Finally…

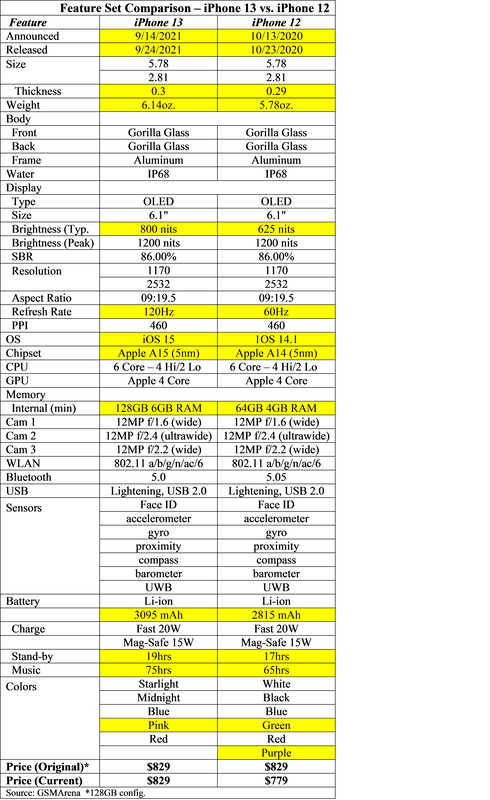

Price is a factor with the iPhone 13 series as prices for all models have remained the same as last year’s models (initial prices) so we expect consumers will have to decide whether the style changes or modest feature upgrades make it worthwhile to buy into the iPhone 13 series or watch the iPhone 12’s all drop in price. While we are personally not iPhone users, it seems that the iPhone 13 changes are rather nuanced and not worth paying full price for, but the real issue is the cost to Apple of the iPhone 13 series, and we are still a bit away from gathering any BOM information.

That said, component costs have been rising in almost every category, and while Apple has the kind of leverage that can mitigate most of those increases, we have to expect at least some BOM cost creep. Speculation that Apple’s high volume purchases from TSM (TSM) at the 5nm node have culled better pricing across the board for the company, with prie increases of 3% to 4%, while others have seen increases between 10% and 20%.

If, in fact the margin is slightly lower on the iPhone 13 series, the question would be is it in line with similar BOM increases in the iPhone 12. If the BOM for the iPhone 12 has moved at roughly the same amount over the last year than Apple needs to sell iPhone 13’s to maintain margins and the extra month of sales will certainly help, but if the BOM for the iPhone 12 has been stable, then the iPhone 12’s discounted pricing will be the key to maintaining stable y/y margins for the line. In that case it would be less important which type of bologna you sell, as long as you sell more.

