Fun with Data – Buying Stuff On-Line

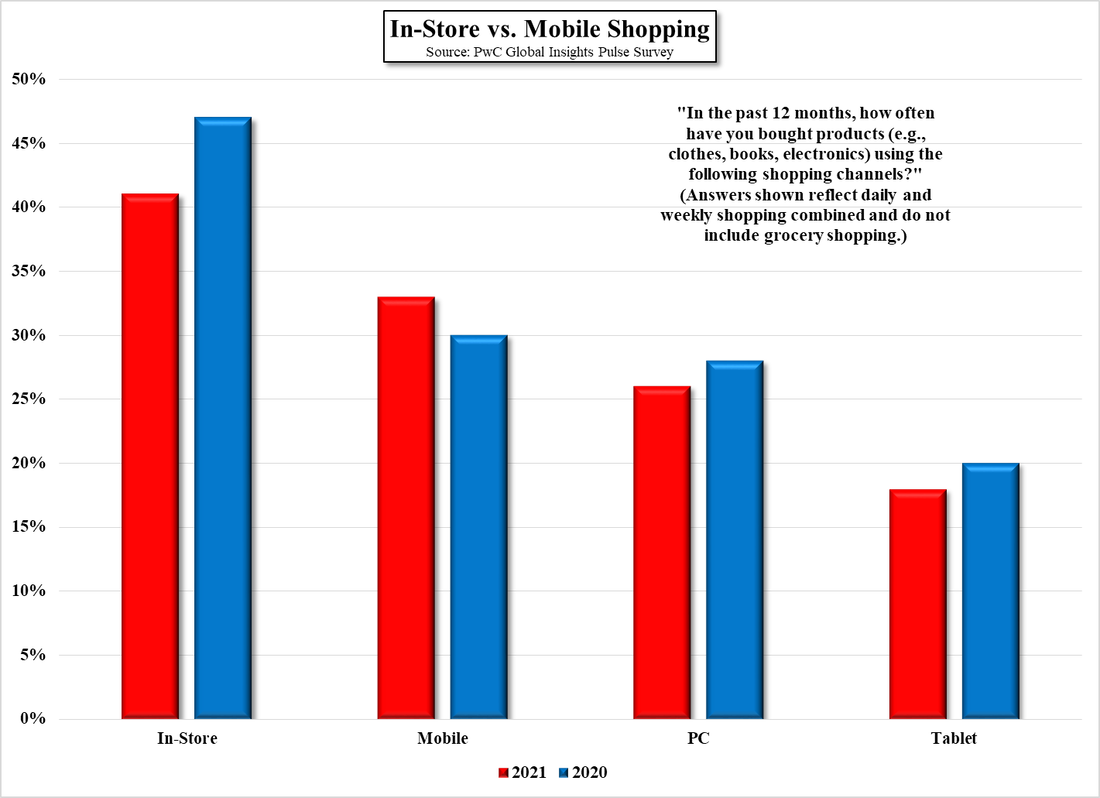

[1] PwC Survey Metodology - For the first pulse in the series, we polled 8,738 consumers across 22 territories (Australia, Brazil, Canada, China, France, Germany, Hong Kong SAR, Indonesia, Japan, Malaysia, Middle East, Mexico, Netherlands, Philippines, Russia, Singapore, South Africa, South Korea, Spain, Thailand, the United States and Vietnam). The survey was translated into 16 languages and fielded in November 2021. The respondents were at least 18 years old and were required to have shopped online at least once in the previous year.

