Fun With Data – Foldable Smartphones

The initial reviews of the Galaxy Fold were favorable from a technology point of view but not from a practical one, as problems with visible crease lines in the display caused many to set aside the technology in order to give Samsung time to fix the display issues. As the company had already committed to the foldable concept they delayed the actual release date (April 2019) until they were able to make changes to the display and the fold hinge to reduce the crease. While this gave hesitancy to consumers that might have been early adopters, especially the lengthy ‘care’ instructions given to consumers upon the final release, Samsung Display and its parent continued to push forward with the concept.

Since then Samsung has released at least two foldable smartphones each year and is expected to announce the 2022 versions in August, with delivery in September, and while there have been numerous ‘leaks’ and unsourced mock-ups about these next-generation foldables, the category continue to evolve. Samsung’s biggest foldable competitor is Huawei (pvt), a Chinese company that is under severe US trade restrictions and is tacitly limited to selling its products in China, but in 2021, despite the poor performance of smartphone brands generally, two additional Chinese brands entered the foldable market with the Xiaomi (1810.HK) Mi Mix Fold, and the Oppo (pvt) Find N devices., and thus far in 2022 both Honor (pvt) and Vivo (pvt) (both Chinese brands) have already released their first foldable smartphones.

Much of this activity was generated when Samsung made a concerted effort to promote its foldable phones in 2H last year. We believe that Samsung felt that enough time had passed from the initial, somewhat sketchy release in 2019, that they could safely assure the public that the durability of these devices had improved significantly, and sales jumped 273% q/q in 3Q ’21 and reached almost 8m units for the 2nd half, relative to a bit over 1m units in 1H. While the unit volumes for Samsung’s foldable smartphones grew substantially in 2H last year, we note that they are miniscule relative to the roughly 690m mobile units that shipped during that period, but if nothing else, it generated considerable interest from consumers and competitors, and likely lit a fire under those brands that were already developing foldable offerings.

Despite Huawei, and the initial models from Xiaomi and Oppo, Samsung remained the dominant vendor in 2021, as seen in Figure 2, with an 88% share of the market based on unit volume, although a slightly lower share based on value, given Samsung’s Flip foldable line, which brought the price of foldables below $1,000. Still, Samsung held an 85% share based on sales value, with the 2021 Galaxy Z Flip 3 capturing over 50% of total foldable smartphone unit volume for the year (Figure 4). Not only did the big jump in volumes spark interest in foldable smartphones from competitors, but it also began a spate of foldable smartphone forecasts that we have compiled to garner some understanding of expectations for the foldable smartphone category going forward.

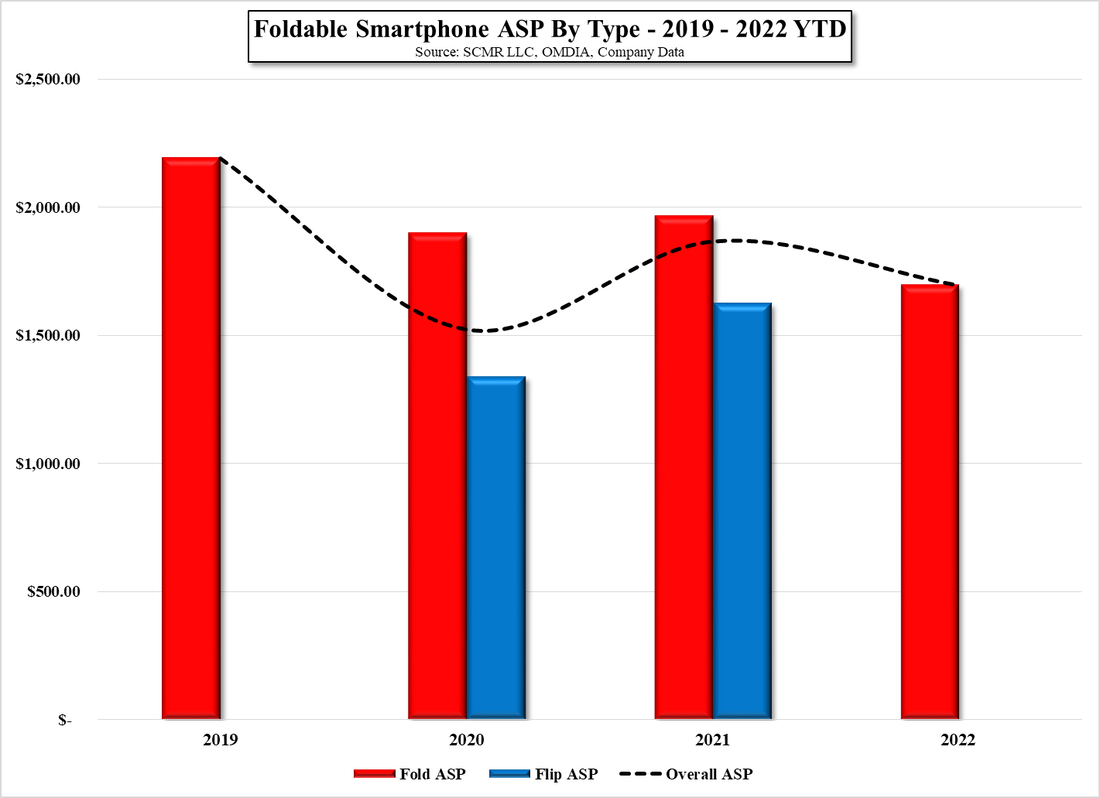

We note that while we aggregate estimates and forecasts, there are always outliers and some of the years further out might have only one or two forecasts, which would account for the unusual volume jump in 2025 and what would look like a decrease in the following year. More likely those years would follow a more linear pattern as forecasts become more plentiful for those years. While unit volumes are certainly a key to understanding the foldable smartphone segment, Samsung’s introduction of the ‘Flip’ model in 2020, and its price reduction in the following year had a significant effect on unit volumes but lowered the ASP across the category. This is important in that it gives us some indication as to price points that will attract consumers to foldable smartphones in high enough volumes to make them a distinctive smartphone category, which was Samsung’s ultimate objective.

Based on available pricing data, we believe the weighted ASP for foldable smartphones in 2021 was $1,688, which would equate to foldable smartphone revenue of $15.3b. If we go further and adjust for the ASP for each brand, that figure drops to $14.6b, as the lower priced offering from Samsung carries more weight than others. That said, we would expect both the unweighted and weighted ASP to decline each year as Samsung increases manufacturing volumes and competitors move to large scale mass production. That said, given that there is limited seasonal data for the category and that we are rather unsure of the reliability of forecasts in the out years, we hesitate to predict sales figures for the category at this time. We do note that the first glimpse of foldable smartphone shipments for 1Q ’22 are massively ahead of 2021, although it is an easy compare, but we feel that by the end of 1H, we should have enough of an understanding of the ‘new’ seasonality for foldable smartphones that we might make more reliable estimates for the 2023 and 2024 years. While we note that hesitation, we do give credit to Samsung for taking a nascent category and making it a viable product differentiator, a task that no other smartphone brand was able to do. Kudos…

RSS Feed

RSS Feed