Fun with Data – Semi Equipment

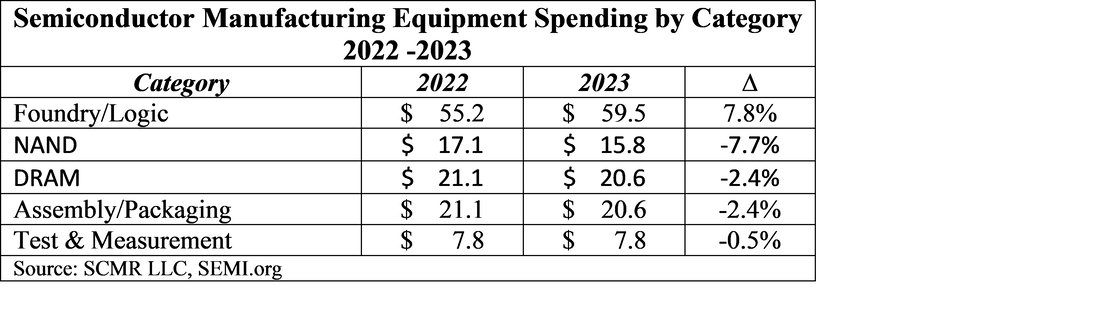

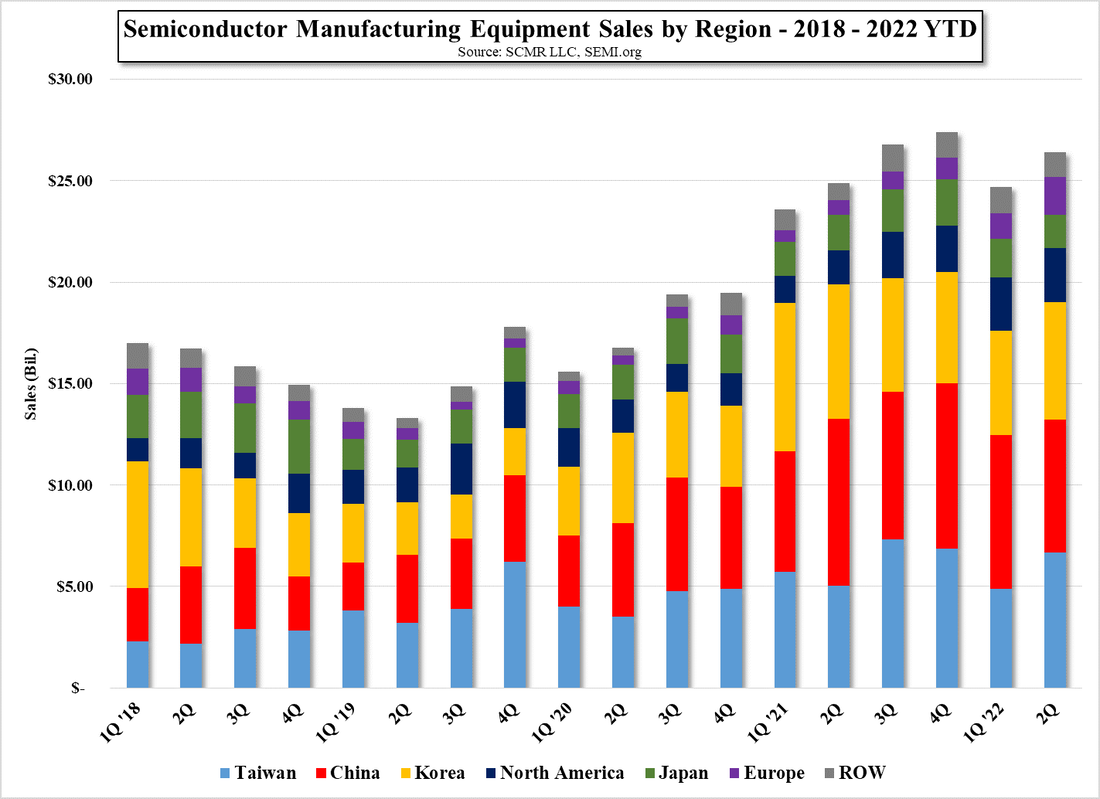

Almost all of the growth in 2023 will be from Foundry & Logic equipment, which is expected to grow from 55.2b to 59.5b, while memory/storage and Assembly & Packaging tool sales are expected to decline modestly from 7.8B to 7.7b, with Test & Measurement tool sales increasing slightly by 0.4%. On a regional basis, Taiwan regained 1st place over China in 2Q after falling behind Mainland equipment sales in 4Q of last year, although both regions had almost identical spending in 2Q. As we have previously noted, Chinese foundries have accelerated purchases of lithography equipment in anticipation of the US tightening restrictions on DUV tools following restrictions on more advanced node EUV tools. While China continues to expand its semiconductor foundry business at a rapid pace, we expect the value of foundry and locic equipment sales will see less growth as US trade restrictions further limit tool purchases to mature nodes, while Taiwan and Korea are able to purchase those higher priced but higher value tools without restriction.

RSS Feed

RSS Feed