Going Up

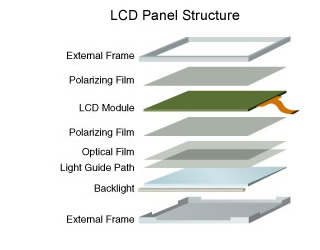

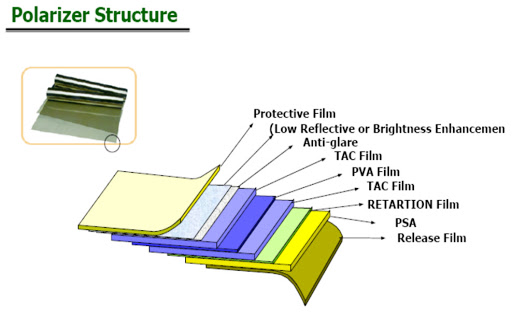

Polarizers are an absolutely essential part of LCD displays. There is a polarizing film in front of the LED backlight which sets the orientation of the light to allow waves of only one direction (vertical or horizontal) to pass into the liquid crystal. Since the liquid crystal can orient the light itself by ‘twisting’ its orientation, it can allow the light to pass through (pixel on) by aligning the direction the same way as the polarizer and can turn off the light by ‘twisting’ the light 90⁰. A second polarizer in front of the liquid crystal, that is aligned the same way as the first, keeps any stray light from escaping when the liquid crystal is ‘off’. Such a system would work without the polarizers but very poorly, with low contrast and a host of other problems. The polarizers themselves are really composite films that also perform other functions but the structure of LCD displays is based on polarized light and therefore polarizers are essential.

The optical compensation film market is estimated at ~30m m2 per month, with FujiFilm (4901.JP), Konica Minolta (4902.JP), and Zeon (4205.JP) being the primary suppliers. Konica produces about 11m m2/m while Zeon produces about 10m m2, with FujiFilm at about 6m m2/m. This falls about 10% short of current demand, however FujiFilm has taken part of their production off line for maintenance, reducing their monthly output from 6m m2 to 3m m2, creating a 20% shortfall. That line is expected to be restored in March but will not be up to full capacity until June, leaving the increased shortfall for much of the 1st half of 2021. Since building capacity in such a short period is not an option, polarizer film producers have taken another approach and decided to raise polarizer prices by between 5% and 10% this quarter, adding a bit more to overall display BOM. As we have noted previously, large panel module assemblers have high volume deals with such component suppliers, but smaller assemblers will have to accept the price increases or even bid higher to secure enough inventory to meet orders, which will give component producers the confidence to initiate another round of increases in 2Q if demand continues to outstrip supply. Sort of the snake that eats its tail…

RSS Feed

RSS Feed