February LCD panel Pricing – a bit of detail

Notebooks panel pricing was also flat for February, with the overall notebook supply chain seeing some part disruptions that are allowing brand notebook panel buyers to hold back orders a bit to try to negotiate better pricing from panel producers. Panel producers have been increasing prices for a number of months and are taking a hard line toward letting prices decline for fear of starting a trend, so prices remain deadlocked until next month. On a seasonal basis alone, we would expect to again see relatively small seasonal price declines next month.

Tablet panel prices were flat in February, with the same push and pull between brands and buyers holding things steady for another month. The only places we have seen any price concessions were for long-term contracts, as tablet panel producers refuse to give short-term price reductions. If demand does not pick up during March and April, it could leave panel producers with inventory that will be getting stale, leading to lower prices to move the older inventory, but things have not progresses far enough that panel producers feel burdened by tablet inventory enough to start discounting.

Phone panel pricing was down 0.3% in February, as pre-release build projects are winding down. Until new models are released at Mobile World Congress next week, and retail customers cast their votes as to whether they are seeing enough to upgrade, we would expect to see little price movement, but if we were betting folk, we would expect some downside over the next few months.

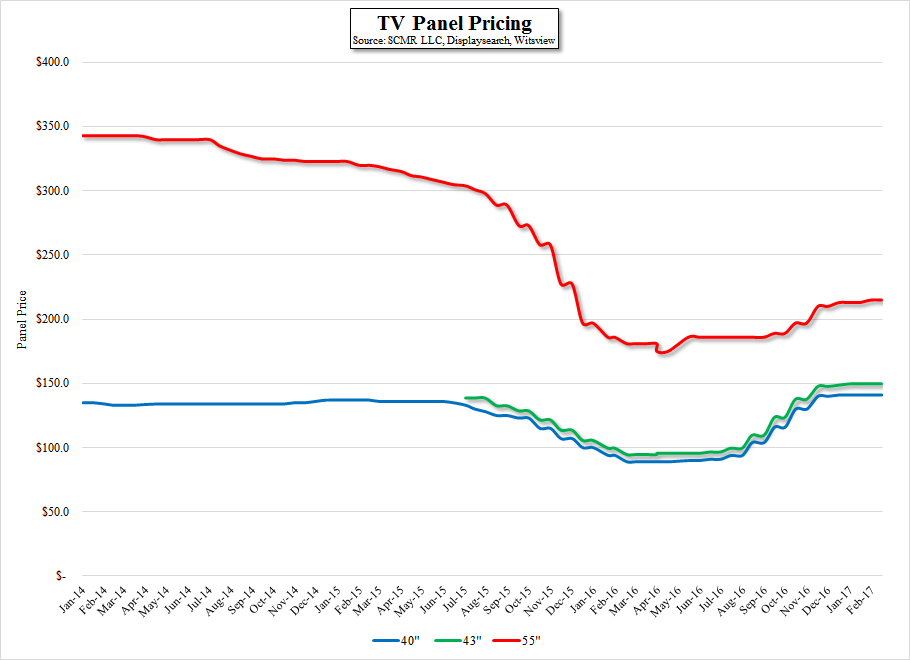

TV panel pricing, the elephant in the room, was mixed, but on a general basis was flat to slightly up. We say mixed as we have noted in the past that structural issues at Samsung Display (pvt) early last year, and the closing of their L7-1 line have caused shortages with certain TV panel sizes, particularly those between 40” and 50”. Further, Sharp’s (6753.JP) new management’s decision to ‘reallocate’ panel production to the Sharp brand, and away from Samsung has exacerbated the problem. But underlying that aspect, is another that we believe is more significant.

TV brands are always under pressure to cut prices or offer discounts, and given that the TV biz is already a relatively low margin business, this can become a very big issue both from the consumer perspective and from a brand profitability perspective. Back when there were only a few LCD TV brands dominating the TV market, price competition was more of a wink and a nod between brands, however as the TV market became global rather than regional, new highly discounted brands (Vizio (pvt) for example) made substantial inroads in the TV market and set the tone for the discounting that TV consumers have come to expect.

Life for TV brands has been more difficult since comparative on-line pricing became available, and margins have remained slim, but through most of this period (essentially until mid 2016) TV panel pricing was in decline, which gave TV brands a little flexibility on set level pricing. As with all cyclical products there came a time when panel pricing could decline no further, as even the most efficient panel producers were working at or below manufacturing breakeven. It took the right combination of events, a manufacturing problem at Samsung Display, a bit of an economic recovery in North America, and a Chinese population that continues to pay premium prices for new features, to snap the downward TV panel price cycle. But what about the brands? Now they face the discounting demands of the general TV consumer, which are even more ingrained in the on-line buyer, the competition from brands in what is now a worldwide market (we bet investors had never seen a Chinese TV in the US until a year or so ago), and now to add insult to injury, increases in the price of TV brand’s main component. What is a brand to do?

As they have done since the TV industry began, they complain, they watch what limited profitability they previously had wither away, and they complain again, but the real question becomes, when will they stop promoting their growth by setting forever increasing year over year unit volume targets, and start to retrench? Panel producers are in the catbird seat now, and certainly will do everything they can to avoid letting panel prices begin another down cycle, but at the first sign of buyers lowering targets, they will shift from the ‘raise prices until they bleed mode’ to the ‘fill the factory, don’t worry about price’. The panel business is one that is based on efficiency and only works when factory utilization rates are high, so when (not if) the TV brands finally refocus on profitability rather than share, we would expect the rise in panel prices to come to a quick halt.

We are certainly not doomsayers, and we have yet to see the signs in the day-to-day comings and goings of the display industry that such is the case, but over the last 20+ years of following the space, we have learned that the industry is lemming-like. When it moves, it has a tendency to move in one direction without much thought about the cliff on the horizon. JOHO

RSS Feed

RSS Feed