Handwriting on the Wall

The result of this demand was notebook panel price increases as seen in Figure 2, which typically would slow demand at least to some degree. However as prices for notebook panels began to increase in late 2020 buyers, fearful that they would not be able to meet customer demand, continued on their buying spree and pushed notebook panel prices higher. Adding to this scenario were component shortages caused by similar factors, and notebook panel buyers began trying to build inventory by double ordering, although that did little since silicon capacity was essentially fixed. Notebook panel pricing peaked out at the beginning of 3Q ’22, while notebook panel shipments continued to rise through November, as brands continued to buy to fulfill expected holiday purchases.

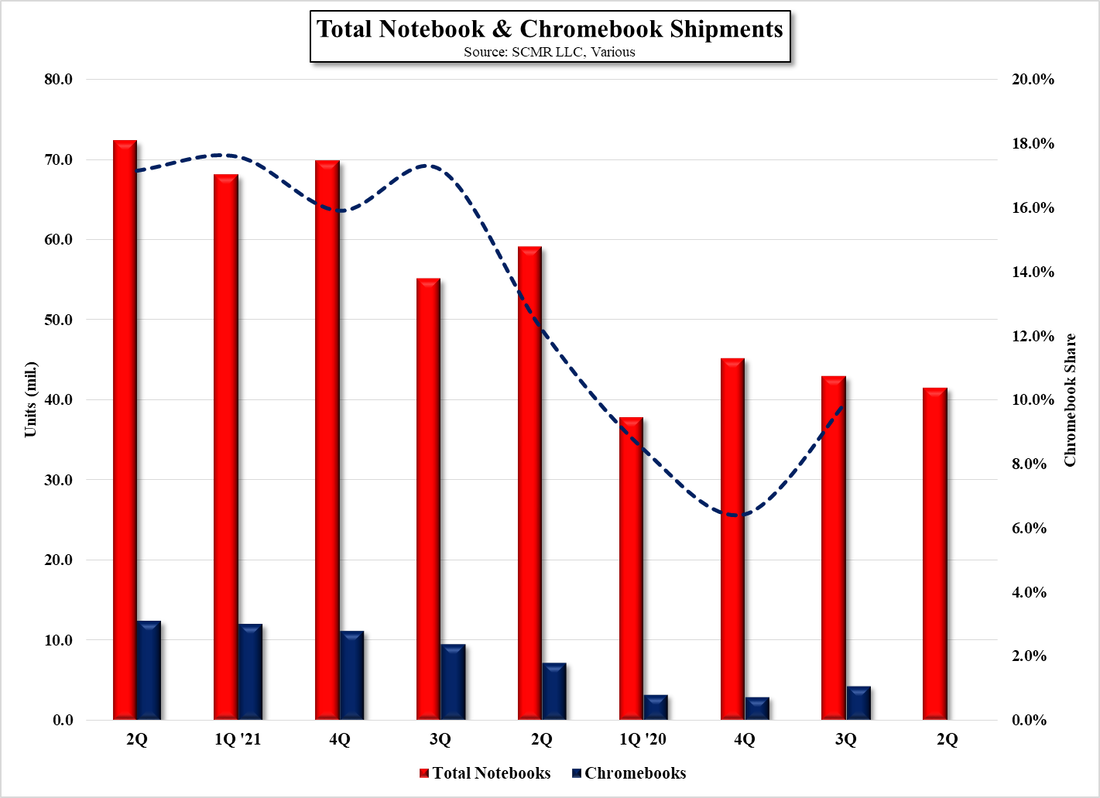

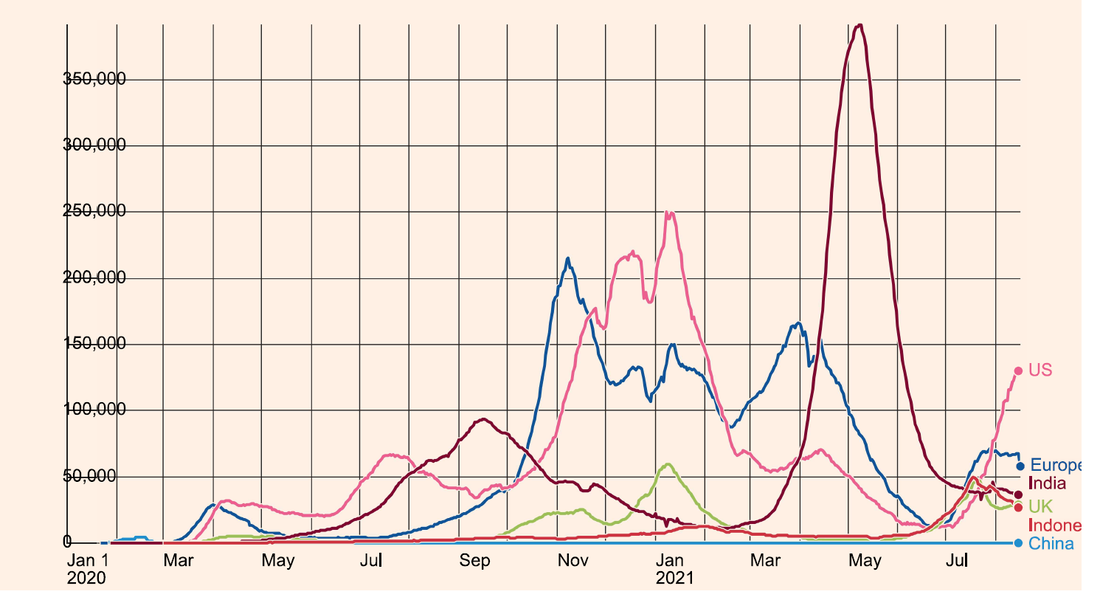

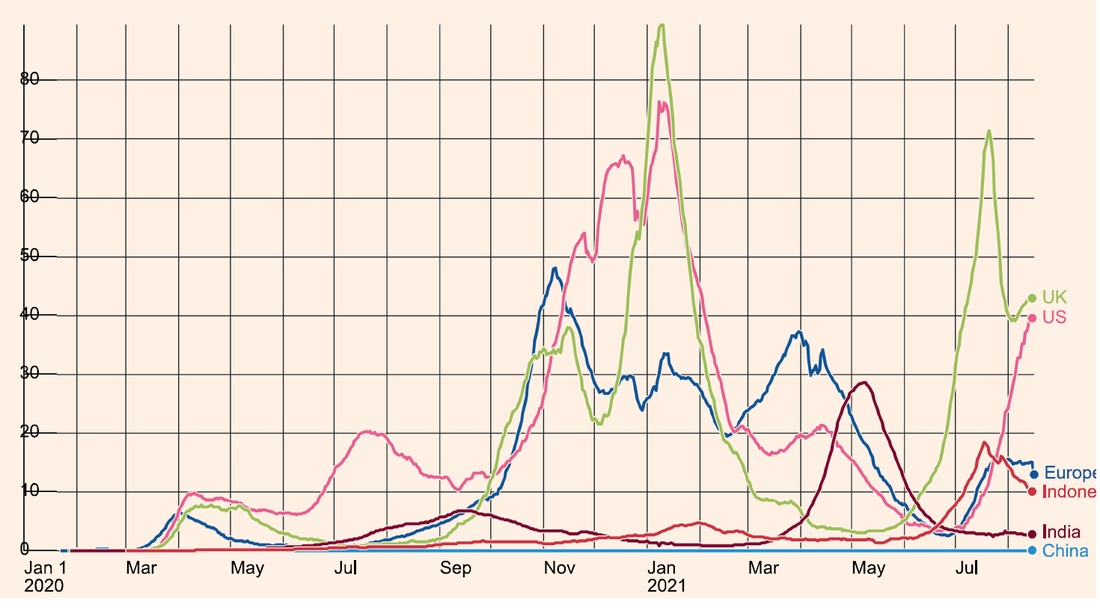

Distributors were inventory constrained throughout 2H ‘;20 and much of 2021, facing the same challenges as component buyers, and most were able to maintain only a few days or a week of inventory and contributed to the demand cycle by increasing orders, which made the situation worse by giving assemblers incentive to order more components and push prices higher, all part of an incestuous cycle that began to end at the beginning of this year, as the COVID-19 pandemic began to become so ingrained in global culture and the ennui of being in isolation pushed folks back to some sort of more normal existence. As can be seen in Figure 3, the timing of those cultural changes might not have been well planned as seen by the case spike in late January, but many of the educational notebook mandates ended along with 2021 and we believe that the increased shipments seen throughout 2021, especially in 2H, got close to satisfying actual demand.

Notebook brands however remained optimistic about expected shipments for 2022, likely making the assumption that 2021 was the ‘new normal’ and demand would continue at those levels, however notebook panel prices have been on the decline since late last summer and notebook panel shipments have been declining since the November 2021 peak. While these are both signs of a path to a more ‘normal’ notebook demand cycle, more telling metrics are that distributors are now stocking between 10 and 12 weeks of notebook inventory and brands are beginning to pull back assembly orders to more realistic targets.

Some of this has been reflected in our previous notes discussing IT panel prices, which are composed of notebooks, monitors and tablets, but target changes by brands are usually the last to go as the cycle returns to some semblance of normalcy. We do not expect demand to diminish entirely but we would expect at least a move toward the averages seen before COVID-19, which, between 2013 and 2019 were 15.38m units/month, as opposed to the average of 21.5m seen between 2020 and 2021 (40% higher). Component shortages will ease a bit but some will remain, while notebook prices themselves are slowly declining as inventory grows and notebook panel prices decline, but the specter of overall inflation will likely keep notebook prices from falling to previous levels which will slow any return to pre-COVID-19 levels, but the direction seems to be becoming more clear and slowly being acknowledged by the industry.

RSS Feed

RSS Feed