Fun with Data – Inventory Tales

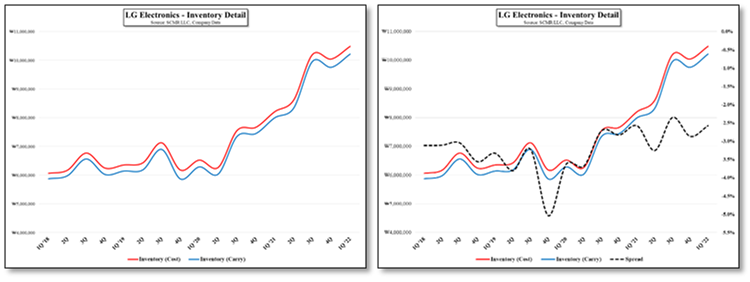

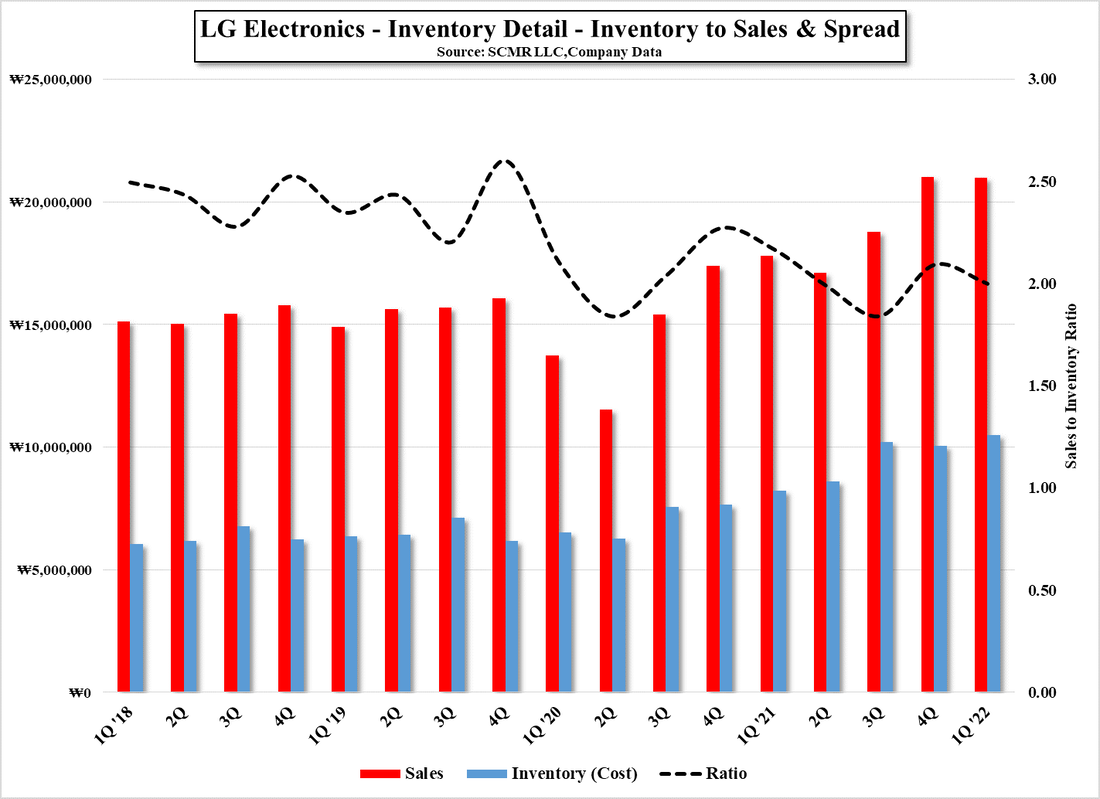

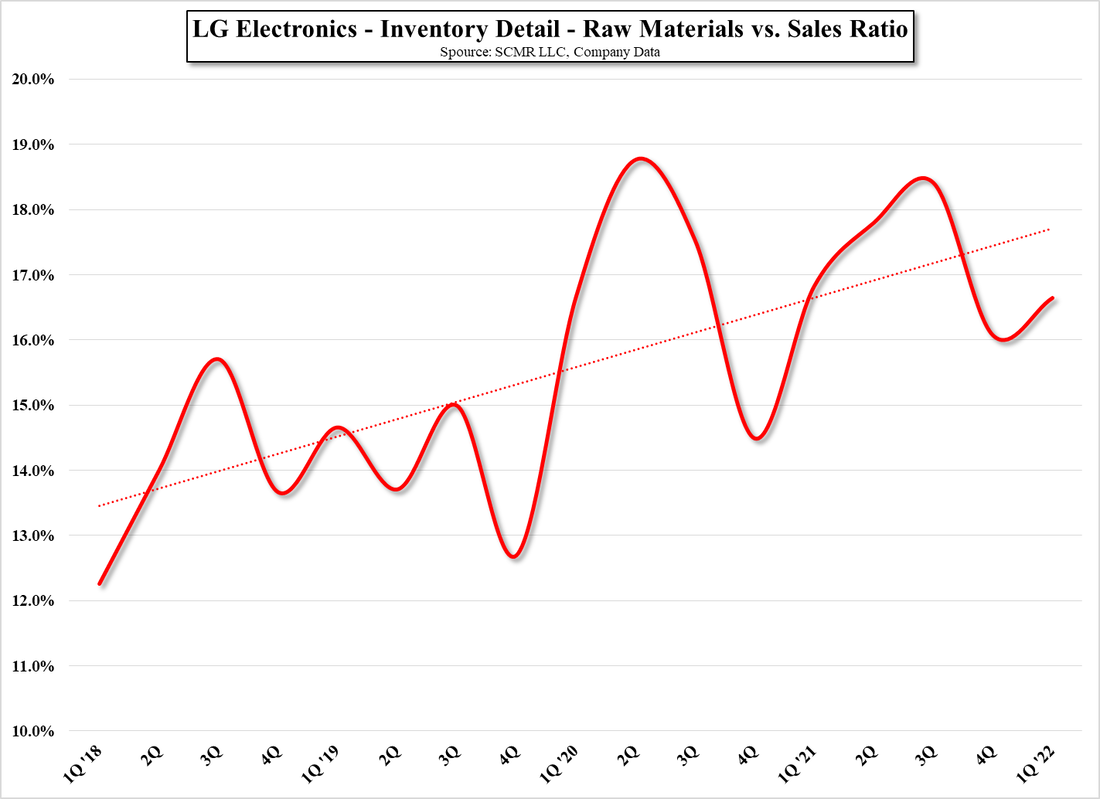

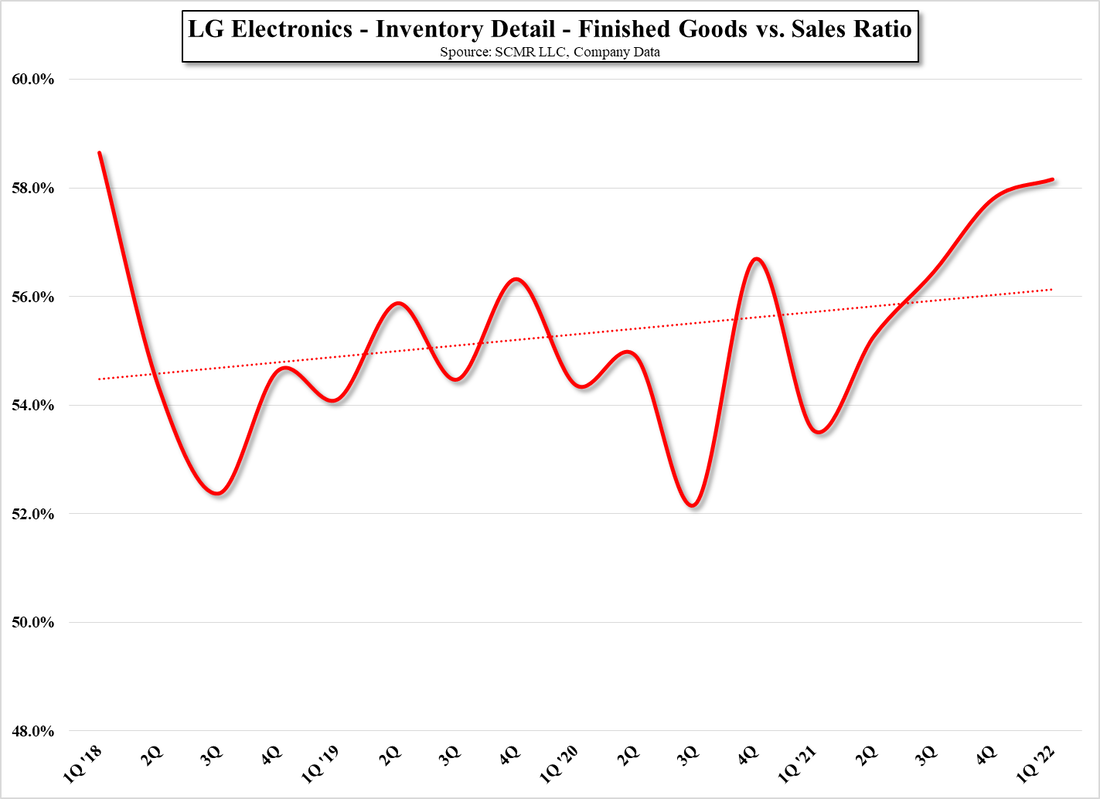

As seen in Figure 9 LGE’s inventory levels have been increasing since 2Q 2020, with the spread between initial cost and carrying cost relatively stable, and when inventory levels are compared to sales, that ratio has actually been declining, contrary to popular belief. That said, when digging a bit deeper in Figure 11, it becomes apparent that the cost of raw material inventory is rising faster than sales, particularly since 2020, pushing the value of raw material inventory from 14.0% of sales in early 2018 to 16.7% in 1Q of this year, with some 18%+ peaks over the last two years. Finished goods as a percentage of sales has also been rising, albeit not as much as raw materials, which puts LGE in the unenviable position of having to raise prices or live with lower margins.

