Fun with Data – Is the US Really Behind in Semiconductors?

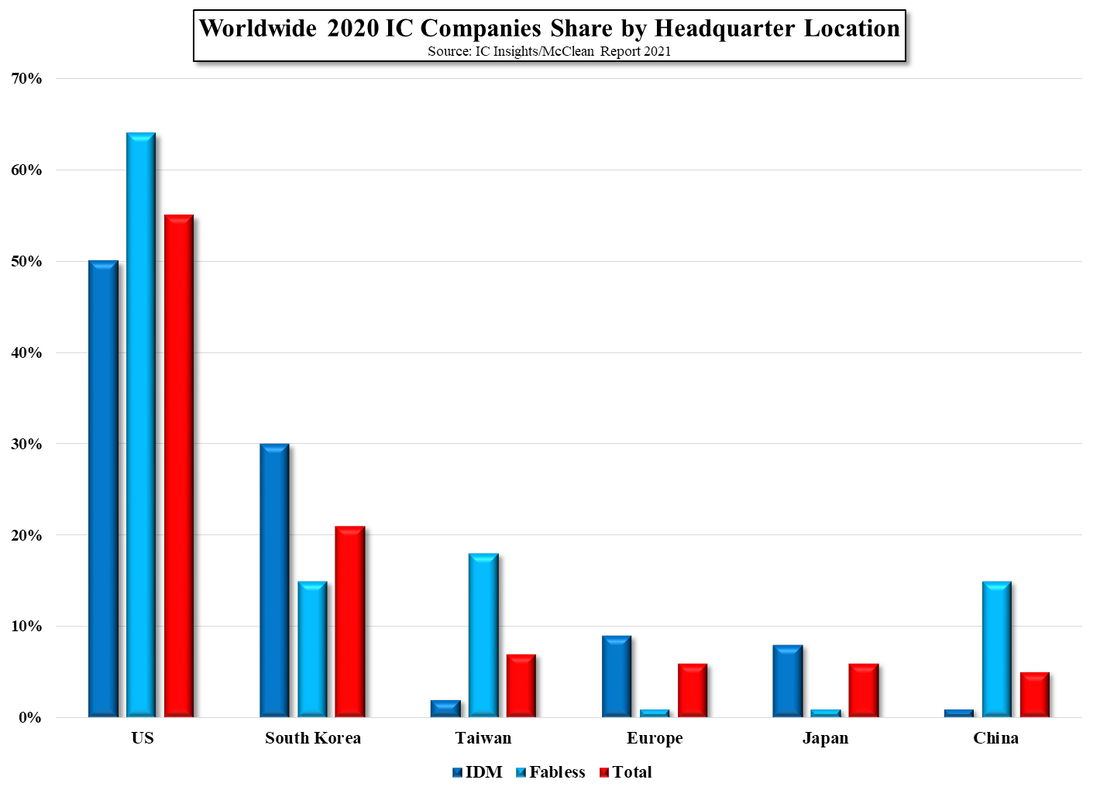

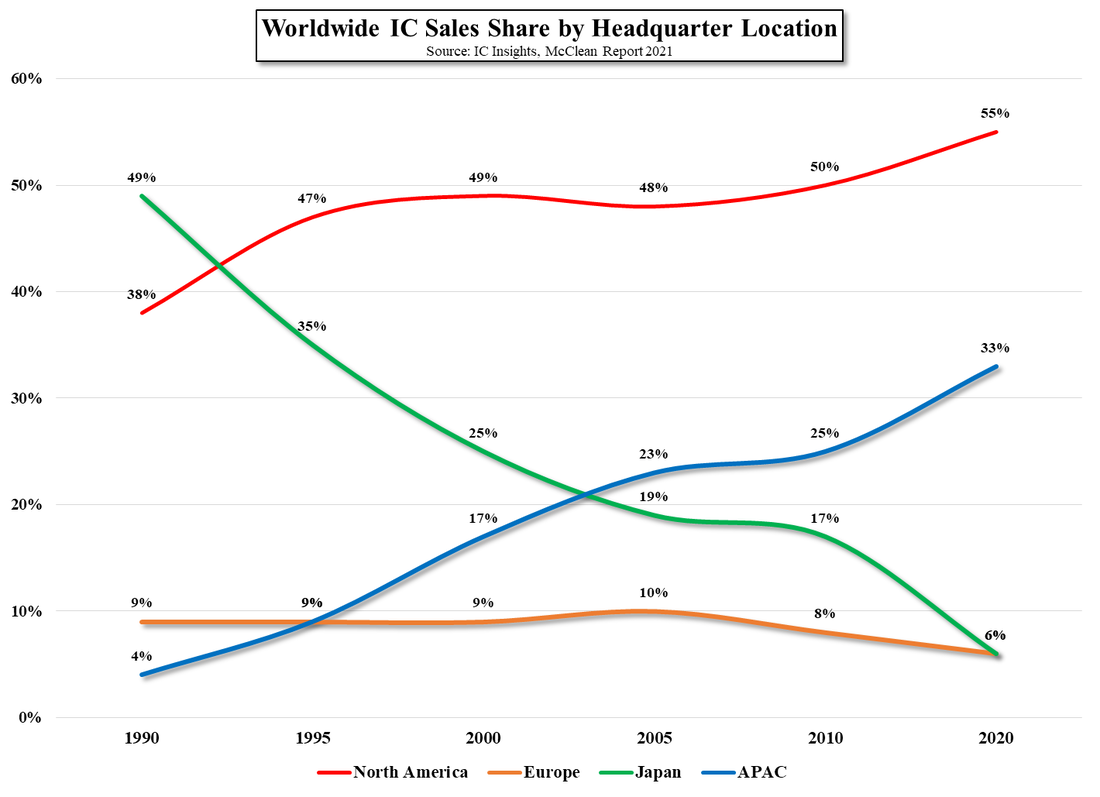

Recent data, a part of a report marketed by IC Insights gave some clarity as to the ‘state’ of the global semiconductor industry, breaking down IC market share by region in 2020, with the data suggesting that the US still has more than a commanding lead in the IC market. The data breaks down share further into IC manufacturers, essentially those operating wafer fabs and fabless producers, along with total IC share, and shows sales data since 1990 (Fig. 2). With global IC sales share at 55% last year in the US, South Korea’s 21% is the closest challenger, and even when adding Korea, Taiwan, and China (APAC in Fig. 2), last year’s APAC share was still only 33%.

The obvious focus of concern, rather than the US, would be Japan, whose declining share over the long-term leaves it a small contender currently (2020) ~6%, but China, the country that seems to be the focus of attention for politicians has the lowest overall IC sales share (5%) of any major IC manufacturing region, and regardless of the development programs, subsidies, and massive publicity campaigns, the Chinese IC industry will take many years to grow to a size that challenges the US. Of course, many foundries and fabless companies have facilities in China, but when it comes to where the money winds up, it’s the US by far.

[1] The financial markets generally are unpredictable. So that one has to have different scenarios... The idea that you can actually predict what's going to happen contradicts my way of looking at the market. George Soros

RSS Feed

RSS Feed