Fun with Data – China Brand Value

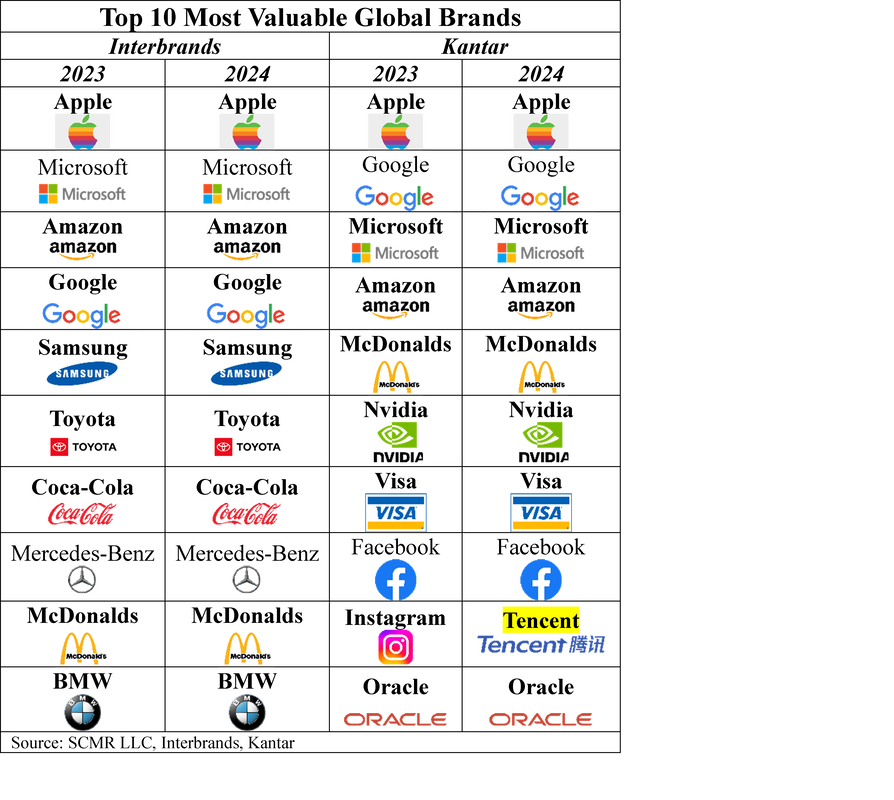

[1] Kantar Survey 2023-2024, Interbrands Survey 2023 - 2024

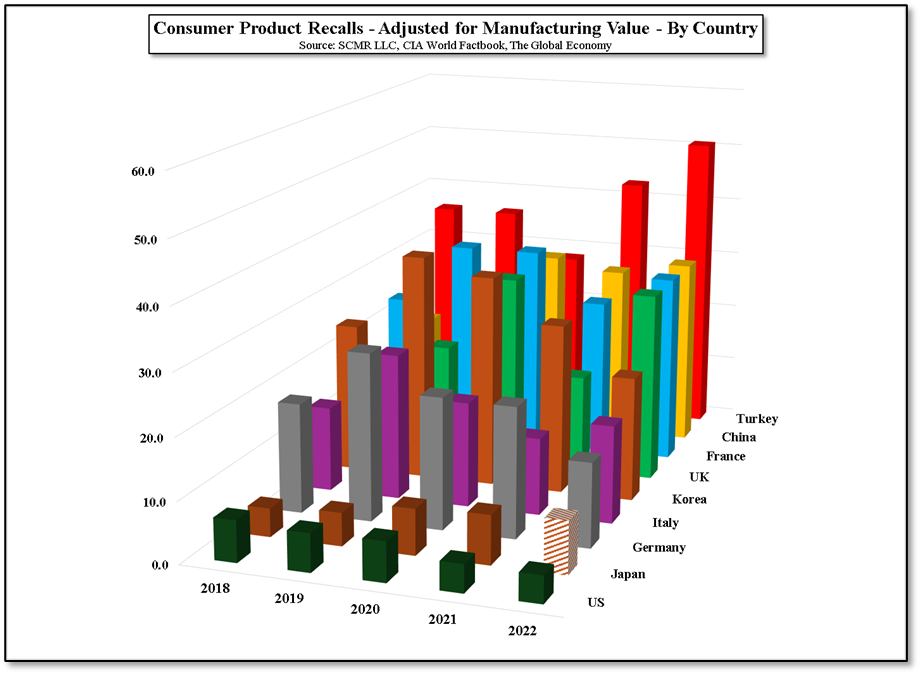

There is also the perception that products made in China are ‘junk’ or dangerous, a perception fostered by competitors who cite recalls and poor quality products. As the quality issue is subjective, we focus on recalls to get a better understanding of the validity of the claim. We accessed global and country-by-country recall data for the years 2015 to 2022, however comparing country-by-country recalls makes little sense without considering the manufacturing value of the country, so we matched that data to each country’s manufacturing value. While China might have more recalls/year than Germany, China’s manufacturing value is 5.7x that of Germany, so we adjust the yearly recall number to each country’s manufacturing value. This generates an adjusted value that reflects a more realistic view of product recalls. From that perspective, China ranks below Turkey and roughly equal to both France and the UK over the 5 years between 2018 and 2022, debunking the recall myth.

[1] Can include US and other countries in North America.

RSS Feed

RSS Feed