Fun with Data – Semi Stuff

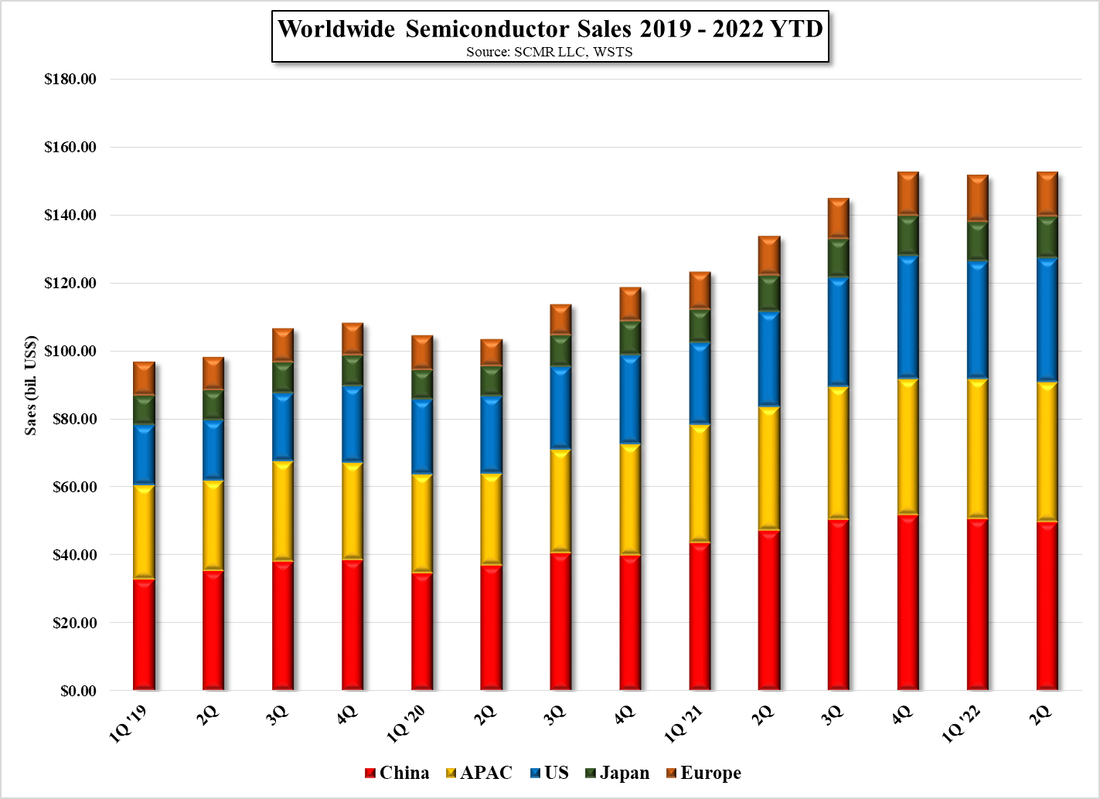

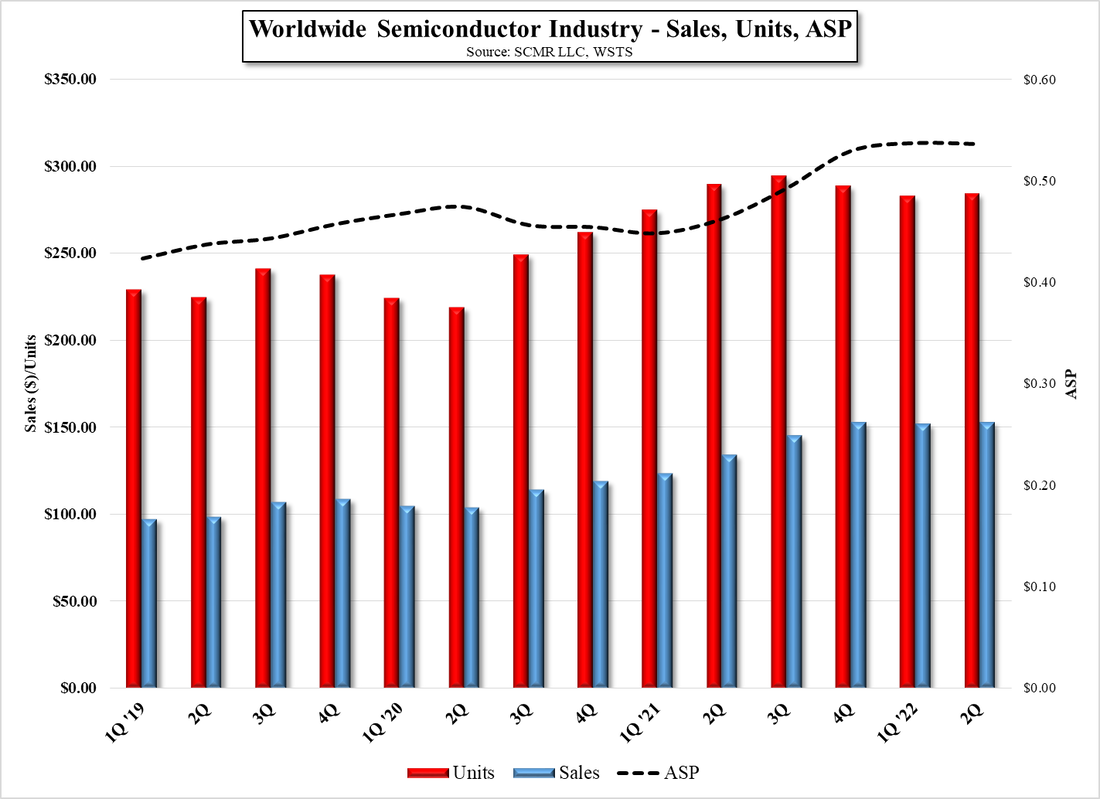

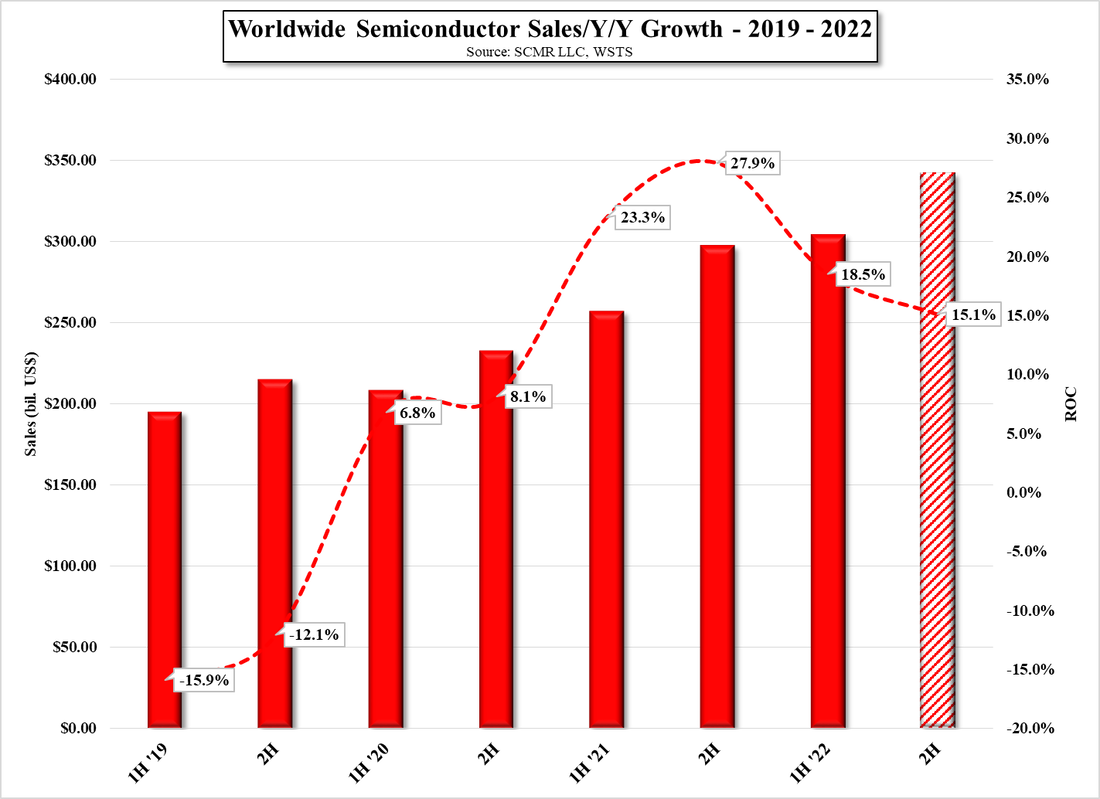

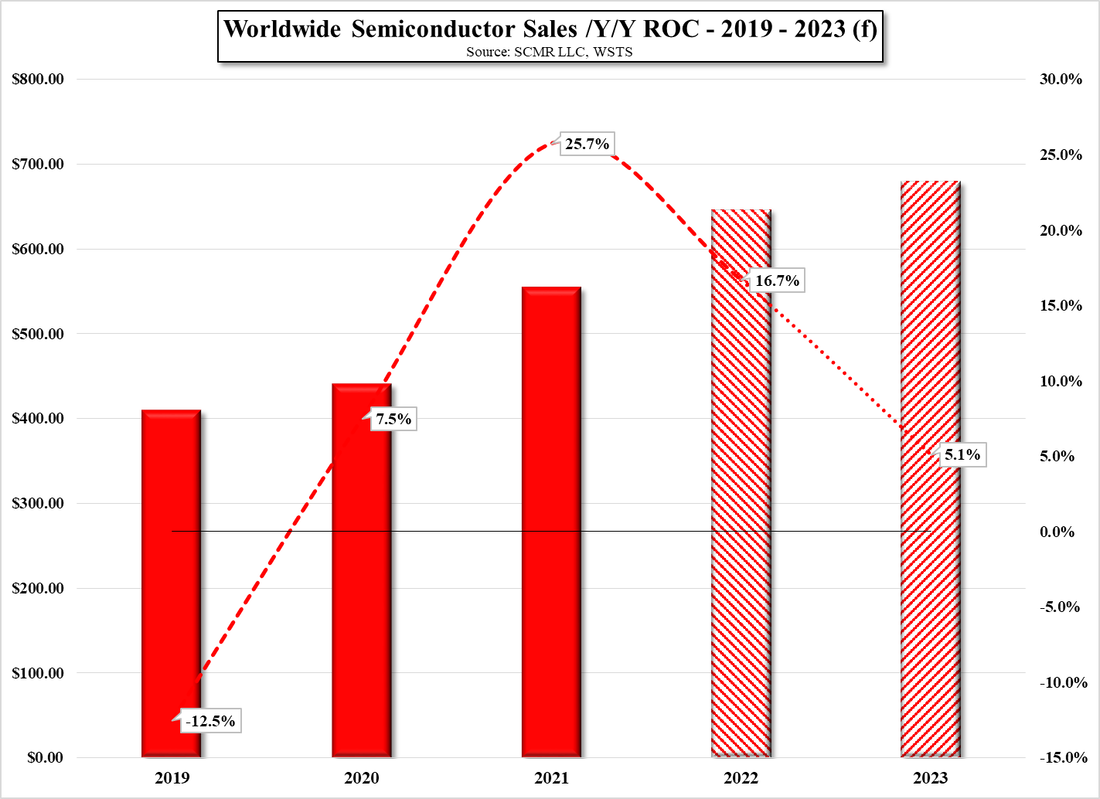

We have seen demand, artificially induced or otherwise, rise and fall for many CE product categories, over the last 2 1/2 years, with much of that reflected in pricing, but given the very specific capacity issues facing semiconductors, plus the expense and time it takes to add capacity, semiconductor sales have been growing steadily through much of the pandemic, as seen in Figure 1 and Figure 2, although in the most recent quarters, unit volumes have been decreasing from their peak last year as sales and ASP have flattened. Based on expectations developed by WSTS (World Semiconductor Trade Statistics), a non-profit