Apple giving up on flexible OLED iPhone 8?

Apple, along with every other smartphone manufacturer has been looking at OLED displays as a way to further differentiate their products in a very crowded market. Given the size of Apple’s iPhone customer base, they command a look at every technology change or potential change in the display space, the same way Samsung Display gets a demo of every new display production tool. That said, there are limitations, some very specific ones, that despite what Apple would like, the display industry cannot supply at a given point in time. Here, it comes as a revelation to some that Apple would be unable to use a flexible OLED display for their upcoming anniversary iPhone, yet even if Apple was happy with the specs, two large questions remain, would they and could they?

As far as would they goes, of course they would. If a company that is known for its leading edge products has the opportunity to leapfrog an entire industry (I feel Steve Job’s ghost looking over my shoulder) it would be the coup of the decade. However, if the opportunity carries significant technology risk, the answer is less clear, especially given the recent Samsung Note 7 issue and its impact on the Samsung brand. So Apple management weighs the monstrous publicity revolution such a device would generate against the potential for the technology to backfire, becoming the recurring nightmare that Apple marketing folk wake up from on a regular basis. Not quite as simple a decision as the results of a drop test might indicate.

Then there is the issue of could they? The answer here would be dependent on what modality Apple would use the technology. Would it be used for one of the three potential iPhone 8 models or all three? Would it be just for a ‘gold edition’ that was extremely limited in production volume? Would it actually serve a purpose to have a flexible smartphone? While these are all significant potential questions, the answers are moot, and the point that Apple was abandoning the idea because of poor production yields answers the question. Such a device cannot be produce for a high volume product today. Not because no one wants it, but because the manufacturing technology needed is not far enough along to provide both a reliable source and a practical price.

