Fun With Data – Smartphone Brands We Like & Use

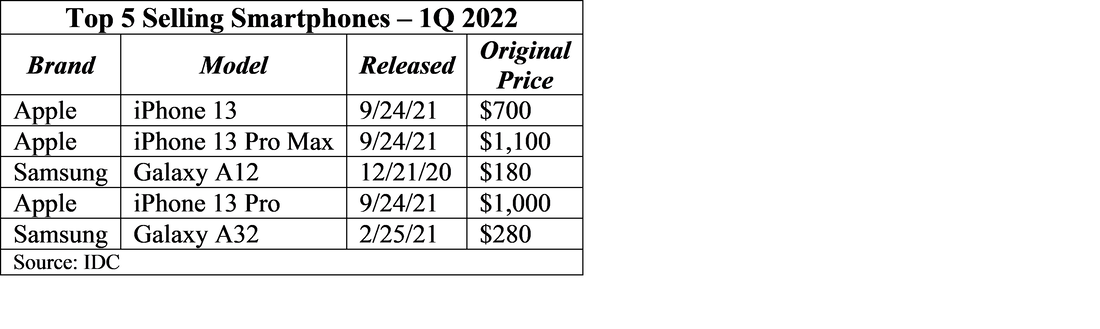

Sources for smartphone data vary considerably, and in many cases do not agree with each other, which is why when we use outside smartphone data we average as many sources together as possible, and while this sometimes keeps our share totals from exactly hitting 100%, it does reduce the influence of outliers and those that include or exclude certain items that other might or might not. That said, Table 1 shows that the most popular selling phone models are the iPhone 13, released in September of last year and two budget Samsung (005930.KS) phones, one from last year and one from late 2020, a bit surprising, although Apple (AAPL) tends to be in the top 5 every year.

In recent quarters it has become a challenge for smartphone brands to differentiate themselves from each other, focusing on a particular feature to try to set them apart. Screen size and resolution was a big feature attraction, but pocket size tends to keep that limited now, and multiple cameras were in vogue a year or so ago, with the current de riguer being phones that have the cameras built into the display, removing those unsightly ‘notches’ that seem to annoy smartphone aficionados. At least for the time being Samsung seems to have taken the size feature to a new level with their popular foldable smartphone line, with other brands pushing hard to come up with a better foldable mousetrap, an Apple sitting somewhere on the foldable horizon, waiting for the category to stabilize before taking the plunge.

But with each new model year it seems progressively more difficult for smartphone brands to come up with features that make it easy for users to justify replacing a relative young smartphone and 5G has done little to push that envelope as 5G modems and antennae costs are relatively low. Gaming features, such as high refresh rates and extended battery life have helped a bit, but the smartphone market overall is getting a bit long in the tooth and needs some impetus to grow. Perhaps software would be the way in which brands could attract users to upgrade, but that would entail smartphone brands making fewer modifications to Android, giving developers and easier time to ensure compatibility across brand hardware, but what it really comes down to is smartphones need new applications that make them more than just displays. Some suggest medical applications as a game changing application, and the FDA seems more open to health tracking applications recently, so blood pressure, heart rate, ecg, and blood glucose monitoring could be just what the smartphone market needs to start an upgrade cycle, but few brands seem to be interested in marketing themselves as ‘health conscious’ rather than ‘faster to view YouTube videos’. Maybe another year of little or no growth might convince them to look for a killer application rather than cameras that rival professional SLRs.

RSS Feed

RSS Feed