forecasting agency for the industry, 2H ‘2022 will grow another 15.1% y/y, pushing full year growth to 16.7%, down from last year’s 25.7%, but still a very strong year.

What might cause some concern is that the WSTS prediction for 2023 calls for y/y growth of 5.1%, the slowest growth since the pandemic began, and while this is still substantial growth for an industry that has grown rapidly during the last two years, we would assume that pricing will be more difficult to maintain in an environment where sales and unit growth have leveled off and will likely be more influenced by seasonal patterns than during the last two years, with ASPs a bit more volatile. Our concern now is that expectations for the 2nd half of this year are a bit more optimistic than the overall global economy might be able to support, and if 2H results are weaker than expected, forecasts for 2023 will be lowered with the potential to slow capacity expansion projects. Under such a scenario fab capacity estimate for 2024 – 2025 would likely be reduced, but we see such changes as positives for the semi space, given the potential for over-capacity in 2024 and beyond. In the CE space it is a bit easier to see the trends as the industry is rarely capacity constrained for extended periods but the semi market seems to have become bifurcated once again, with certain products remaining in short supply while others see weakening demand, making it more difficult to spot macro trends, but we take what we can from the data thus far and look toward 3Q to better understand how weak CE demand will affect the semiconductor supply chain.

RSS Feed

RSS Feed