Hair of the Dog

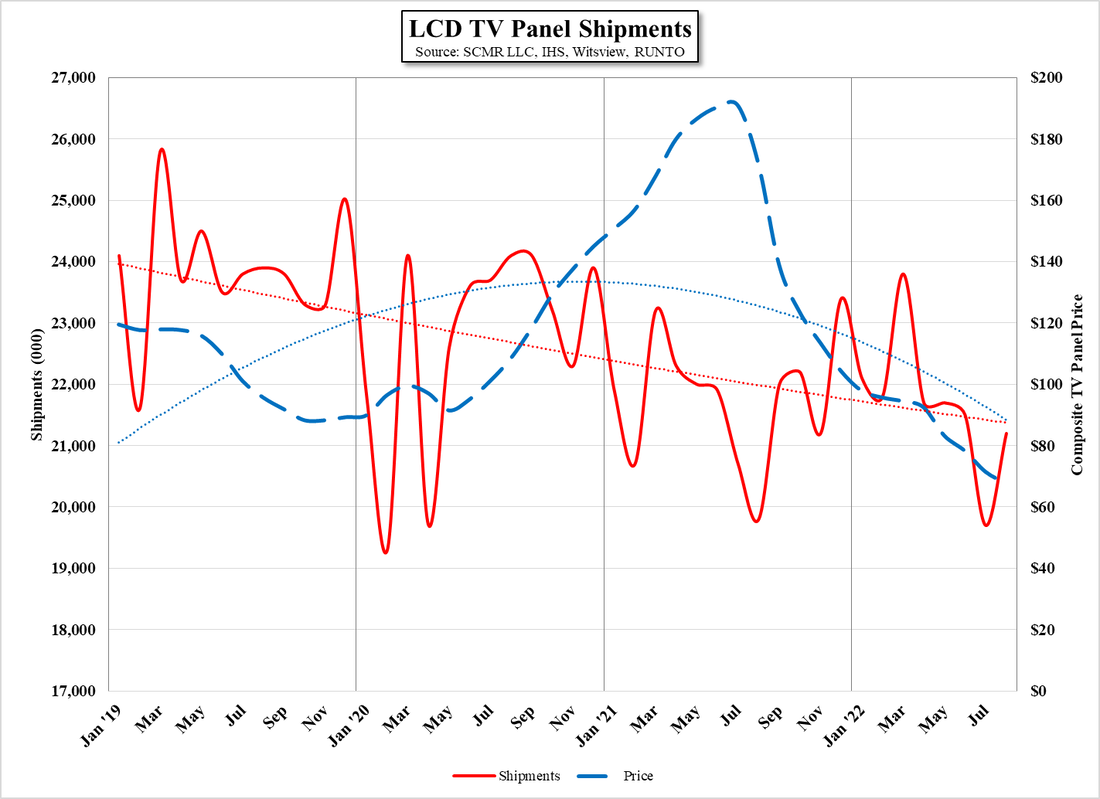

In the shorter term, especially between mid-year 2020 and mid-year 2021, there was a large spike in TV panel pricing, a function of a modest increase in demand during the worst of the COVID-19 pandemic, and COVID related shortages that pushed panel prices higher as brands were willing to pay up for access to capacity, but as the worst of the pandemic passed, demand for TVs fell back to pre-pandemic levels and more recently to new lows. As we have noted, panel producers have been facing a dilemma as TV panel prices reach cash costs and potentially material costs. Do they continue to produce and lose money on every panel or do they cut production? Either choice is an expensive one, and while panel producers were coming off a few very profitable quarters during the pandemic, profitability can dry up quickly for panel producers unless they are running fabs 24/7 at near capacity.

Eventually panel producers gave in and began reducing utilization, but this took more than a few months of ‘wishing and hoping’ that saw TV panel prices decline at a pace rarely seen in the industry. As the TV panel lower utilization rates began to eat through panel inventory, the rate of TV panel price declines has begun to slow (see Figure 5), and we have begun to hear that some Chinese panel producers are thinking about raising prices for certain TV panels.

Price stability is a strong incentive for any high volume manufacturer, especially ones that have seen component costs rise significantly over the last year, and we understand that panel producers have likely been breaking even or losing money on some production projects in order to keep large customers happy, but perhaps it might be wise not to push buyers into an adversarial position so quickly, making sure that excess inventory has been eliminated and that there is some semblance of demand before increasing prices.