What this seems to imply is that while there was certainly over-ordering in the CE space to protect brands from being unable to provide product to a demanding consumer base, the issue of raw material price increases seems to have had a bigger effect on inventory balances than a build-up of excess units. That said, there are still many points in the CE supply chain where there is excess unit inventory, but we see the bigger issue as being the high cost of that inventory and how to market it to consumers, especially given the reduced buying power consumers are currently facing. Do companies like LG dump the high-priced inventory at a big loss, figuring the year is going to be a write-off anyway and its good to clear the decks, or do they hold or even raise prices to maintain margins, likely extending the inventory glut and reduced production levels into 2023?

We expect that perspective has been changing over the last few weeks, with the idea that holding margins, even if it means carrying higher inventory levels, giving way to the idea of aggressive discounts to move high-cost units. We still don’t believe CE companies are convinced that the current macro environment is ‘real’, with managers kneeling by their bedsides each night praying for a return to the ‘new normal’ demand they became used to in late 2020 and much of 2021, but we expect reality will catch up by the end of 3Q, especially if 3Q ends as poorly as it began. If that mindset is translated into a heavily discounted holiday season will consumers respond? We believe so, but not with the same vigor that was seen a few quarters back, as the need for a new smartphone, TV or laptop has been sated, leaving only a customer base of true bargain hunters, rather than a customer base that is willing to pay up for immediate gratification.

This leaves CE brands betwixt and between, willing to take the quick hit to move inventory but unable to finish the job, dragging sales weakness into 1Q 2023, but that does give us hope that there is still potential for a better balance between CE supply/demand for much of next year, and we rarely take the optimistic view this far out, although to us, this is the least radical scenario we could expect. Of course there is still plenty of time for deleterious world events or another outbreak of something to throw a monkey-wrench into the whole megillah, but it could happen.

RSS Feed

RSS Feed