E-Sim Update

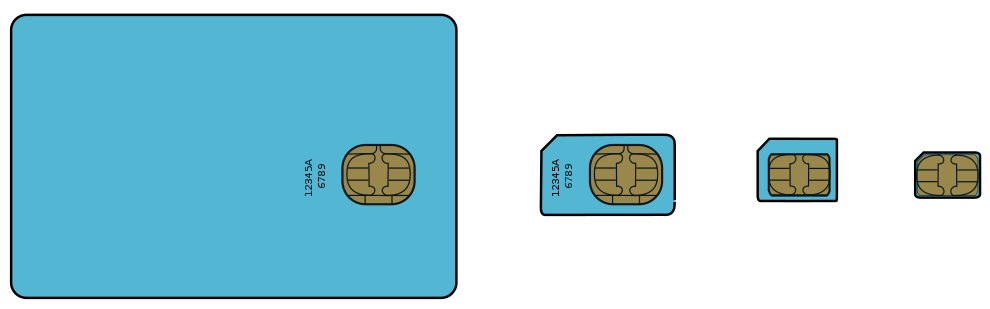

With new standards for eSIMs just released by the GSMA, large mobile industry support organization, it will become easier to provision smartphones or other mobile devices without any physical hardware changes, which will allow the eventual elimination of the SIM card, which has been around in some form since 1991. SIM cards store authentication information needed by networks to identify those devices that are subscribed to that specific network, along with emergency numbers, service numbers and storage for user data, and while the size of physical SIM cards has continued to decline from the original 3.57” x 2.13” card to today’s nano-SIMs (0.48” x 0.315”), they are still a thorn in the side of both mobile operators and their customers.

We note that SIM cards are not only used in smartphones, but the many security systems that use cellular service to communicate with central stations or emergency services must follow the same authentication and identification procedures that are part of smartphones. Many of those devices were built to use 2G networks, communicating via SMS messages, which forces carriers to continue to maintain 2G networks to allow those devices to function. Where things get complicated is with IoT, where eventually billions of devices will need to be connected to a network, and those devices will need the same connectivity identification as mobile users, which is why the eSIM was invented. As an embedded device, the eSIM is part of each smartphone or IoT device and is not removable. This serves two functions, the first, saving considerable space inside any mobile device, allowing for a smaller size of larger battery or other components to increase functionality. Second, the eSIm can be programmed over the air, meaning carrier changes can be made easily, without any physical intervention.

We have noted previously that carriers were very wary of the eSIM idea, fearing that mobile users would flip from one carrier to another every time a new discount program was offered, especially heavily discounted programs, but that fear had to be weighed against the opportunities presented by IoT, with its potential for rapid device count expansion, and the cost savings of not having to force the user to go to an expensively staffed physical location. While we expect that most normal mobile users are unaware of the potential for shifting carriers via eSIM and would still resist the procedure unless it was quite advantageous financially, we do believe that over time younger users will begin to realize that they can switch carriers as often as they would like, especially if they can find a bill aggregator that will allow them to pay whatever carrier they happen to be using during a given month automatically, but that is more of a generational change that will take time, giving carriers the runway to find ways to hold onto e-SIM customers more tightly.

We did a fast check of smartphones that include e-SIM cards, either exclusively or in combination with a physical SIM. Last year there were 36 phone models that were e-SIM only and 18 that were either dual or triple SIM models. So far this year there have been 9 e-SIM only models and 16 models that include an e-SIM and at least one physical SIM card, which would indicate that while phone brands are happy to provide e-SIMs, we expect they will be more likely to provide both capabilities until the user base and carriers become more open to using the e-SIM only. That said, smartphone brands also gain another advantage by using e-SIMs, and that is having to produce less variations of each model, especially variants that are carrier specific, as the e-SIM allows any carrier network to be used with any phone.

All in progress on e-SIM specifications that make it easier for both phone brands and carriers to adopt the technology are good for the consumer and advantageous for the brands themselves. There are things that continue to slow adoption, primarily the requirement for carriers and service providers to have certified security facilities to manage the encryption keys imbedded in e-SIMs, particularly MVNOs (Mobile Virtual Network Operators – aka service providers that do not own their own network), who are big physical SIM supporters as they fear the ‘churn’ mentioned above. That said however, we do expect real e-SIM push will come from smartphone brands who are always looking for internal smartphone real estate and a chance to reduce power requirements that the e-SIM would allow.

RSS Feed

RSS Feed