Early August Panel Prices

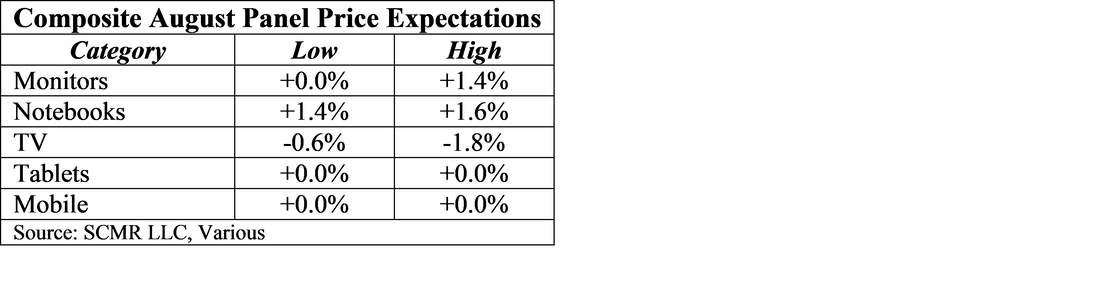

Our expectations for August panel prices indicate that IT products, primarily notebooks and monitors, will continue to see upward panel price movement, but TV panel prices, depending on size, will see some price declines. Since we aggregate panel prices, both from a number of sources and by size, the overall panel price movement can belie the fact that some panel sizes can see price increase while the aggregate price is negative. This is a normal occurrence in many panel categories, however it become consequential when there is a change in momentum, as we believe is currently afoot. In the TV space, smaller TV panel (32” to 55”) prices are expected to decline, while larger (65” and above) are expected to rise, as the consumer’s quest for larger TVs continues, while smaller TVs, more common in developing markets, are more easily produced and are offered by a large number of panel producers.

As to the real reasoning behind this change in panel pricing perspective, while component shortages can limit panel output, the underlying demand is the true driver for panel pricing, and while demand for IT products remains relatively strong currently, TV demand has been weakening as the COVID-19 vaccines have begun to ease concerns about venturing outside and away from a TV screen. Right now this is an iffy proposition, as the ebb and flow of COVID-19 can push sentiment in one direction or another, but the general focus, at least in most developed countries is that life is, at the least, trying to return to normal, which helps to break the bonds of TV binging.

Notebooks still have yet to see demand slow, although some of the county-wide educational programs that have created such demand are beginning to tail off as students begin to repopulate classrooms. We expect this will be the last display category to tail off, as the results of bringing students back to classrooms won’t be known until September or October, but monitors, for which demand has also remained strong, would be the segment that we expect could see some weakness over the next few months, with returning office workers offsetting some of the weaker stay-at-home demand.

From the supply side, while we expect capacity utilization to remain relatively high as we enter the seasonal build period, we have seen a more enthusiastic view of capacity additions from a number of panel producers in recent months. Whether this is a result of being profitable for the last few quarters or a continuing need to dominate a particular display category, we do not know, and most of the proposed capacity increases, at least in the LCD space, are relatively small, or have been underway for more than a year.

That said, while the capacity issue is certainly one we watch closely, the fact that most large panel producers have been shifting capacity away from TV panel production and increasing their IT panel output. This is a logical move as IT panel demand remains visible while TV demand is less so. IT panel products also tend to be more profitable on a per m2 basis, and the model variety is greater than the TV space, leading to a bit less head-to-head price competition and more specialized feature selection which leads to higher prices, but the shift toward IT panel production also carries significant risk when IT panel prices begin to weaken and utilization rates begin to decline. We expect that IT panel buyers, who have been on the wrong side of the bargaining table for a year, will push to regain their negotiating leverage and panel producers will respond by quickly lowering prices.

None of this will happen in an instant, especially as we are entering the seasonal build period when panel demand is typically highest, but both panel and component price increases that have become almost normal across the CE space also add to that risk as consumers are less in need of immediate gratification and more willing to wait for more reasonable device prices. Panel producers will not panic even when they see some order cancellations or cut backs, but when they are unable to fill that open capacity with new orders they will start making deals to keep fab utilization from falling. They have yet to face that situation, but it is more of a ‘when’ than an ‘if’ situation in our view.

RSS Feed

RSS Feed