Foldables On the Cheap!

Recent rumors seem to see that changing, and while the new Samsung Galaxy Foldable models were expected to have a number of new features, they have been expected to be priced the same as the previous models. However recent ‘unidentified sources’ have indicated that the new models will be cheaper, despite the added features, with up to a 20% decrease in price from previous models. While that would bring the price of the Z Fold 3 down to $1,600 and the Z Flip to $1,104, actual pricing will vary by country, along with a number of incentives for those that pre-order, when that option becomes available.

Even with the possible price reductions foldable smartphones are still expensive, although they do carry significant ‘look-at-me’ value, but in our note yesterday we indicated how Samsung Display was opening up its foldable production to other smartphone brands, which will certainly help to lower the production costs for foldable products, at least Samsung’s foldable products. Because Samsung Display is becoming so dependent on its small panel OLED business, they must walk a fine line concerning margins so as not to imping on profitability, and we expect, while yields for foldables are likely lower than for flexible OLED displays, margins are comparable or higher, even with the lower yields.

If Samsung is going to eliminate the Galaxy Note line this year or next, which sold about 10m units/year at a rough average price of $1,000, they need to reach the top of their expected range for foldables to make up the difference this year, which is not an impossibility, but what we would consider a reach. From Samsung Display’s perspective, selling foldables to outside customers is gravy since Samsung Electronics foldable demand will make up for the overall loss of Galaxy Note displays, and by next year, if Samsung and others are successful in maintaining foldable momentum, they will have built a new business around foldables that would continue to grow.

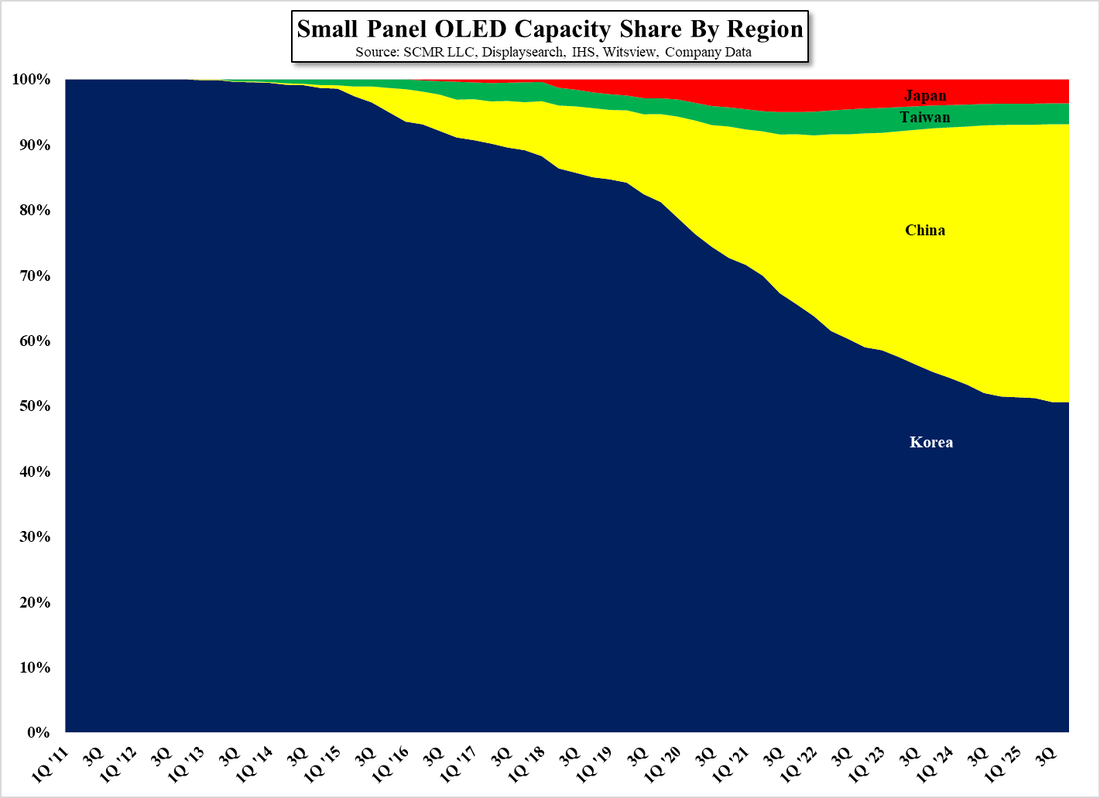

That said, all is not without risk, as expectations grow for foldable price reductions. If Samsung does not meet those expectations this year, we could see another unit volume shortfall, which could tarnish the foldable market and slow adoption. As SDC has no choice but to forge ahead, we expect to see more foldable smartphone adaptations later this year and as we mentioned yesterday a number of initial models from brands just entering the foldable market. That said, we do expect it to take at least another two years for foldable smartphones to reach parity with high-end flagship smartphones, as all brands are looking for the segment to boost margins, and SDC needs the same to balance its flexible OLED business, so what will push down foldable prices? Chinese competition, which to date has been modest, more from a delivery standpoint than a quality one, but that will continue to improve over time with BOE (200725.CH), Visionox (002387.CH) and Tianma (000050.CH) all vying to develop viable foldables. Samsung Display has the lead but China is certainly a viable contender.

RSS Feed

RSS Feed