Fun with Data – Phone Usage

- Penetration

- Mobile vs. Desktop

- Connection Frequency

- Content Consumption

- Focus for Advertising

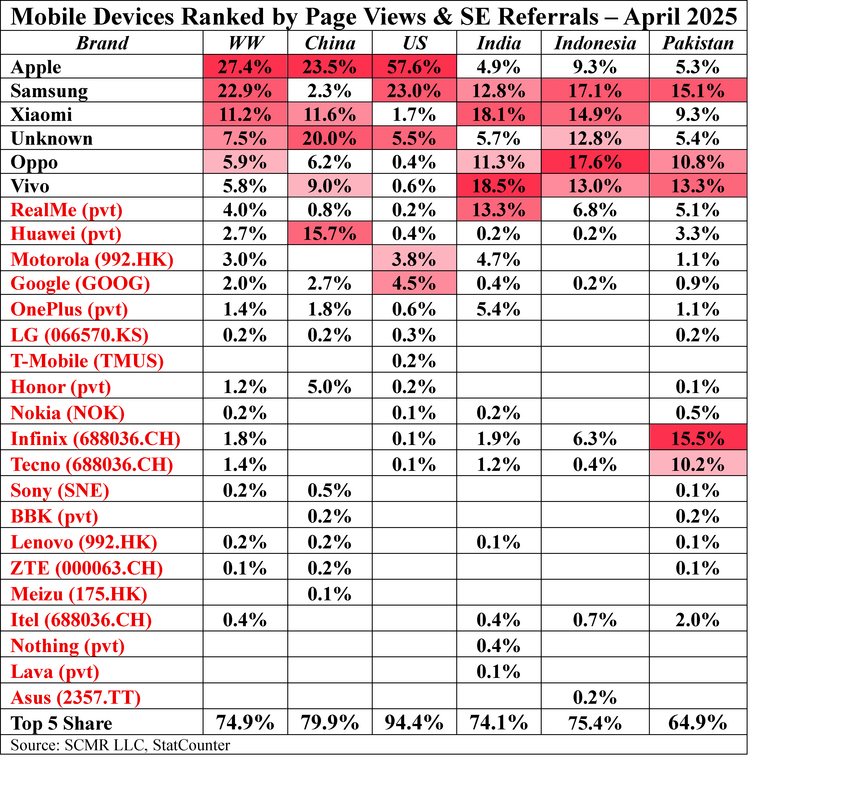

The US has the most brand loyalty, with Apple (AAPL), the top brand with a 57.6% usage penetration, more than twice the leader in any other country, and is also the leader, albeit with a smaller share, in China. In the US the top two usage brands, Apple and Samsung (005930.KS), represent 80.6% of tracked website traffic, a grater share than the combined total (top 5) share in all other countries and over 50% of the worldwide share. When averaging brands across the five countries (unweighted) Apple still maintains the greatest share (20.1%), followed by Samsung (14.1%), Xiaomi (1810.HK) 11.1%), Vivo (pvt) (10.9%), and Unknown (9.9%). Without Unknown, 5th place went to Oppo (pvt) (9.3%).

RSS Feed

RSS Feed