Equipment Inflation

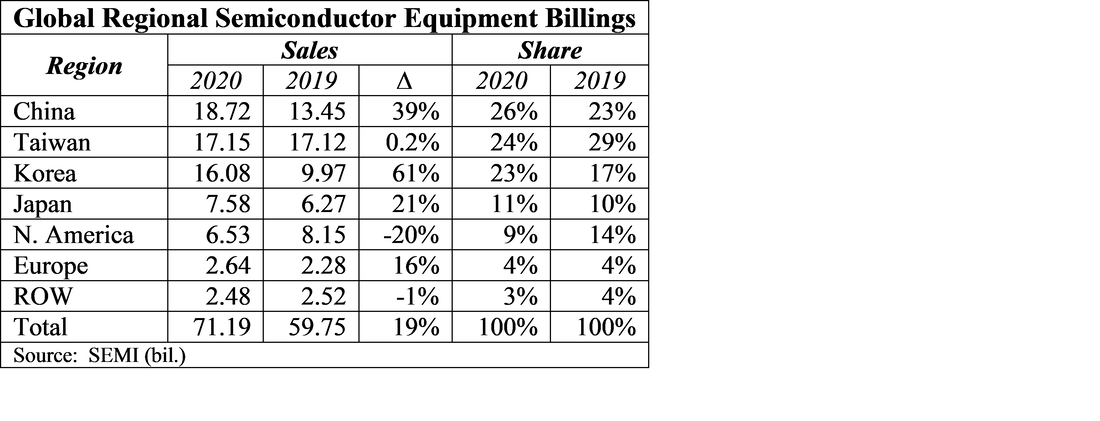

First, last year saw a 19% increase in semiconductor equipment sales billings according to SEMI, and that data shows that China is now the largest market for semiconductor equipment, increasing its share from 23% in 2019 to 26% in 2020, and outspending Taiwan (#2) by 9.2% and given the Chinese government’s mandate toward semiconductor self-sufficiency, there seems to be no end to available financing for legitimate semiconductor projects. The issue that makes this more difficult are the restrictions placed on Chinese companies by the US government, which limits their ability to purchase certain semiconductor capital equipment that is necessary for reaching that goal.

China has already been a purchaser of used semiconductor equipment over the last few years, but given that many vendors of such equipment are small and are not listed companies, the data for the 2nd hand market is hard to come by. That said, in theory, the same restrictions that govern the sale of new semi equipment also carry to used equipment so even 2nd hand semiconductor tools face license restrictions, but that only works toward increasing demand, with China’s domestic tool suppliers not quite ready for prime time.

Despite the issues, Chinese OSATs are under pressure to deliver product and are pushing to expand capacity while the market is strong. While they might not be able to buy EUV tools for 5nm nodes, there is plenty of business at 28nm and above, and there are few restrictions on such tools, but given the strong demand globally, lead times are long, if one can even get in the queue. That causes OSATs to look for used equipment which is immediately available, and the competition for such tools becomes aggressive enough to bring prices for what was once almost valueless used equipment, to premium prices. It is not easy to accept that used equipment costs more than new equipment in some cases, but if you are unable to fill customer orders during profitable times and lead times are measured in multiple quarters, the extra cost is part of doing business.

RSS Feed

RSS Feed