February Taiwan Panel Sales & Shipments

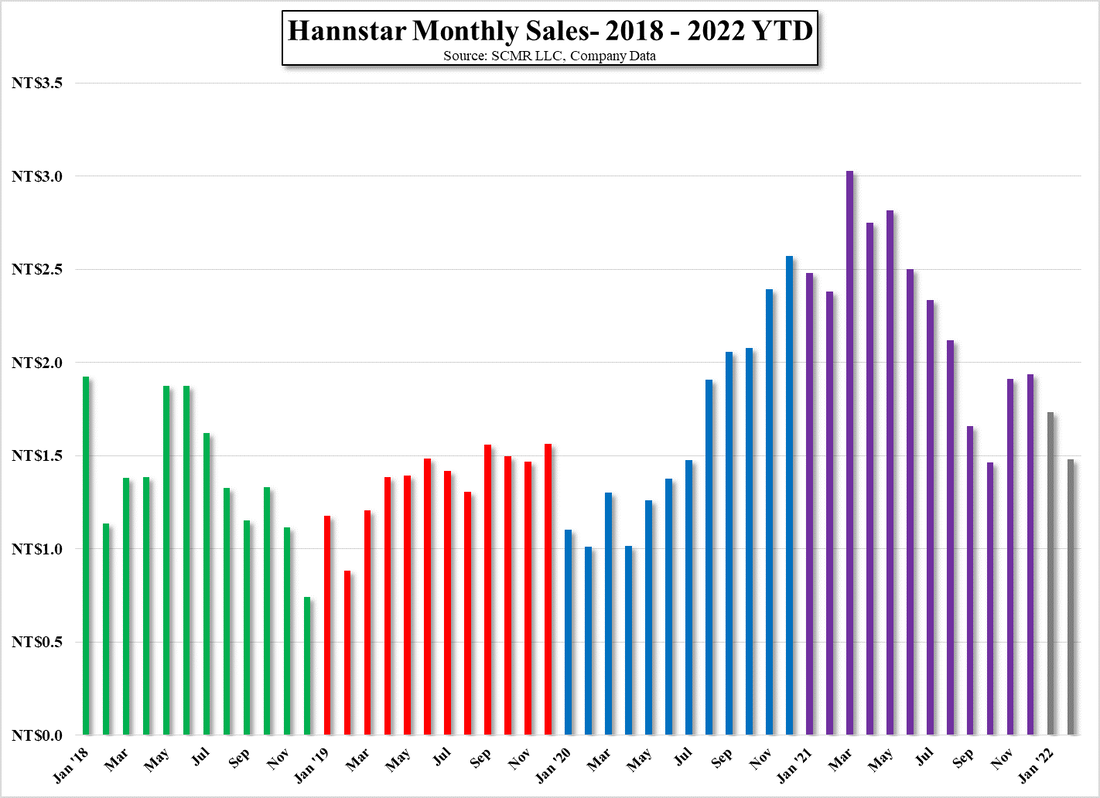

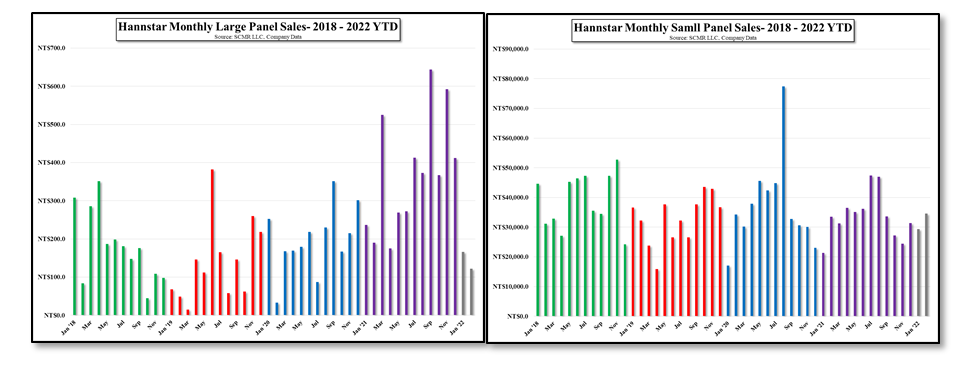

In the case of AU Optronics and Innolux, sales have fallen to levels at or below February 2021. Both panel producers generate considerable revenue from TV panel sales (generally between 30% and 35%) with the remainder from IT products (notebooks, monitors, tablets) and small panel (smartphone, watches) sales. As large panel prices have declined steadily since last July, the effect has been obvious on sales, but only within the last 2 – 3 months have panel prices for IT products begun to decline. Those panel products had helped to offset the decline in TV panel prices until recently and now have begun to pressure overall sales as those panel prices weaken. As this trend has continued through February, first quarter results are likely to be under pressure, although the declines in TV panel prices have slowed somewhat as IT panel price decreases increased. As panel producers spent much of last year shifting production away from TV panels and toward IT panel production, this makes the industry more sensitive to IT panel price declines. Hannstar is primarily involved in producing small panels so the effect of TV and IT panel price declines is less obvious however component shortages and weak demand for smartphones has also affected Hannstar’s monthly sales trends this year.

RSS Feed

RSS Feed