But wait there’s more…

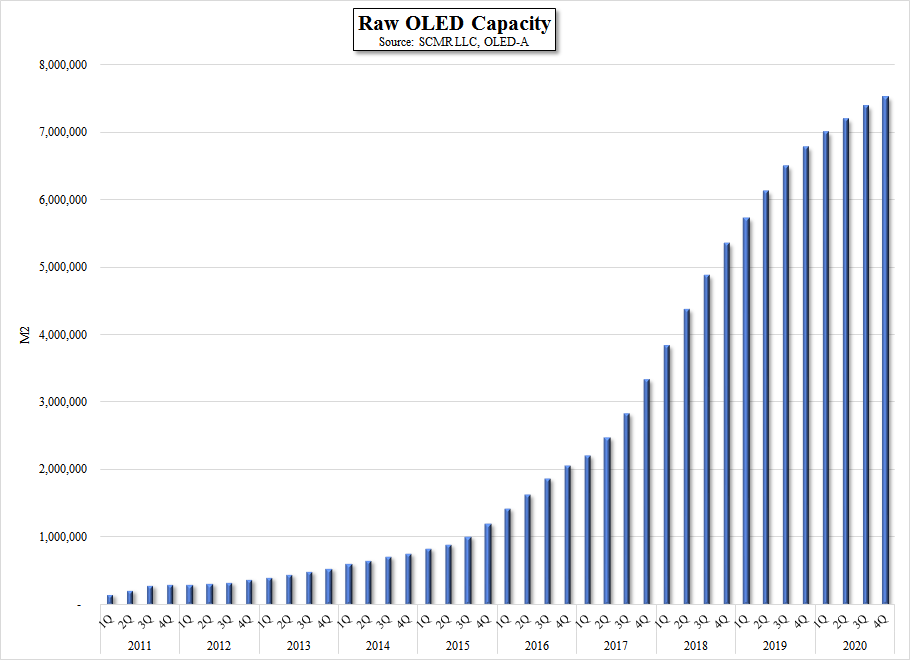

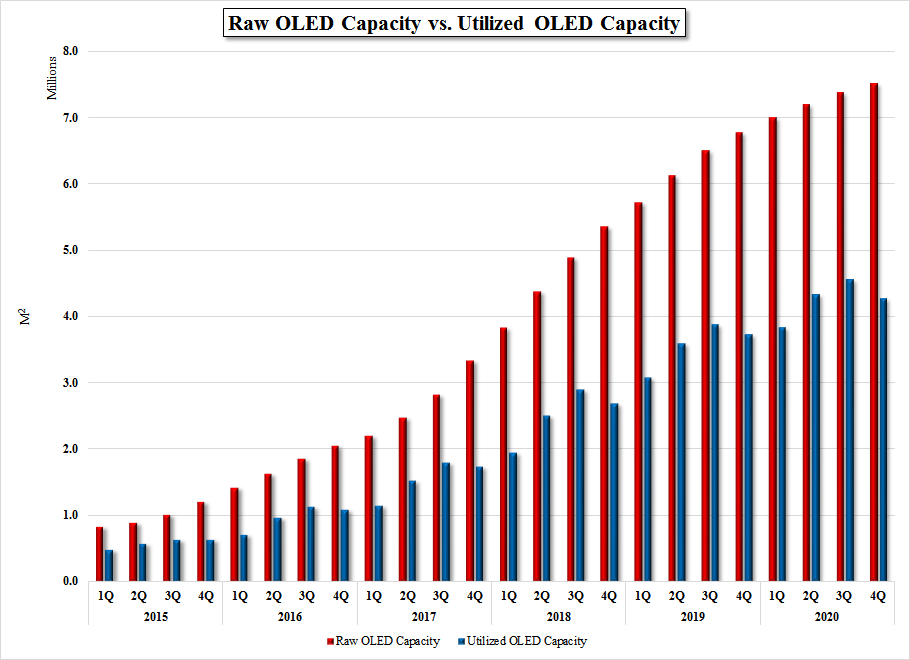

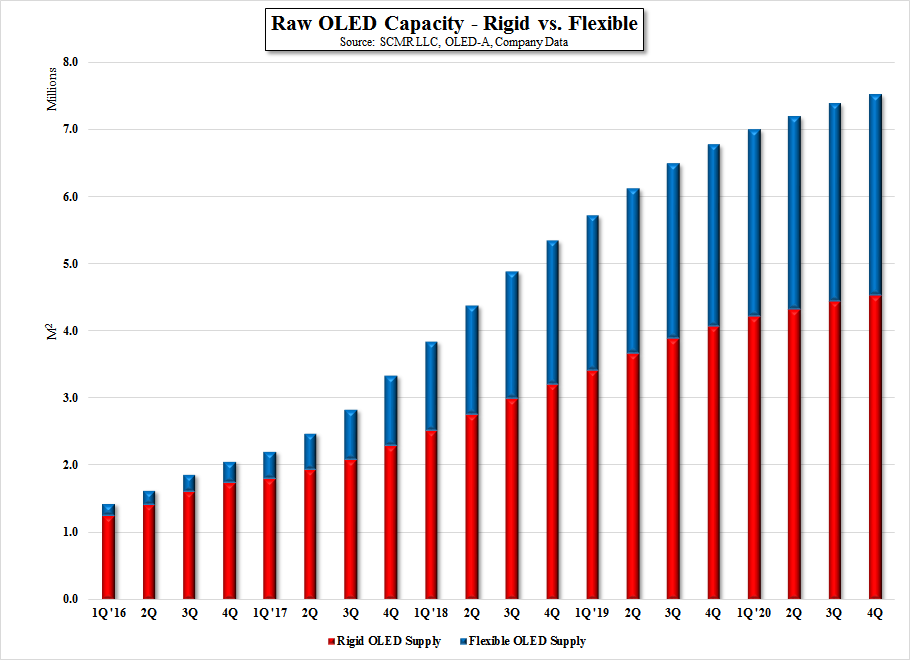

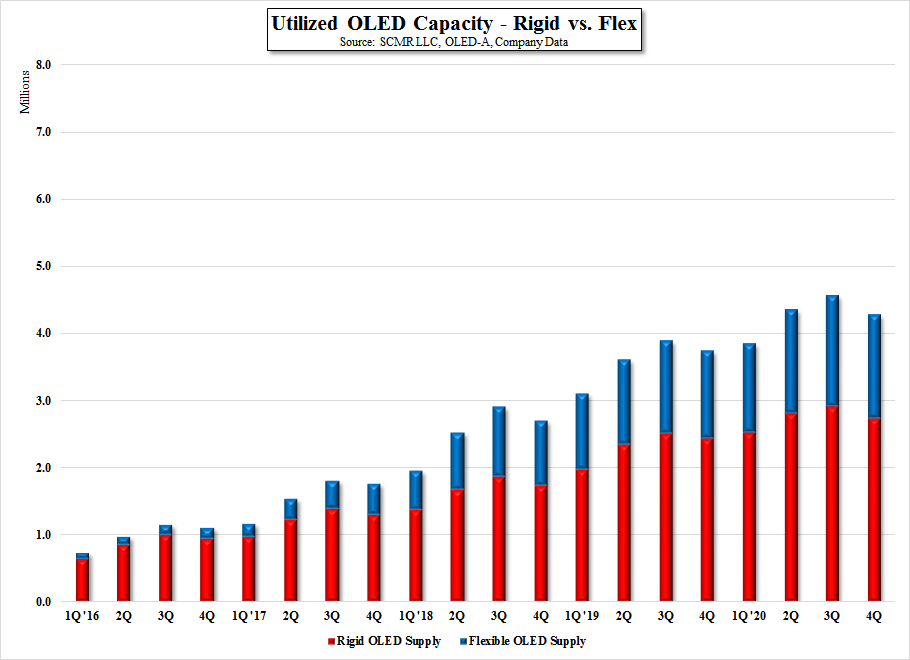

Since there are a limited number of small panel OLED producers, especially relative to small panel LCD producers, and these small panel OLED producers have limited capacity, and in most cases very limited OLED production experience, one can see the funnel through which a flexible smartphone might pass through getting narrower by the second. Bur there is even more… the amount of OLED capacity just mentioned is for all types of OLED substrates, but a flexible OLED device would have to be produced on an OLED line designed for flexible OLED substrates, which is another smaller subset of OLED small panel capacity, and if you believe that most OLED producers have relatively limited high volume production experience, those that have experience with high volume flexible OLED production could probably fit into a small auditorium.

But, but, but there is even more…

Who might have the ability to make a flexible OLED? There is only one OLED producer that can make conformed OLED displays today, and those are easy to make compared to a truly flexible device, and that is Samsung Display, a subsidiary of (trumpets please) Samsung Electronics, Apple’s biggest competitor. One has to consider the concept that if Samsung Display has developed the skill to produce high volume flexible OLED displays, who would get first crack at it? OK, Samsung Display is a business on its own and of course they would love to have a display customer as large as Apple, but we would have to expect that Samsung Electronics has been jointly developing and likely funding a flexible display program at SDC for many years, and it would take a lot of visits to the corporate offices to convince Samsung Electronics to give that up to a rival before they used it.