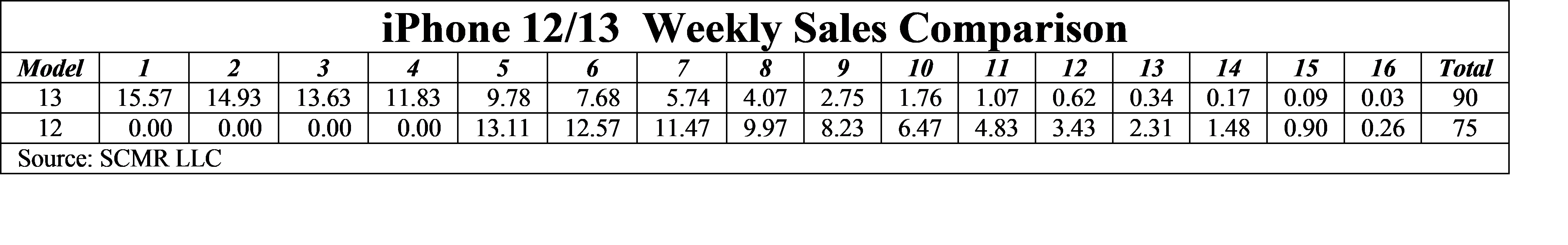

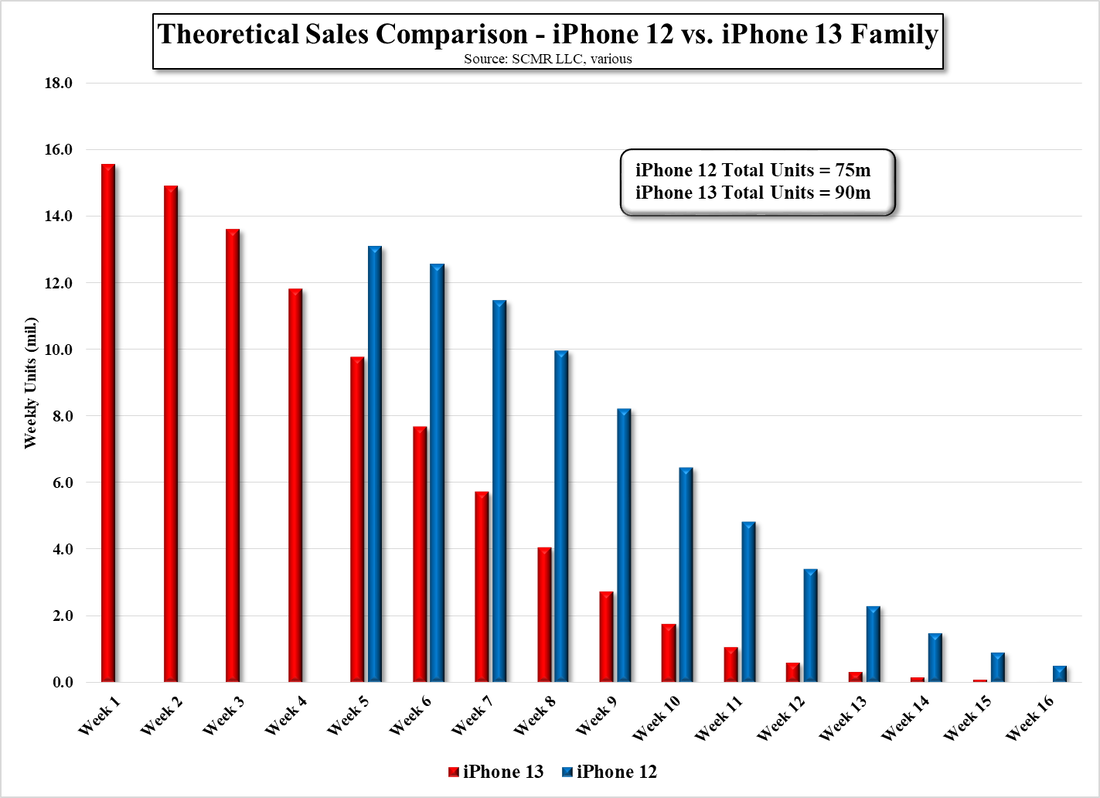

We do note that there has been considerable talk concerning Apple’s order levels for the iPhone 13, which are expected to be ~90m units by year-end. At 20% above last year’s order rate, much has been made about the optimistic view that Apple has on the iPhone 13 family, however it seems there is more to the numbers. As the announcement date for the iPhone 13 is ~1 month earlier than the iPhone 12, the number or pre-order and selling days would increase by ~36% while the orders have assumedly increased by 20%. Assuming that the early weeks would see the highest order numbers, we set-up a sales schedule to make a more realistic comparison.

Despite the difference in the starting dates, we decreased the starting (Day 1) unit sales by .1% each day from the pre-order date until the end of the year. By adjusting that initial unit sales value, we were able to model theoretical weekly sales for both the iPhone 12 and the iPhone 13 to the previous year’s total (75m units) and expected total units sold in the initial year for each. In order for the iPhone 13 series to meet its goal of 90m units this year, inclusive of the extra days, it would have to outsell the iPhone 12 by ~18.7% in its 1st week of sales, so we should be able to understand how close Apple will be to its goal for the iPhone 13 line as the estimated data becomes available.

All in, while Apple has made some positive changes this year, we see little to get excited about, other than the extended battery time. Earlier in the year we had expected that Apple might lower the price of the iPhone 13 family, but the increasing component costs that have plagued the CE space seems to have dashed any hopes of same, although there is still some time for holiday discounting. We believe it could be a bit of a struggle this year for Apple to meet its 90m unit goal without stepping up marketing spend. Hopefully there will be a bigger increment to the feature set next year and a real reason to upgrade. BTW, Apple has lowered the initial price of the iPhone 13 in China (higher than in the US) by ~$124 relative to last year’s model, so we do expect sales in China to be stronger this year, especially with Huawei (pvt) being almost out of the smartphone business. Last year China was ~20% of Apple’s sales.

RSS Feed

RSS Feed