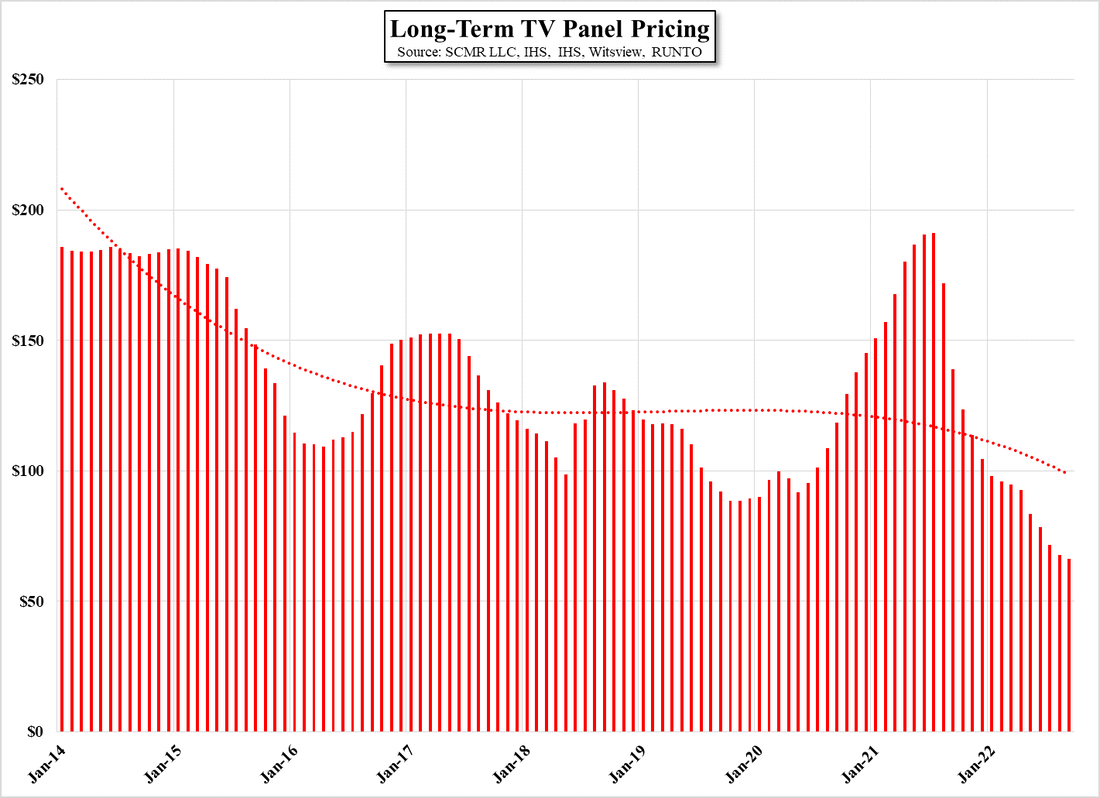

Much of the price talk seems to be rooted around 32” TV panels, essentially the smallest typical TV panel size, and understandably so, given that such panels are currently 10% below pre-pandemic lows and 69.7% below pandemic highs (see Figure 6) and likely a money loser for most TV panel producers, but even the slightest bit of success in raising prices on just these TV panels will begin to justify panel producers raising prices on other TV panel sizes and start the process of choking off the possibility of rescuing a dismal year for the TV industry during the upcoming holiday, that we believe can only be salvaged with the heavy discounting that might stimulate consumers to buy TVs.

Behind our doubts as to the effectiveness of TV panel price hikes, is the fact that TV set sales during the heart of the pandemic ‘borrowed’ from the 2021 holiday season and perhaps a bit into this year’s holidays, and a worsening economic environment will do little to stimulate incremental TV set sales this year. With both of those factors in mind, we see the potential for any TV panel price increases as a negative that has the potential to extend the low end of this panel cycle further into 2023, and given that the number of panel producers that produce TV panels has declined as Samsung Display (pvt) and LG Display (LPL) eliminate or reduce their LCD large panel capacity, such pricing decisions are more readily falling to Chinese panel producers, such as BOE (200725.CH), Chinastar (pvt), HKC (248.HK), and CHOT (pvt), and while the Chinese LCD panel industry shows a somewhat unified face to the outside world, there is intense competition among the players that could push TV panel prices lower if such increase attempts are rejected by TV set panel buyers.

The panel business is an easily unbalanced ecosystem, known for extremes, and while panel producers are feeling the wake-up hangover after a very big party, counting on ‘the hair of the dog’ to alleviate the pain, has little basis in fact, and drinking more, or in this case raising TV panel prices quickly, will likely only serve to extend the hangover…

RSS Feed

RSS Feed