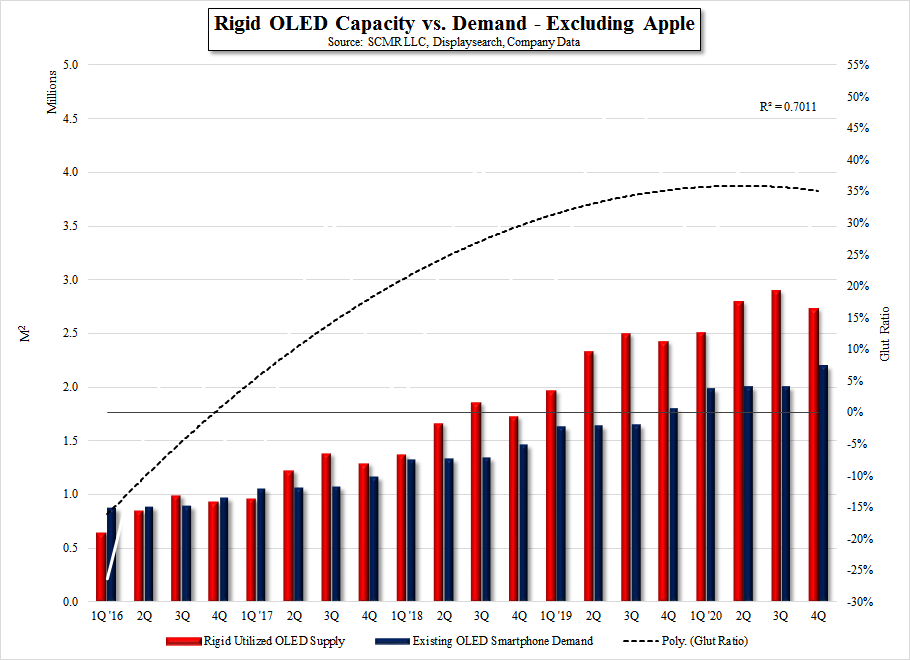

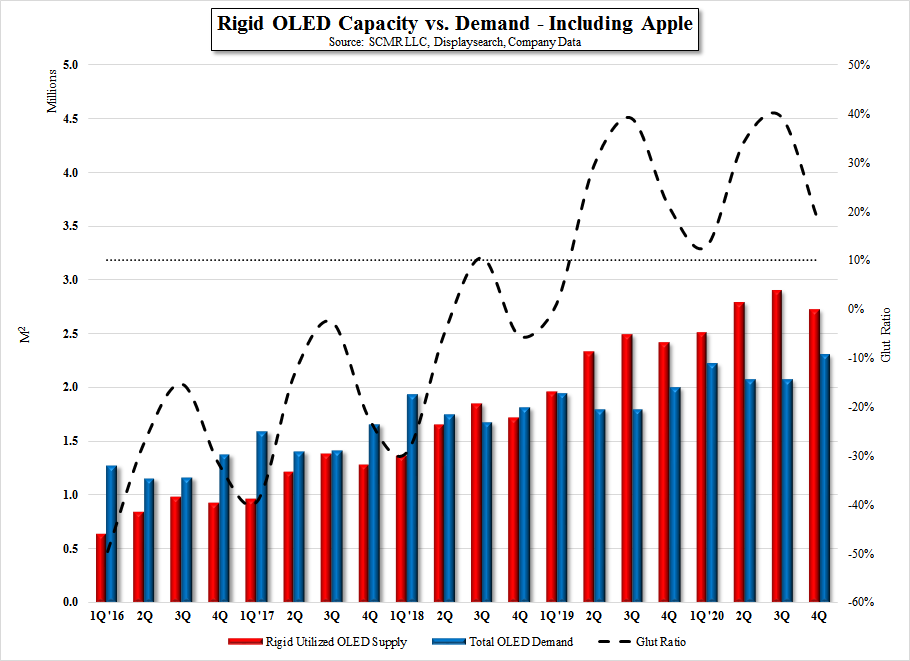

We don’t mean to be flippant in our evaluation of the Trendforce note, but this is a topic we have spent a great deal of time on. The aspects mentioned thus far are structural, and do not begin to reflect the vast number of technical issues that remain to be solved when speaking about a mass produced flexible OLED device, but we certainly don’t rule out the possibility, and in fact, believe that display flexibility will be the biggest long-term driver in the display space for the next decade. We have seen many flexible OLED demos over the last few years, and believe that eventually some will be able to move into scalable production, with Samsung likely the first to make the technology practical, and maybe sooner than most believe, but that funnel is very narrow, and while we have absolute faith that the industry will eventually solve those problems necessary for the mass production of flexible OLEDs, it seems disingenuous to blow off the idea due to ‘production problems’ or ‘low yields’. It’s a bit more than that and we would be happy to detail our models, assumptions and conclusions with investors on request. Watch the funnel get smaller in the charts below…

RSS Feed

RSS Feed