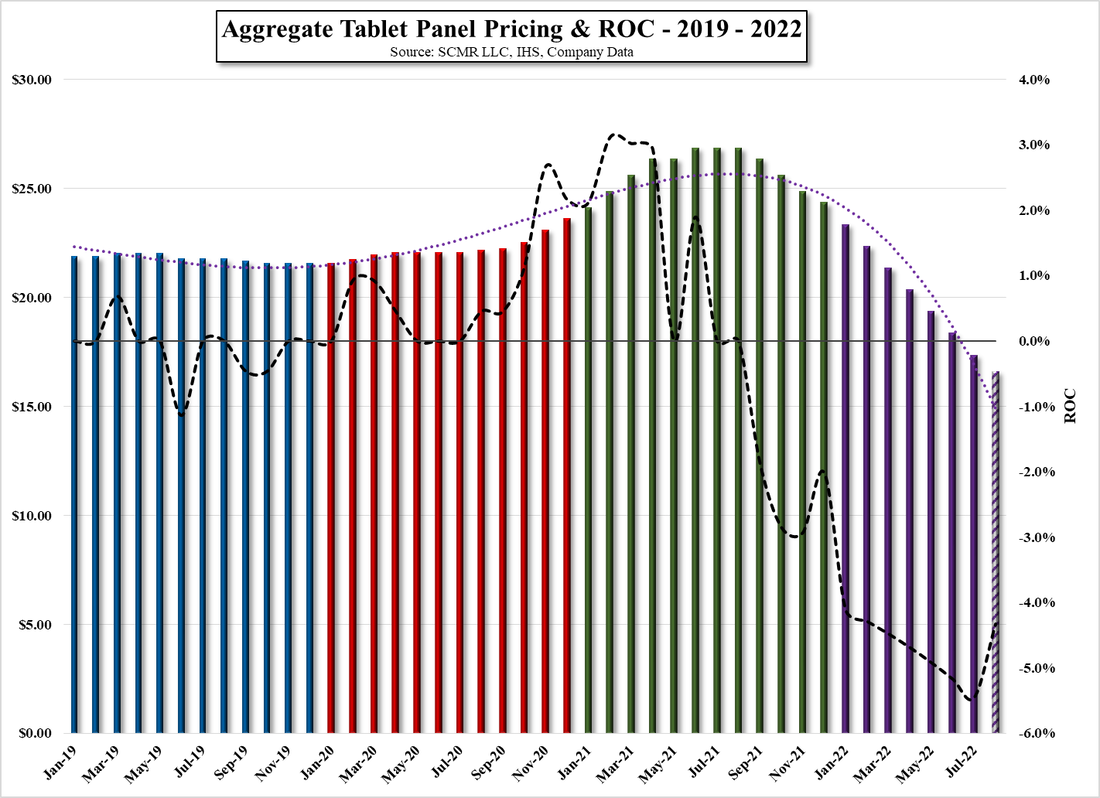

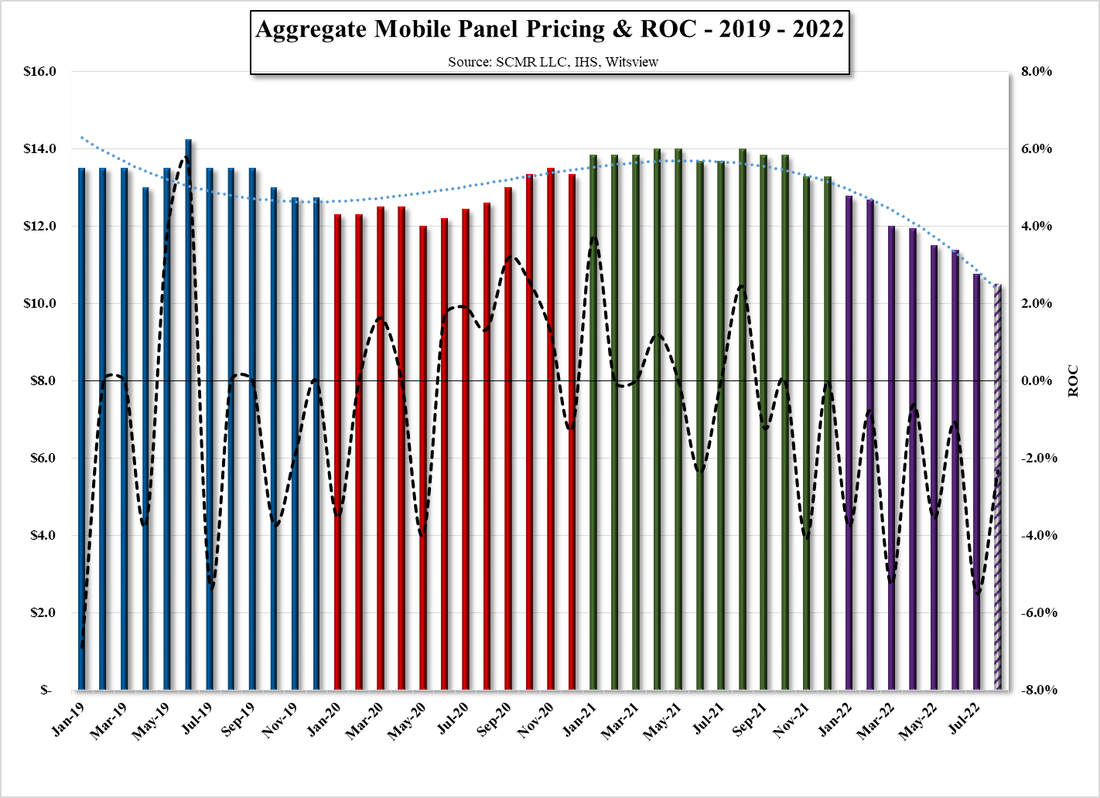

Based on July large panel pricing all display categories are at or below their 3 year lows which brings up the question of at what point will such low panel prices begin to stimulate demand. Declining panel prices boosted notebook (+9.7% m/m) and tablet (+15.7% m/m) shipments in June and the overall large panel display space saw a 0.8% m/m increase in sales, and while that could begin to paint a picture of a bottom, we expect July sales to decline as brands cut targets further and panel producers get more aggressive toward discounts in order to maintain current utilization levels. With large panel prices expected to fall again in August, it would be hard to be optimistic in the near-term, although display sales should see a modest seasonal pick-up in September, but even with some improvements in logistical costs, we would expect more of a bounce along the bottom rather than an easily definable recovery.

While there are many mitigating factors that could change over the next few months, we are a bit more optimistic about 2023 in the display space, although we temper that feeling with the inherent overcapacity in large panel production and a careful definition of what a ‘better year’ might look like. We expect a return to a more normalized 1st/2nd half split but do not expect more than a modest y/y sales recovery in 2023, with most of the profit leverage coming from reductions in raw material and component prices and less from improving demand. We expect panel prices to begin to stabilize in late 1Q or early 2Q, but to remain at pre-pandemic levels. The timing will depend on how aggressive brands will be during the holidays, essentially how willing they are to sacrifice margin to return inventory levels to pre-pandemic norms, and inflation/recession fears at the consumer level.

Calling the bottom of the display cycle here seems premature as there is a considerable likelihood that the industry will see sales declines in the near-term and while some might consider our modestly optimistic view of 2023 a recovery, we see it more as a return to what existed before COVID-19, warts and all and more a return to the industry status quo than a recovery. Maybe our perspective is a bit biased toward the glass half empty here, but at this juncture it is hard to see what would fill the glass.

RSS Feed

RSS Feed