Has It Started?

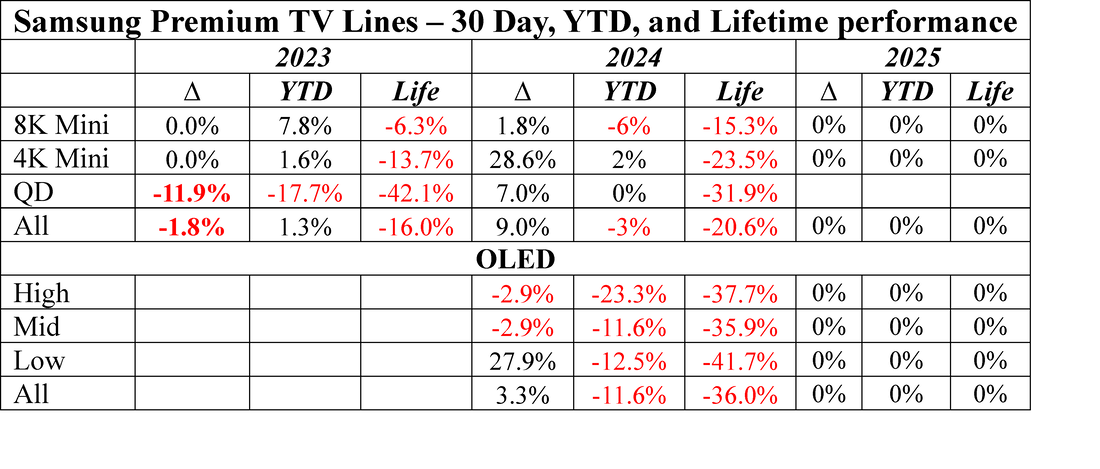

Samsung’s 2025 OLED TV set line, which has been available for ~ one month followed a more typical early pattern and saw no price change during the period, however the 2024 OLED line did. While the high and mid 2024 OLED price tier models saw a modest 2.9% decrease in price, as one might expect, the low-end models saw the opposite, rising 27.9% in less than 30 days. Typical monthly price moves for most OLED models are +/-1.2% and while there have been bigger monthly moves than the average, this month’s increase was the largest ever for this segment of the line.

There are always a number of factors at work when it comes to pricing, particularly inventory levels, component pricing, FOREX, and consumer demand, but now we have the added factor of tariffs, which seem to change on a moment’s notice. We cannot pin down the price movements we have seen here to a particular factor, but we expect there will be considerably more volatility in TV set pricing as existing on-shore inventory gets worked down. As Samsung’s sets are assembled primarily in Mexico, for the time being they are exempt from more recent tariffs, as long as regional (Chinese components) sourcing does not exceed 40%.

This gives Samsung the ability to (if so desired) maintain low pricing while sets from Hisense (600060.CH), and TCL (000100.CH) rise, capturing incremental volume, however it seems that Samsung is moving prices up, despite the exemptions. While this will be beneficial in the short-term if it is sustained, it will do little for shipment volumes and customer satisfaction. With Chinese TV set brands competing aggressively for share in all markets, Samsung gains the price advantage for a while. Whether they choose to use it to regain share is still an open question.

RSS Feed

RSS Feed