FC-BGA II

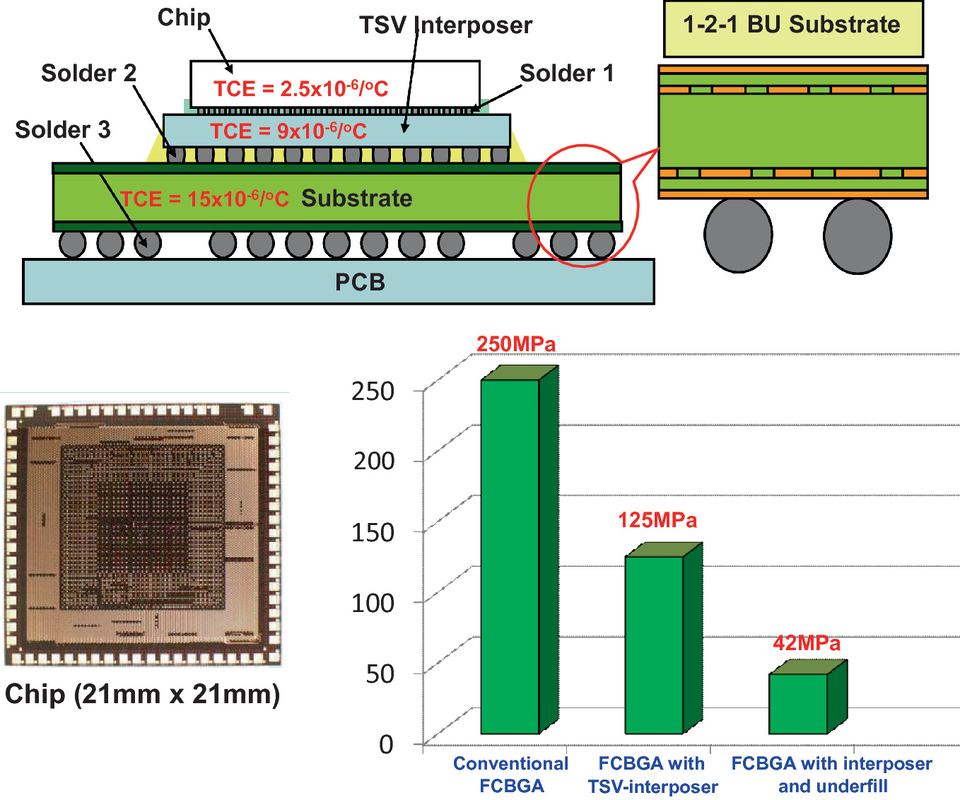

As we noted last week, during the shortages that the semiconductor industry has been facing, there is little opposition to funding advanced packing solution expansion projects such as these, and as complexity increases, low yields limit unit volumes to a degree which justifies expansion. While growth over the next five years is pegged at between 6% and 8%, FG-BGA products are typically higher margin for OSATs compared to typical consumer applications, with demand from AI, HPC, networking and automotive the drivers for the space, making such projects even more attractive. Intel’s EMIB (Embedded Multi-Die Interconnect Bridge) and other 2.5 and 3D stacking methods are encouraging high-speed direct interconnects internal to the package, while eliminating TSVs and interposers, keeping packages smaller and connections faster. FC-BGA compliments such advanced processes, which gives some upside to the market, but expansion seems to be happening at an unprecedented rate over the last few months, giving rise to a careful watch over the balance between supply and demand in 2022. The diagram and table in Fig. 2 shows the advantage of using FC-BGA without TSV interposer and underfill in an image sensor product.

RSS Feed

RSS Feed