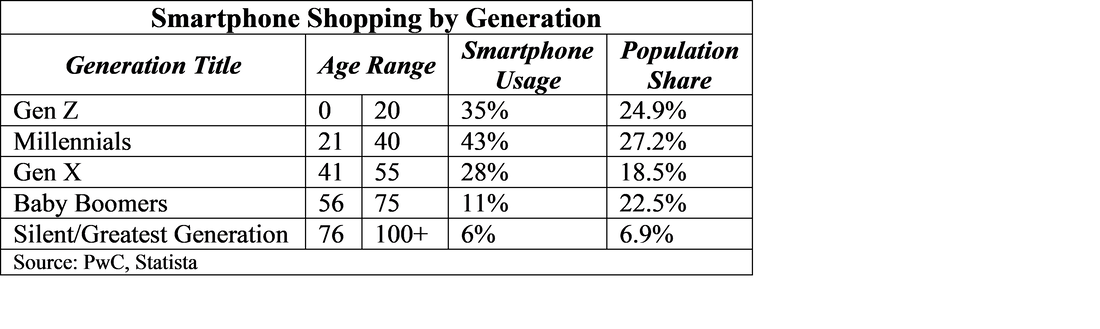

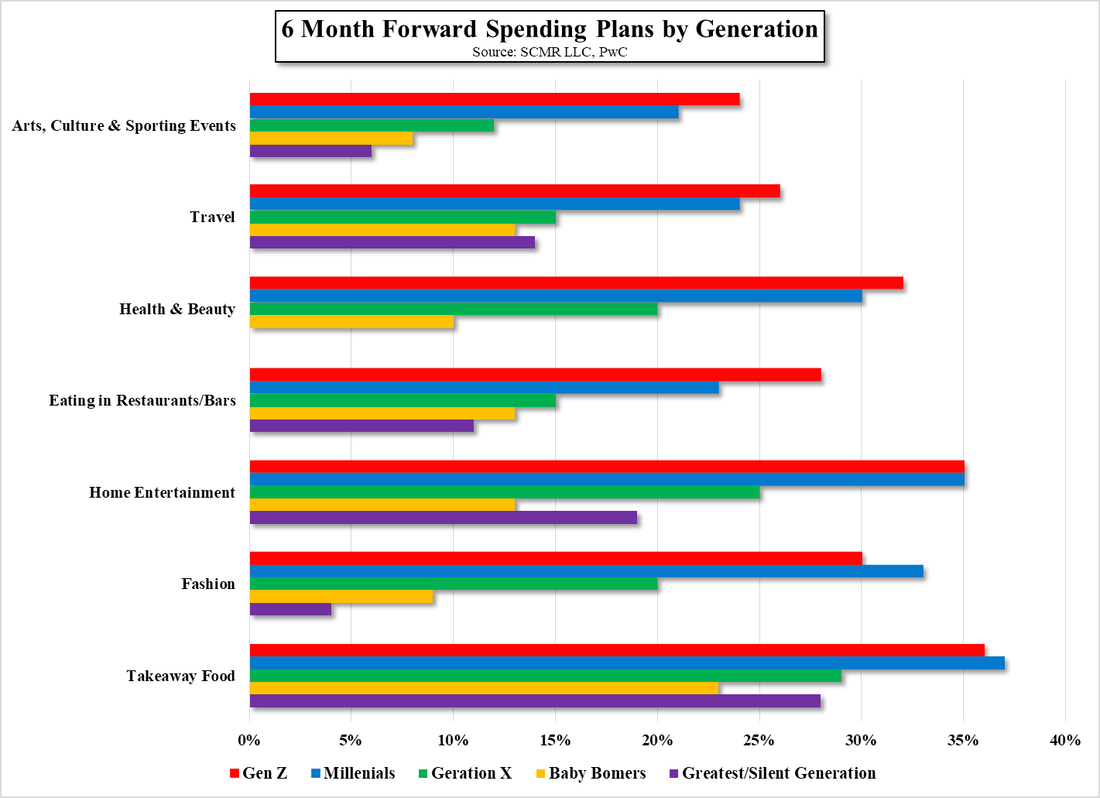

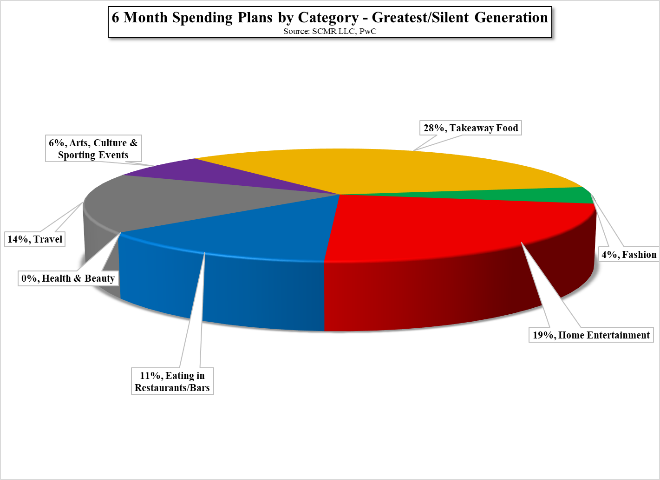

While the highest rate was from millennials, which was no surprise, we were a bit stumped by the lower rate for Gen Z, although that could be due to their relatively low earning power. Missing from the data was “The Silent Generation” (b. 1925 – 1945), who, we assume were living up to their name and not answering any questions. We added the percentage of the US population each generation represented in mid-2019 for reference.

RSS Feed

RSS Feed