Fun with Data – AI Usage

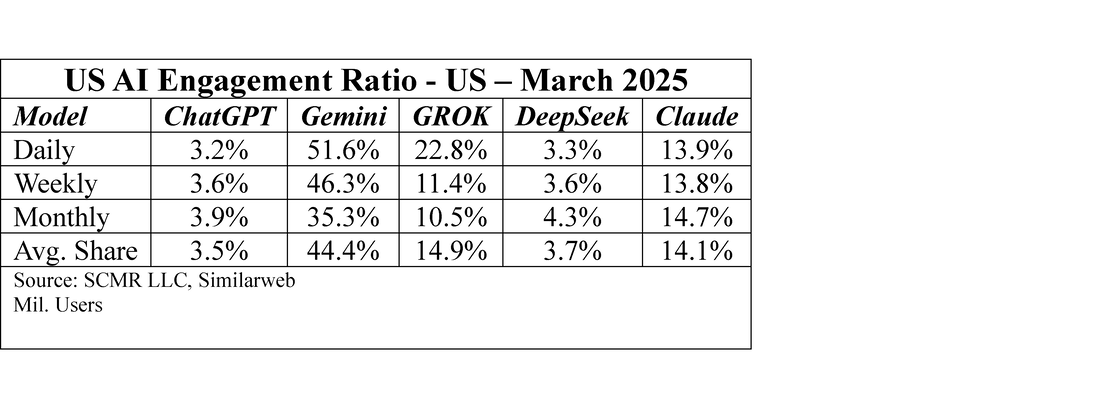

An example might be browser statistics, essentially the number of times a particular browser type is opened in a given period, or how often a website is visited and how long users remain on the site. These are routine statistics that are readily available, so in the fierce battle for Ai supremacy, such data is as important or more important than the benchmarks that are used to compare Ai model performance. Depending on which metric is used, AI models can be ranked according to the number of times they are accessed and can even be segmented by country, phone OS (Android, iOS, etc.) and a variety of other categories. However, when it comes down to who is using what AI and how often, such user data is a good start toward trying to calculate a model’s potential for profitability.

The big problem is the fact that there are typically a number of AI model pricing tiers , with the far most popular being ‘free’, and the data that is collected by your phone’s OS or by your browser does not know if you are paying for the model’s service or if it is free. This means the value of such user data is more general than might be hoped for, but we take what we can if it helps to put together the puzzle.

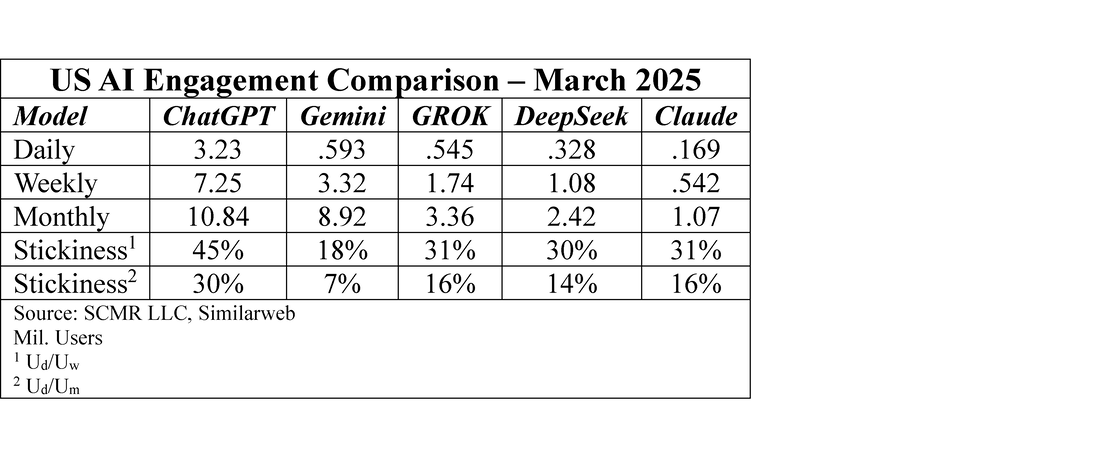

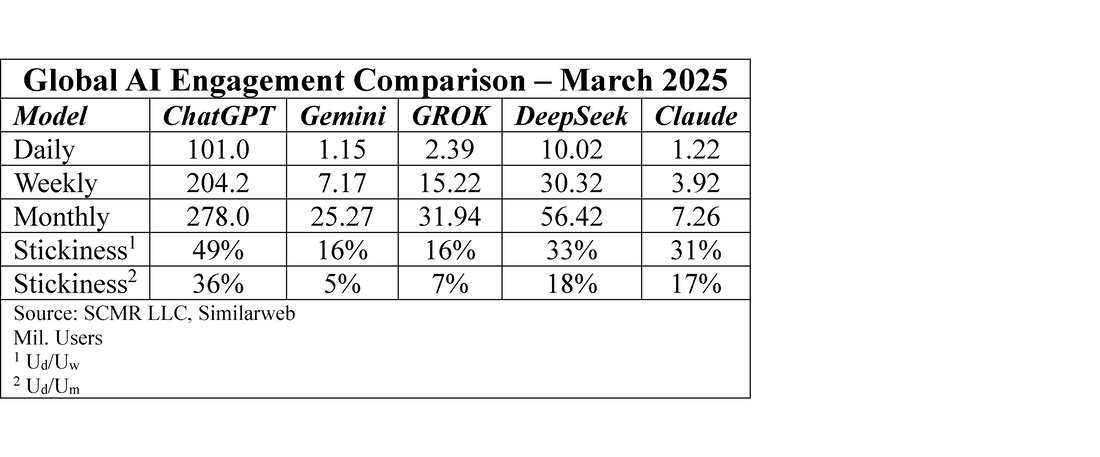

We note that ‘stickiness’, as it is used here is a ratio between daily users and either weekly (Ud/Uw) or monthly users (Ud/Um), with the higher number indicating that users are more likely to return to the model on a regular basis. Again, ChatGPT is the obvious ‘stickiness’ leadeer while surprisingly Gemini the weakest. We would have expected Gemini, with its ability to access some of the Google search index, to have been stickier.

As noted above, the data that shows what percentage of each model’s users are ‘paid’ users, is not publicly available, as it would open each model to a level of transparency that would likely make management uncomfortable, especially as growth slows, so right now we have to rely on more typical ratios for subscription models, especially as AI models are a new category. Worst case would be a 2% to 5% ‘paid’ ratio, and best case between 10% and 25%, the average for ‘freemium’ subscriptions that offer a free trial period that converts to paid if the user finds value. The calculations get very complex even if we know the exact paid ratio for each model as the models are priced based on the number of tokens processed rather than a monthly fee. How each user breaks down as to token use is another ‘internal’ metric that will take time to discover. Until then estimates are just supposition, making future growth and profitability unusually difficult to pinpoint, at least for now, although we expect AI investors might disagree..

RSS Feed

RSS Feed