Fun with Data – Small Panel OLED Demand & Apple

Now that we have full demand data for small panel flexible OLED displays, we note that the results for flexible OLED displays in 2Q was only off by 1.9% putting 2Q composite small panel OLED demand 12.85% below expectations, not a great number but certainly better than the rigid miss. As can be seen in the table below, while both Apple (AAPL) and Vivo (pvt) came in above small panel flexible OLED expectations, Apple represented 49.6% of actual small panel flexible OLED demand in 2Q and was the only brand that saw better than expected results in the composite, with the composite itself being down 13.6% q/q and down 3.4% y/y.

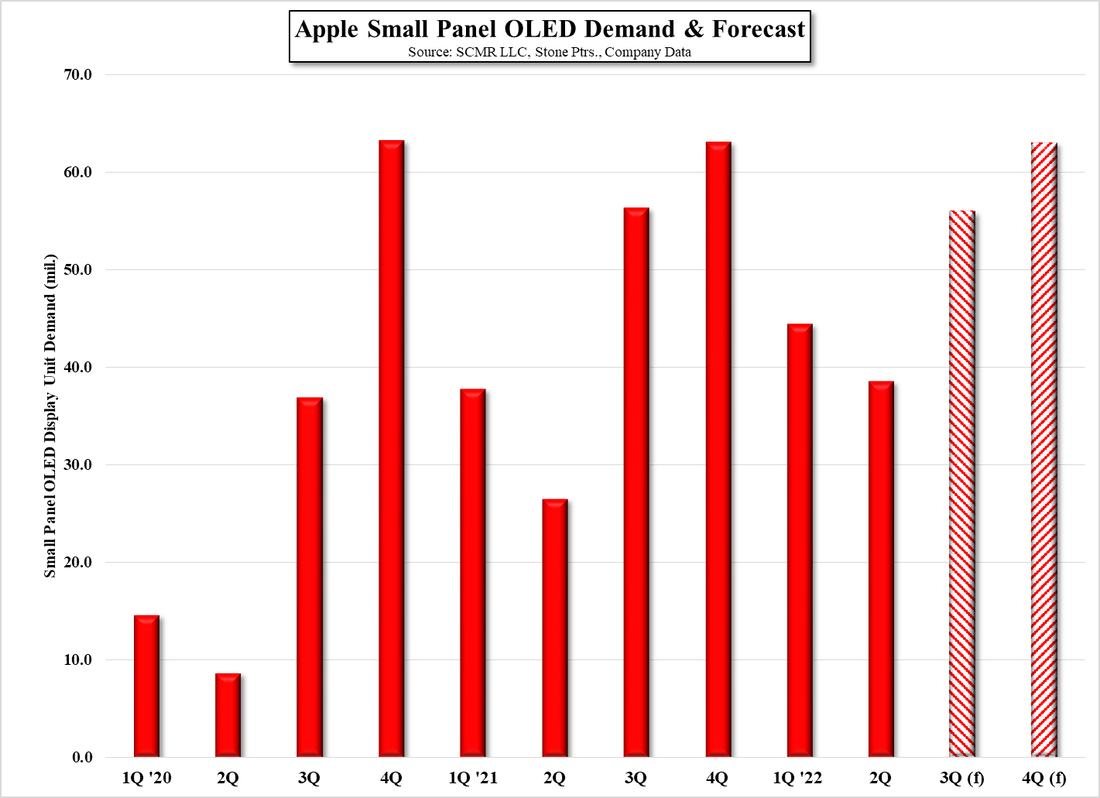

All in, another weak quarter for smartphones continues to put a damper on small panel OLED growth, despite an increasing share of the overall smartphone market, with Apple the only substantial standout. As the iPhone 14 series was announced on September 7, much of the 3Q actual results will rest on the new iPhone line’s popularity during the last 15 days of the month, and based on those results, Apple will determine it order rate for 4Q. In 2020 and 2021 Apple increased orders q/q in 4Q (11.9% and 71.5% respectively) while the y/y increase was less than 1%. While we expect Apple is optimistic about customer demand for the iPhone 14 series, we assume they will temper that enthusiasm a bit as the macro-economic situation continues to weigh on consumer spending, which would lead us to expect Apple’s full year small panel OLED demand to be ~200m units, up 9.8% y/y. Given that almost all of Apple’s iPhone models (old and new) are OLED, this gives a good approximation of Apple’s 2022 display demand, which should translate into shipments, less build and transport timing and existing inventory.

RSS Feed

RSS Feed