Who sells to Daddy?

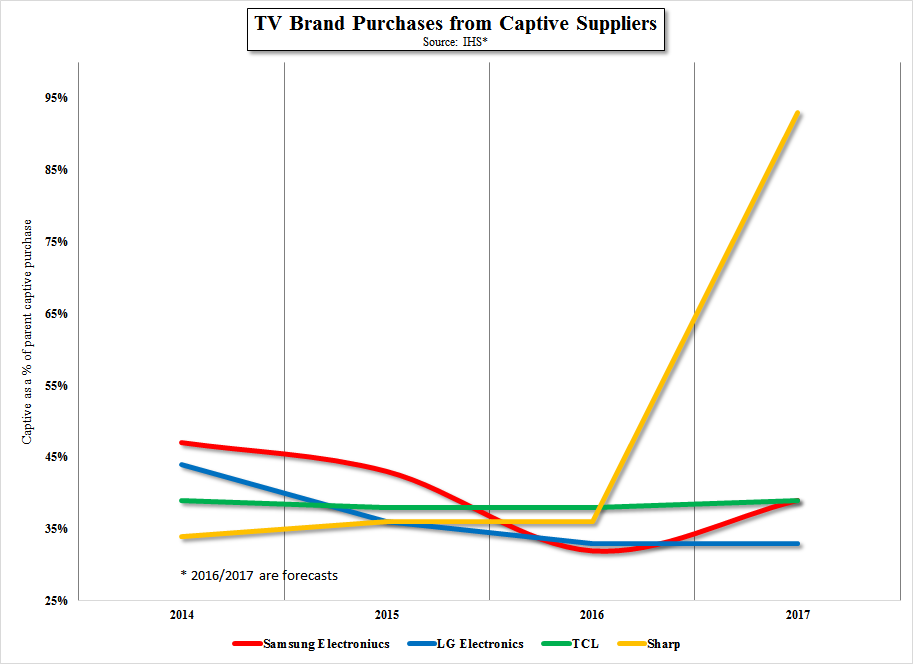

Some of the semi-captive relationships are simple such as LG Display (LPL) and LG Electronics (066570.KS), while some are more complex, such as Sharp (6753.JP), but the balance between filling the parent company’s needs and developing external customers, while maintaining high utilization rates can be a daunting task, and one that changes both yearly and quarterly. That said, for the last few years the percentages have not changed much, with the base around 32% and the peak around 47%. However last year, as we have noted previously, Sharp was purchased by Hon Hai (2317.TT)/Foxconn (2354.TT), and the new Sharp owners made a significant change in their plans that has affected the entire TV display industry.

The yellow line in the chart below indicates that the new combined entity of Sharp/Foxconn will now buy almost all of their TV panels from their semi-captive supplier, and Sharp, the panel supplier, will limit its outside client’s sales to less than 10%. While the idea behind this change is based on the new owner’s desire to resurrect the Sharp TV brand, using owned assets to contain costs, Sharp’s outside customers, primarily Samsung Electronics (005930.KS) and Chinese TV brand Hisense (600060.CH) were left to scramble to fill the panels that they had thought would come from Sharp.

This came during a cycle where Samsung Electronics had been decreasing its reliance on its subsidiary Samsung Display, and Samsung Display had been diversifying its customer base in a similar fashion, a result of a period when Samsung Electronics (and most of the industry) saw rapidly slowing TV sales, and had to cut its quarterly/yearly targets, leaving Samsung Display with idle production capacity. Vowing to keep this from happening again, Samsung Display began to add external customers, as can be seen by the red line. Samsung Electronics was also diversifying its TV panel supplier base, to avoid causing the same problem, given its participation in Samsung Display’s results. Samsung Electronics contracted with Sharp, BOE and others to give Samsung Display the opportunity to expand its external reach.

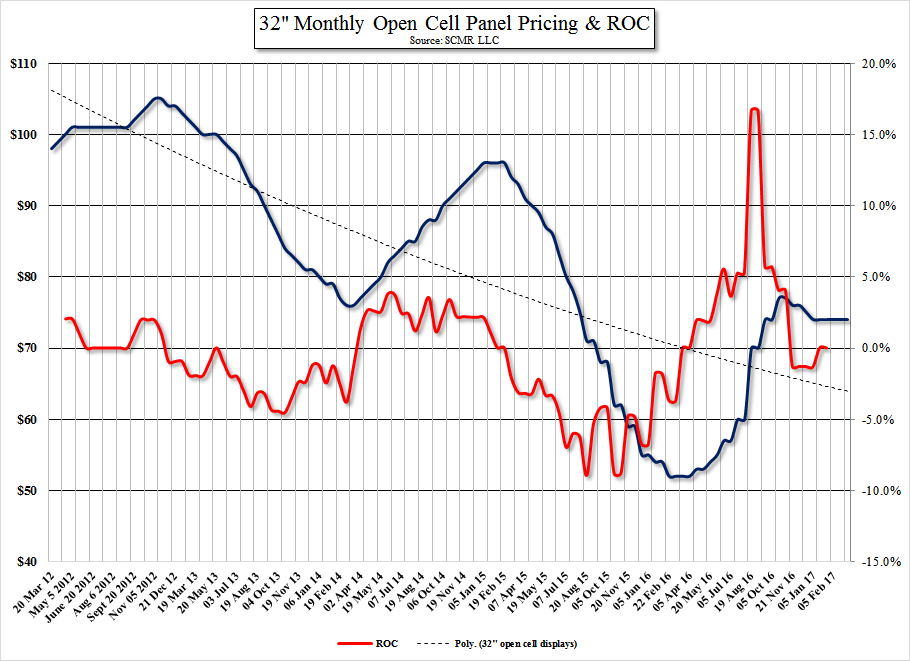

This was actually working well until Sharp was bought by Hon Hai/Foxconn last year, and the management of Hon Hai/Foxconn decided that they would use the well-known Sharp brand name, which had fallen out of favor on a world-wide basis, to build an ‘in-house’ brand for the combined entity. While the idea is certainly valid, the abrupt way in which the decision was made, essentially telling Samsung Electronics that it would no longer be supplied by Sharp, had undertones that seemed to indicate as much of a desire to resurrect the brand as to cause discomfort to the share leader, forcing them to scramble to fill the missing TV displays before the 2016 holiday season. This issue, an earlier problem with production at Samsung Display, and Samsung Display’s intention to convert older production lines from LCD to OLED, set the tone for a ‘panic’ scenario, where buyers switched from ‘buy what we need for a good price’, to ‘make sure we have what we need, regardless of price’, with the result being the first increases in TV panel prices since early 2015.

The question that comes to our suspicious minds is how much of the Sharp/Hon Hai/Foxconn shift was to benefit the Sharp brand, and how much was to help to bolster TV panel prices? We can’t see into the mind of Hon Hai Chairman Terry Gou, but as the founder of the world’s largest contract manufacturing business, we would imagine the answer would not be based on a single concept. If the restoration of the Sharp brand was the ultimate goal, why cut off a big customer so abruptly, knowing that it will likely eliminate Samsung Electronics as a Sharp customer for the foreseeable future, should the Sharp brand be unsuccessful. LG Display and China Star (pvt) will be filling in the gaps for Samsung Electronics and we cannot answer the question, but the scenario seems to be playing out like a season of Dynasty, just without the face slaps and giant hairdos.

RSS Feed

RSS Feed