Fun with Data – Notebooks

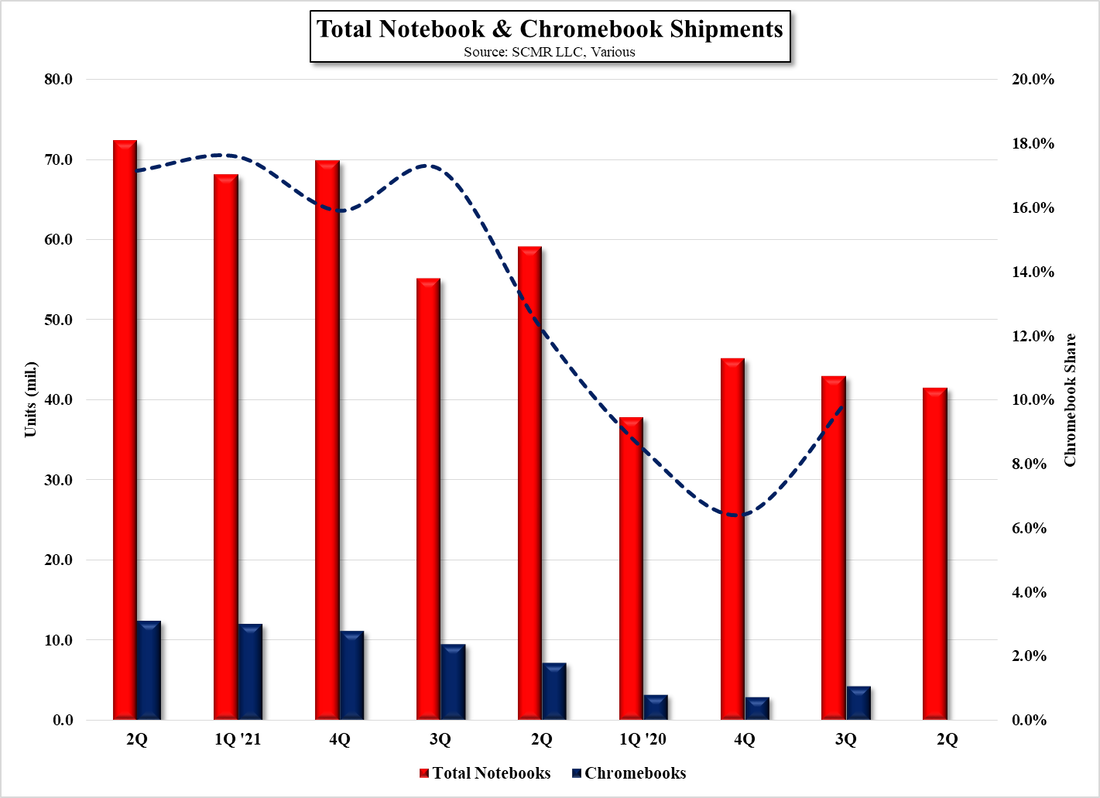

It turns out we were right as to general notebook demand while inflation pushed notebook shipments even further down than we had expected. 2Q aggregated notebook shipments were down 32.8% q/q and down 35.2% y/y, with shipments less than 1% above the low point seen when COVID became a global crisis and below pre-pandemic averages. We expect a bit of a recovery during the holiday season but 3Q notebook shipments are typically up 8.7% q/q and 4Q up 6.4%. If we plug in those numbers to the 2Q data, 2022 shipments would be 252.5m units, down 26.0% y/y and lower than either of the two years before the pandemic, and would be disastrous for notebook vendors and brands.

This would lead us to make the assumption that 3Q will see a more substantial q/q shipment recovery although July and August were likely less than spectacular. We expect inventory levels are being worked down, leading to lower cost inventory as panel prices decline, which should mean more substantial discounting. However, since much of 3Q has already passed, we would see much of that potential discounting in 4Q rather than 3Q, which would help to boost the full year number a bit but still leads us to only a marginally better 3Q shipment number. All in it is going to continue to be a very difficult year for notebook brands.

RSS Feed

RSS Feed