Fun With Data – The Cost of Doing Business

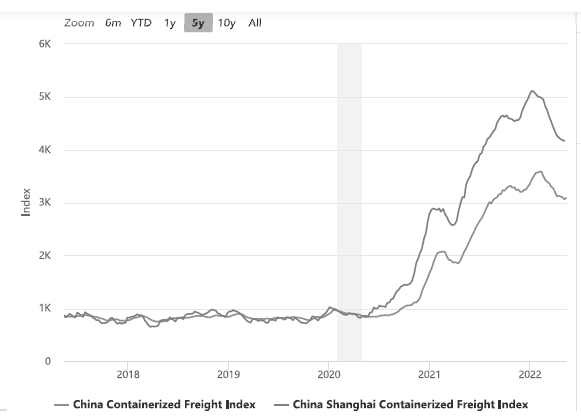

In past years, transportation costs for CE products were usually a function of demand, with higher cost air freight being used when demand was high and container shipping when delivery time was less critical. While those factors still exist to a degree, Figure 2 shows the China/Shanghai Container Freight Index, which hit an all-time high early this year, and that has caused both companies to have already spent about 1/3 of what they spent for the entire last year just in 1Q of this year on transportation & logistics.

RSS Feed

RSS Feed