Fun With Data – China TVs

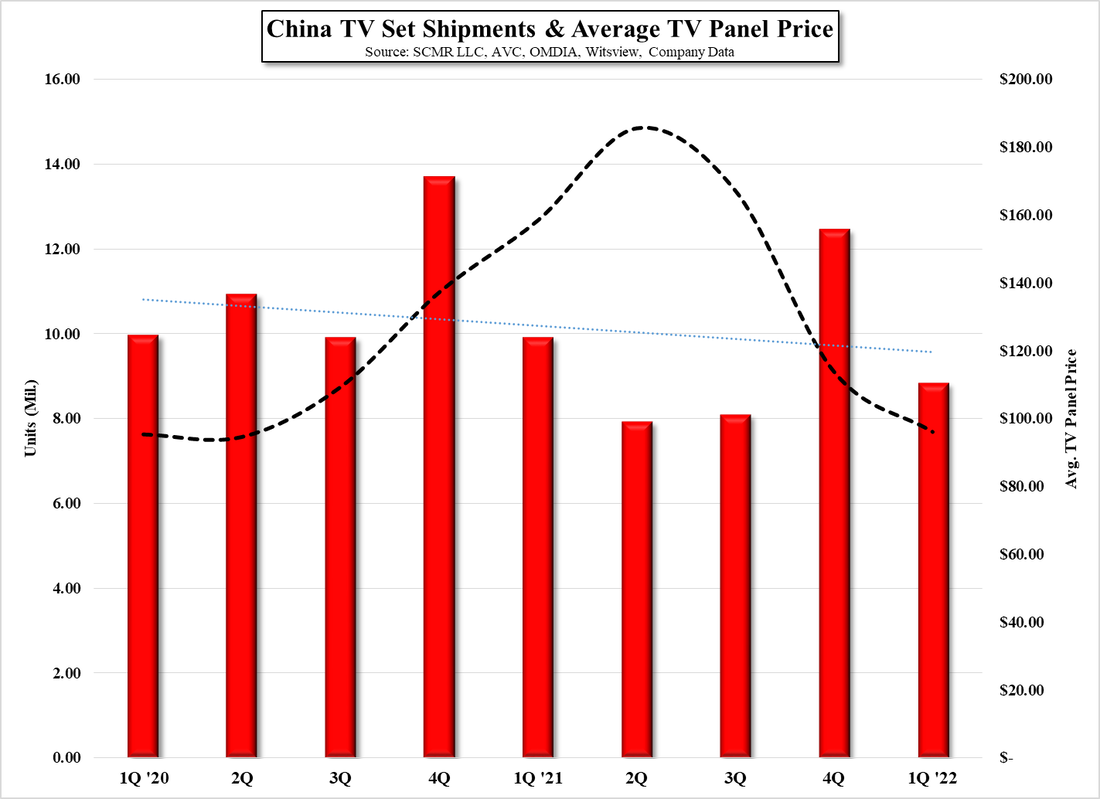

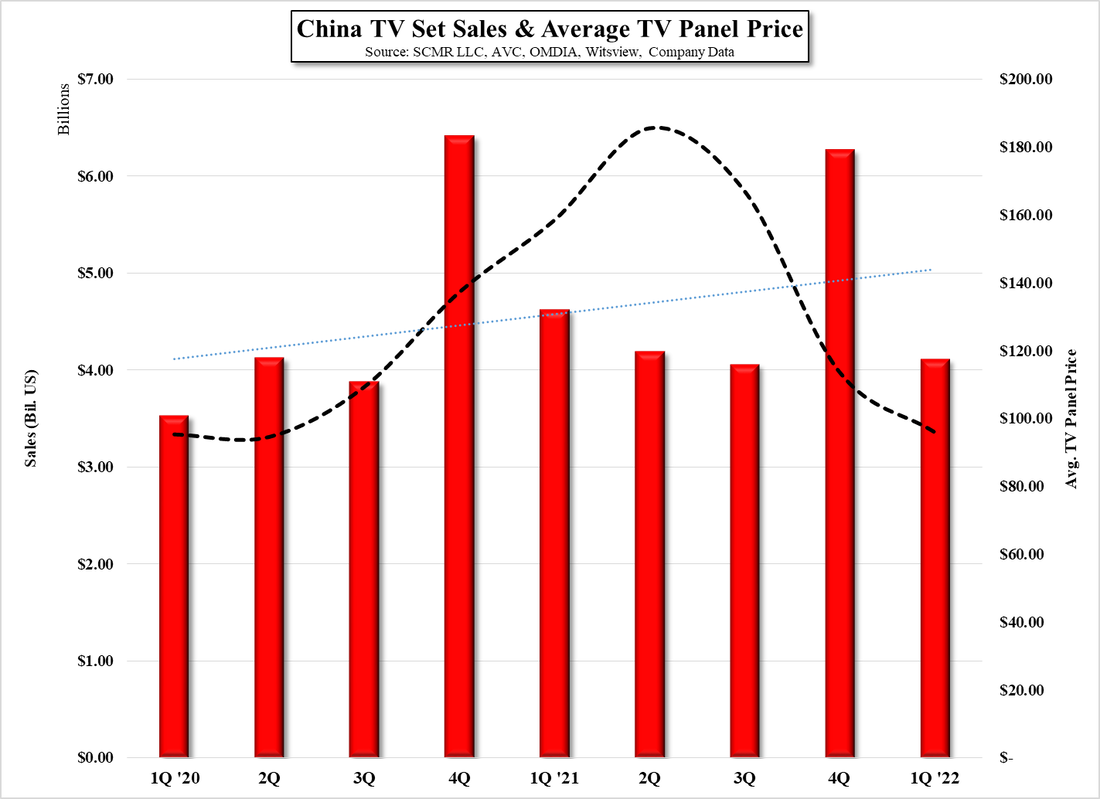

But it seems that the relatively high TV set prices and a less onerous COVID infection rate have begun to take a further toll on TV set shipments in China, with 1Q ’22 TV set unit volume down 10.8% y/y and sales down 11.0% y/y. Given the strong 1Q seen last year weaker results in 1Q this year should not be a big surprise, but more telling will be 2Q results in China that would be more indicative of a trend, but while TV panel prices are still declining, component shortages and price increases will likely push unit volumes lower. The good news for TV set brands in China however is that unit volume comparisons will become easier in 2H while sales comparisons should be a bit more difficult.

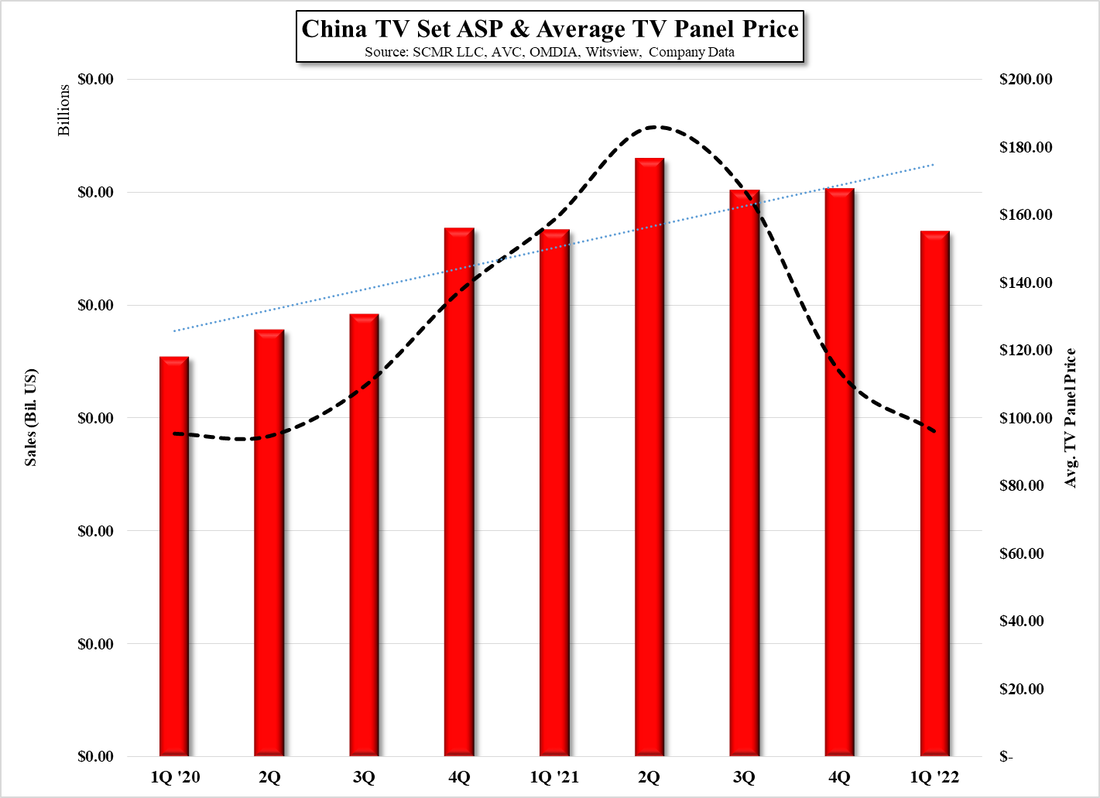

Chinese TV set brands are a bit slower to reduce the aggressive unit volume targets that they set toward the end of the previous year and sometimes do not publicly make those changes known, although leaks from suppliers now tend to eventually reveal same, but Chinese TV set brands are facing a difficult problem in that set prices are still relatively high giving little incentive for Chinese consumers to upgrade. Some of the higher price points are due to component and transportation costs, but the Chinese set market is proving to be a bit less elastic that brands might have assumed, with the average price of a TV set in China falling by 7.5% q/q in 1Q this year while both unit volume and sales dollars both declined.

The problem seems to be that from a consumer’s standpoint, the average price of a TV set in China is basically flat y/y, after peaking in 2Q last year, so there seems to be little incentive to trade up currently. If Chinese brands are willing or able to bring TV set prices down further, there is some chance that Chinese consumers could see value later this year against last year’s higher ASP’s, which is what both Chinese TV set brands and panel producers are counting on, and likely the reason volume targets have not changed in light of the 1Q weakness. The May 1st 5 day Labor Day holiday in China is expected to show weaker sales than last year despite aggressive promotions but many expect it to be the turning point for the CE space in China, with 2H pulling Chinese CE brands back into a more positive zone. Seasonally that would be the obvious bet but much will depend on how stringent the Chinese government is concerning further COVID lockdowns and how flexible CE brands will be toward lowering prices if raw material and component prices begin to ease, and those are much less tangible situations.

RSS Feed

RSS Feed