Chinese markets seem to be taking a breather

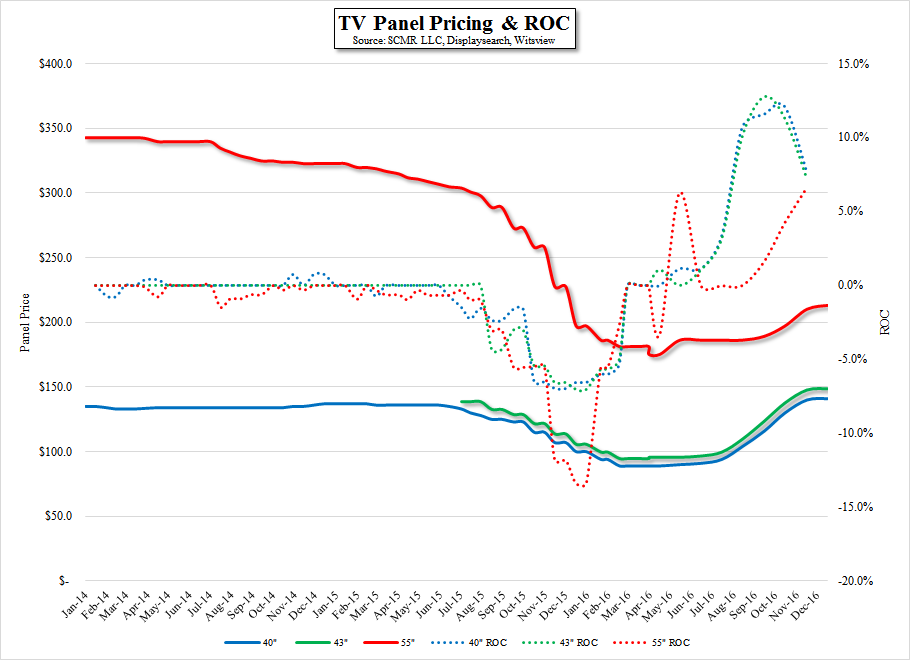

Further, in situations where inventories are above average seasonally adjusted levels, panel pricing has a tendency to decline, which has only modestly been the case most recently. We continue to focus on a number of patterns, particularly 32” TV panels, which are essentially an entry level size for emerging markets, and 55” TV panels, which have become standard to the majority of worldwide TV buyers. Neither category has seen any real price deterioration and those panel sizes (40” – 45”) that have been in short supply due to Samsung Display (pvt) issues, continue to increase in price, albeit at lower monthly increases than seen in 3Q.

So the question is, who do you believe? Panel producers, who have a vested interest in continuing the price increases that have put them back into profitability, anecdotal inventory reads, TV brands, who are for the most part are setting higher shipment goals for 2017 than in the previous year, despite lackluster TV growth, or Chinese smartphone vendors, who expect to see sales from inventory during the 1st quarter? We always go with pricing, which is why we track it on a monthly basis, but when all of the signs are pointing in different directions we become suspicious, as we are currently. At a gut level if feels like everyone is saying what they hope rather than what they expect, which usually leads to a disappointment. Maybe our gut is wrong, but the stars do not seem to align in this situation, at least for the time being.

RSS Feed

RSS Feed