Fun with Data – China Smartphones

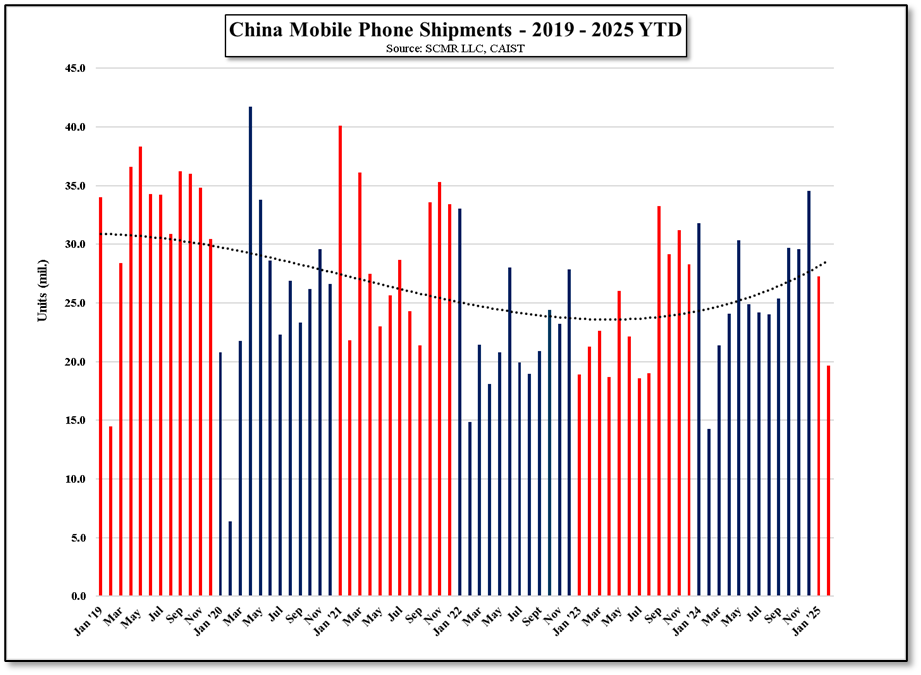

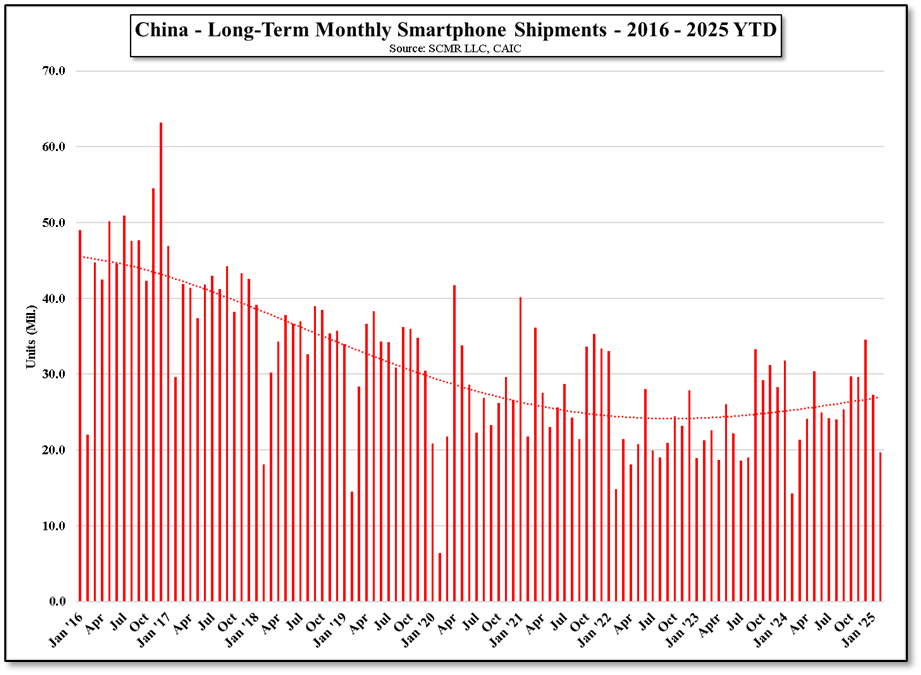

So far this year (Jan/Feb data only) January smartphone shipments were down 14.2% y/y, but February shipments were up 37.9% y/y and above the 5-year average by over 25%. On January 20, the Chinese government added smartphones to its “New for Old” consumer product subsidy program, which we expect accounted for the strong February results. While we expect continued strength in smartphone shipments in the domestic Chinese market, we expect consumers took advantage of the subsidy at the onset, and front-loaded February shipments. March is typically a strong shipment month, so we can see how much front-loading was done in February through the March shipments when they are released.

While the domestic situation for Chinese smartphone brands improves, the current trade war with the US, despite recent smartphone exceptions, still requires that Chinese smartphone brands entering the US pay an import tariff of between 20% and 25%, which, unless absorbed by the brand, will make them less attractive against other non-Chinese brands. The most common Chinese brands entering the US are:

- One Plus (pvt) – Offered through all three major US carriers, although estimates for US sales are between 5% and 10% of company totals.

- TCL (000100.CH) – Typically sold unlocked. Estimates are for between 10% and 15% of total sales to the US.

- Motorola – Owned by China’s Lenovo (992.HK) and sold through all US carriers and retailers. Roughly 20% to 30% of total sales (estimated) are in the US.

- ZTE (000063.CH) – While most consumers believe ZTE smartphones are banned in the US (They were in 2018, but they paid a $1.4b fine and the ban was lifted), pre-paid phones from Metro (TMUS) are made by ZTE, but the numbers are small.

That said, they have one thing in their favor, Apple (AAPL) who has been able to lobby the President to postpone another massive Chinese tariff increase. While Apple is still a competitor, it has considerable production in China, and therefore works toward the same goals as Chinese brands in this instance. As Apple continues to shift iPhone production away from China that will dissipate, leaving Chinese brands to fend for themselves, an unenviable position at best, at least for the next 3.5 years.

RSS Feed

RSS Feed