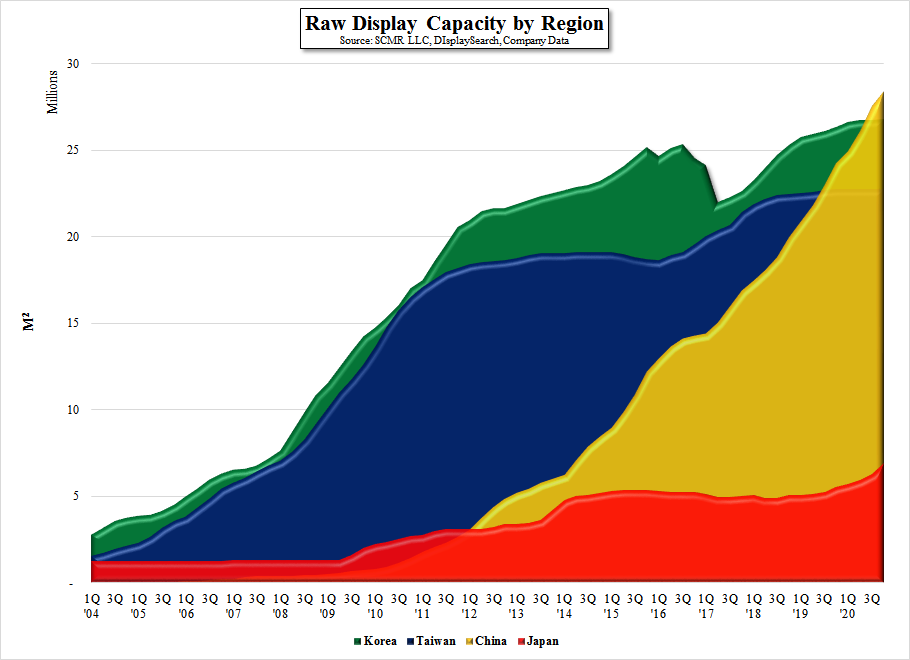

Chinese press indicates South Korea will be beaten by 2019

We expect a slightly different path, although with the same result, as we expect that on a raw capacity basis, China will overtake South Korea in 3Q 2020 rather than the end of 2019. This will be accomplished by the phase two investments for a number of ultra-large format fabs, and the continued buildout of a number of small panel LCD and OLED lines. Other than a meltdown in display pricing, and this would not necessarily slow Chinese fab expansion, we believe this is an inevitable conclusion, as China’s ultimate long-term goal has been to reduce or eliminate China’s dependence on outside display suppliers. While this goal is important to the Chinese government, panel producers also understand that the Chinese market is not the worldwide market, and they must learn to effectively compete globally as well as in China. This means matching or beating foreign competitors on not only price, but on quality, which has been an issue in the past. As Chinese display firms become more experienced, we see the quality issue becoming less important, but proving that to end users can be more time-consuming than expected.

We do note that we have seen a number of comments in the Chinese press expressing concern that the Chinese display industry might be heading into a period of over-supply, based on the government’s aggressive financing of display capacity projects. We note the same concern a bit down the road, as industry growth slows and panel size increases moderate somewhat, but the articles expressing such concerns remain buried below those proclaiming South Korea’s ultimate defeat.

RSS Feed

RSS Feed